The DAX (DE30) opens slightly higher at the beginning of the week. However, initial gains have been somewhat reduced, and currently, the German index is only up by 0.20% ahead of the publication of the Ifo business sentiment index.

The forecasted reading of the index indicates a further deterioration of sentiment in Germany. In September, the Ifo is expected to drop to 85.2 from 85.7 the previous month. These levels suggest that the German economy is undergoing a significant slowdown, which is also confirmed by other macroeconomic readings. Historically, these Ifo index levels were only seen during the pandemic in 2020 and before the crisis in 2008.

The overall condition of the German economy remains weak; however, this doesn't significantly impact the main DAX (DE30) index prices for several reasons. First, the economic slowdown is not yet evident in the financial results of companies, and for now, forecasts also remain optimistic. Secondly, many companies listed on the DAX are international corporations, with a significant portion of their operations and sales occurring outside Germany. Companies like BMW, Siemens, and Bayer have a global character, which means that their results can be influenced by global economic conditions, not just those in Germany. For this reason, index quotations are more dependent on the economic climate in the USA than in Germany, which is clearly seen when comparing the chart with SP500 (US500).

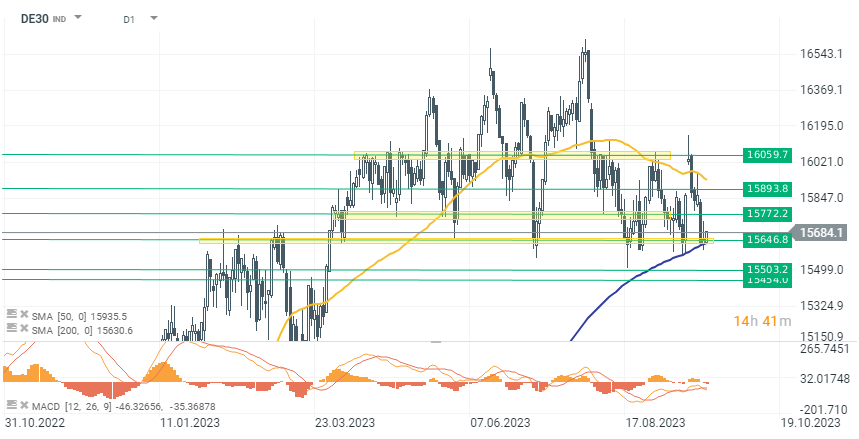

From a technical perspective, the DAX is currently testing the support level at 15,650 points again. This barrier was a significant resistance level before April this year when the index tried several times to rise above it. Since then, the mentioned level has been a key support zone, from which the index has rebounded 7 times. We are currently during the 8th test on a daily interval. However, divergence on MACD and increasingly weaker upward rebounds may indicate that the buying strength is waning, and soon the index may permanently break below the 15,650-point level. In such a case, the next support zones would be the 15,450-15,500 point area. Source: xStation 5.

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.