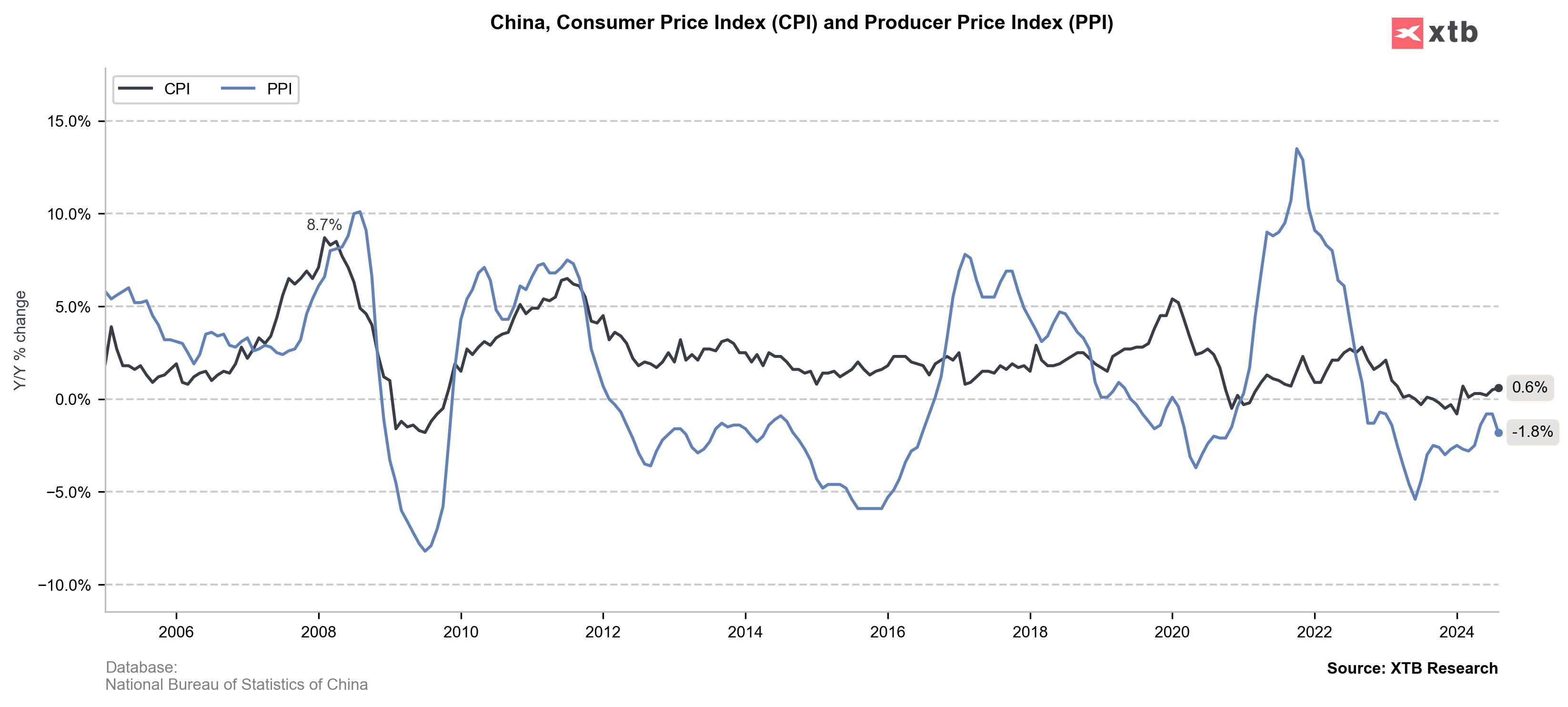

China's economic indicators show persistent deflationary pressures, with consumer prices rising less than expected and producer prices continuing to fall. Despite attempts to stimulate growth, the world's second-largest economy faces challenges in reviving domestic demand and combating overcapacity issues.

China's consumer price index (CPI) rose by 0.6% year-on-year in August, falling short of the expected 0.7% increase. This modest growth extends a period of economic weakness that has lasted over a year. Meanwhile, the producer price index (PPI) declined by 1.8% year-on-year, marking the 23rd consecutive month of contraction and exceeding the anticipated 1.4% decrease. These figures underscore the ongoing struggle with weak domestic demand and overcapacity in various sectors.

A key factor in the slight CPI increase was the rise in food prices, which climbed 2.8% year-on-year in August, the first positive print since June 2023. Pork prices, a significant component of China's CPI, surged by 16.1%. However, core inflation, which excludes volatile food and energy prices, rose by only 0.3%, indicating persistent weakness in underlying demand.

China's economic challenges persist

The inflation data stand in stark contrast to the government's efforts to stimulate economic growth. Retail sales rose by just 2.7% in July from a year earlier, reflecting subdued consumer spending. The real estate sector, a traditional driver of economic growth, remains in a prolonged downturn, further dampening domestic demand.

China's former central bank governor, Yi Gang, recently emphasized the need to focus on "fighting the deflationary pressure," calling for more proactive fiscal policies and accommodative monetary measures. The government has already launched a $41 billion campaign to support equipment upgrades and consumer goods trade-ins, but the impact has been limited so far.

The ongoing deflationary pressures are symptomatic of a broader issue of production surplus outstripping demand. This overcapacity problem, particularly evident in industries like steel and manufacturing, continues to weigh on producer prices and overall economic growth.

Despite these challenges, some analysts expect a "moderate rebound" in CPI in the second half of the year, driven by growing consumption demand and higher food prices. However, the persistence of deflationary forces has prompted global brokerages to scale back their 2024 growth forecasts for China to below the official target of around 5%.

Source: xStation

Source: xStation

CH50 (D1 interval)

The Chinese Index has started to decline based on the weaker than expected data. Only today it is down around 1%. It is also slowly approaching key support at 78.6% Fibonacci retracement at 11099. Currently it has also broken through the lower Bollinger band, which has previously been an opportunity for a reversal. RSI is in a downtrend and entering oversold territory. MACD also confirms bearish sentiment with space for further downside. For bulls to regain momentum the weekly close at 11306 must be broken. It would later on act as support while trying to break resistance at 61.8% Fibonacci retracement, which has previously been a strong support level in downtrend.

Daily summary: Stocks Climb Despite Geopolitical Chaos, Dollar Retreats (05.01.2026)

The coup in Venezuela boosts Europe and local defense stocks⚔️

Daily Summary: Massive Gains in U.S. Indices Completely Wiped Out

US Open: A Powerful Start to the New Year for Nasdaq!

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.