The HSCEI futures are down 1.1% as risk appetite plunges. Anticipation of a series of key US labor market releases is generating caution worldwide, while geopolitical tensions are adding further pressure on Asian indices.

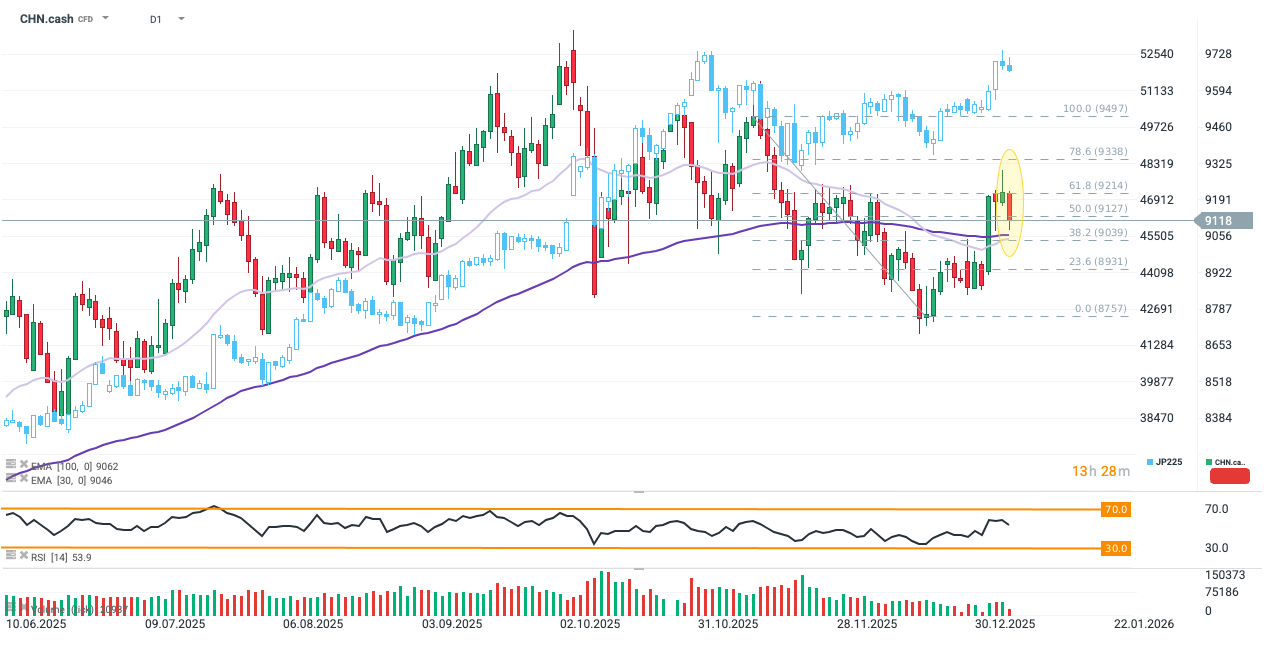

CHN.cash is trading below the 50% Fibonacci retracement of the last downward wave, but the sell-off has halted near the 100-day exponential moving average (EMA100; dark purple). Holding above this level will be crucial for continuing the rebound that began at the turn of 2025–2026. The blue line shows the Nikkei 225 futures, also under pressure from Beijing’s actions. Source: xStation5

What is driving CHN.cash today?

-

China has halted exports of certain rare earth metals and dual-use goods to Japan, citing national security following comments by Japanese Prime Minister Sanae Takaichi on Taiwan. The restrictions took effect immediately and could disrupt supply chains in key sectors, including electronics, aerospace, and defense. China also launched an anti-dumping probe into Japanese chemicals used in semiconductor production.

-

Beijing’s decision has rattled sentiment across the region. Chinese rare earths accounted for a staggering 63% of Japan’s imports in 2024, and the restrictions could seriously disrupt production in electronics, automotive, and defense sectors. For Chinese firms, this means losing a significant customer base, while investors face increased uncertainty across the supply chain and pressure on strategic component prices.

-

CHN.cash is also weighed down by a slowdown in AI-driven optimism. Risk appetite is clearly declining as investors prepare for key US labor market data, which will be particularly relevant for Fed policy in the coming months. Expectations for Friday’s NFP report are relatively high – the market anticipates labor market stabilization and further job growth following months of mixed readings. Preludes to the report include today’s ADP and JOLTS releases, which are expected by consensus to confirm a stable employment narrative, though demand for new hires remains subdued.

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.