Cryptocurrencies continue upward move launched over the weekend with Bitcoin reaching a fresh all-time high above $68,000. Litecoin and Caradono gain around 8% while BitcoinCash and Chainlink trade over 3% higher. Rally was supported by some upbeat fundamental news like Mastercard launching crypto-linked payments cards in Asia. Ethereum has also managed to reach a new record above $4,800 today but has erased almost all of the gains since. Nevertheless, the technical situation on the chart suggests that there is still some room to extend gains.

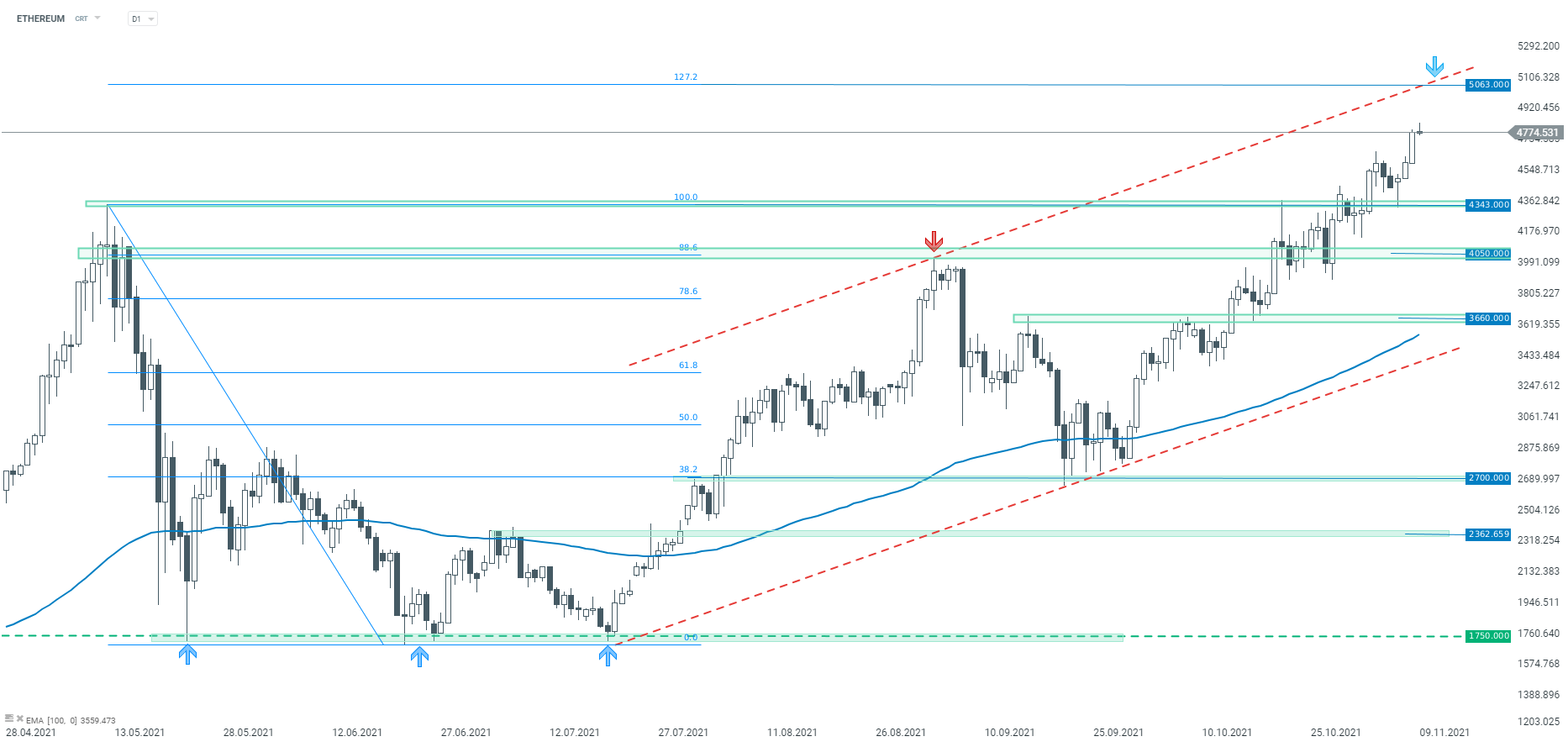

Taking a look at ETHEREUM on a daily interval, we can see that the coin has been trading in a steep upward move this week. Price broke above highs from May 2021 last week but has pulled back to retest the area later on. An attempt to break back below on Saturday failed and ETHEREUM rallied to new record highs. The next potential resistance to watch can be found at the 127.2% exterior Fibonacci retracement at $5,063. Should the price halt advance and starts to drop, the zone near $4,343 should act as the first support.

Source: xStation5

Source: xStation5

Cryptocurrencies sell-off 📉Ripple loses despite Amazon partnership

Bitcoin slips below $90,000 📉 Is a broader sell-off ahead?

Bitcoin dips to $91K despite strong ETF inflows 📉

Crypto news: Bitcoin returns to gains in 2026 📈 Will the U.S. seize 600,000 BTC from Venezuela?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.