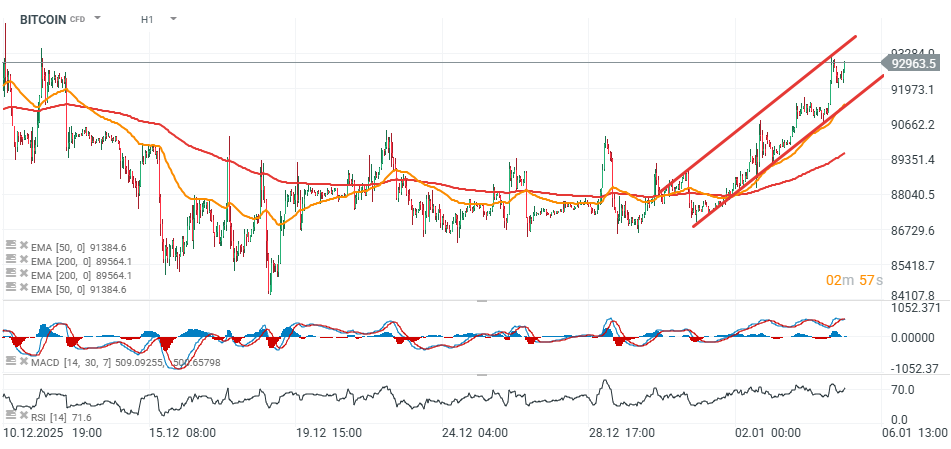

Bitcoin is rising today to nearly USD 93,000, i.e. the highest level since the first half of December 2025, amid positive sentiment on the U.S. stock market, where Nasdaq 100 and S&P 500 futures (US100 and US500) are gaining ahead of the open. Bitcoin is up more than 6% this year and has rebounded after falling to a record oversold level (RSI) last seen in August 2023. On-chain data point to historically high BTC accumulation by so-called whale addresses, while overall market sentiment remains largely subdued, opening the potential for trend continuation.

- Oil reacted with a slight decline below USD 60 per barrel following a U.S. military operation in Venezuela. If the United States were indeed to take control of Venezuelan oil reserves, this could represent significant pressure on global inflation and, as a result, support risk assets, including Bitcoin.

- However, it is difficult to expect this effect to be immediate; we are rather talking about a multi-year horizon. Venezuela’s oil sector requires tens of billions of dollars in investment to return to processing capacity comparable to historically record levels from years ago. It is also unclear whether the U.S. will achieve its objectives in Venezuela without a ground military intervention, and such a scenario would more likely support oil prices than weigh on them.

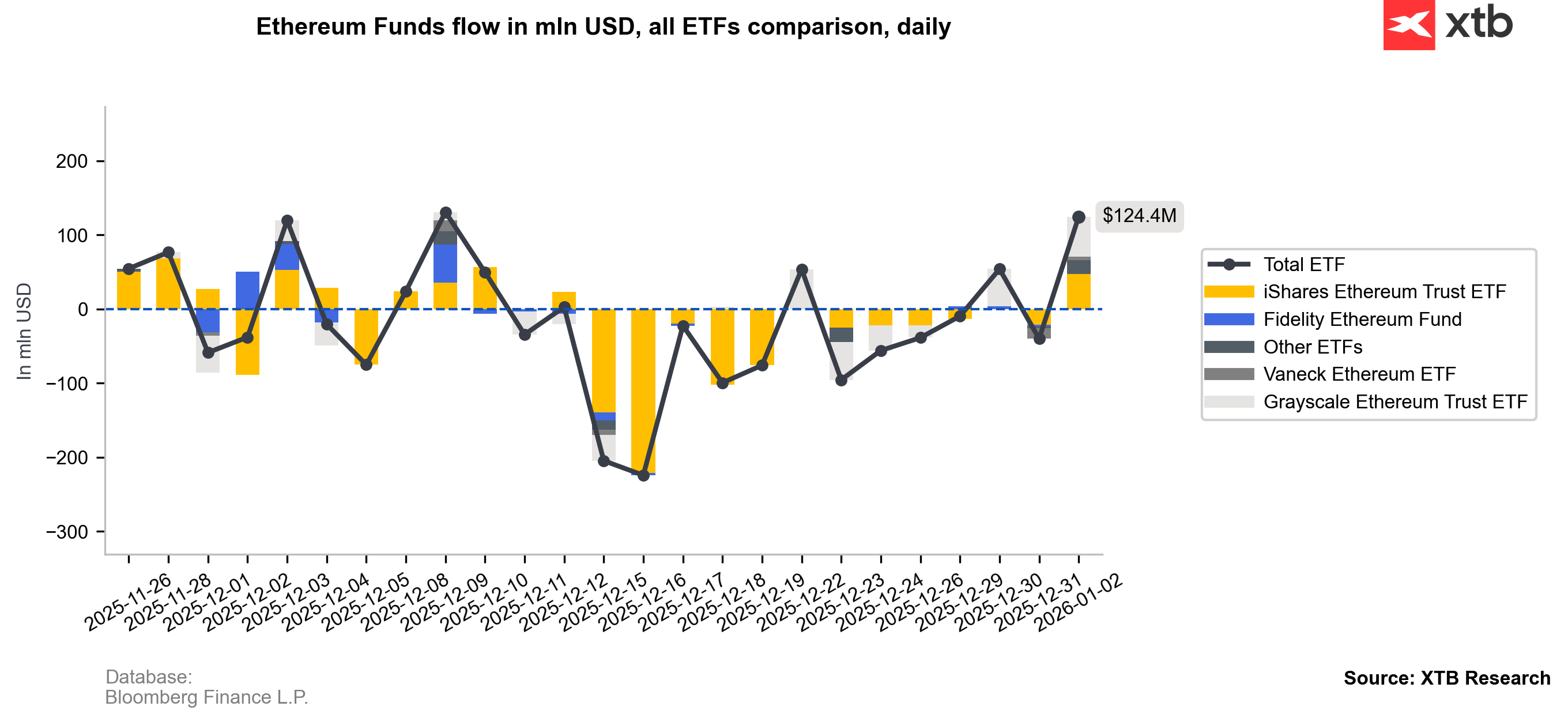

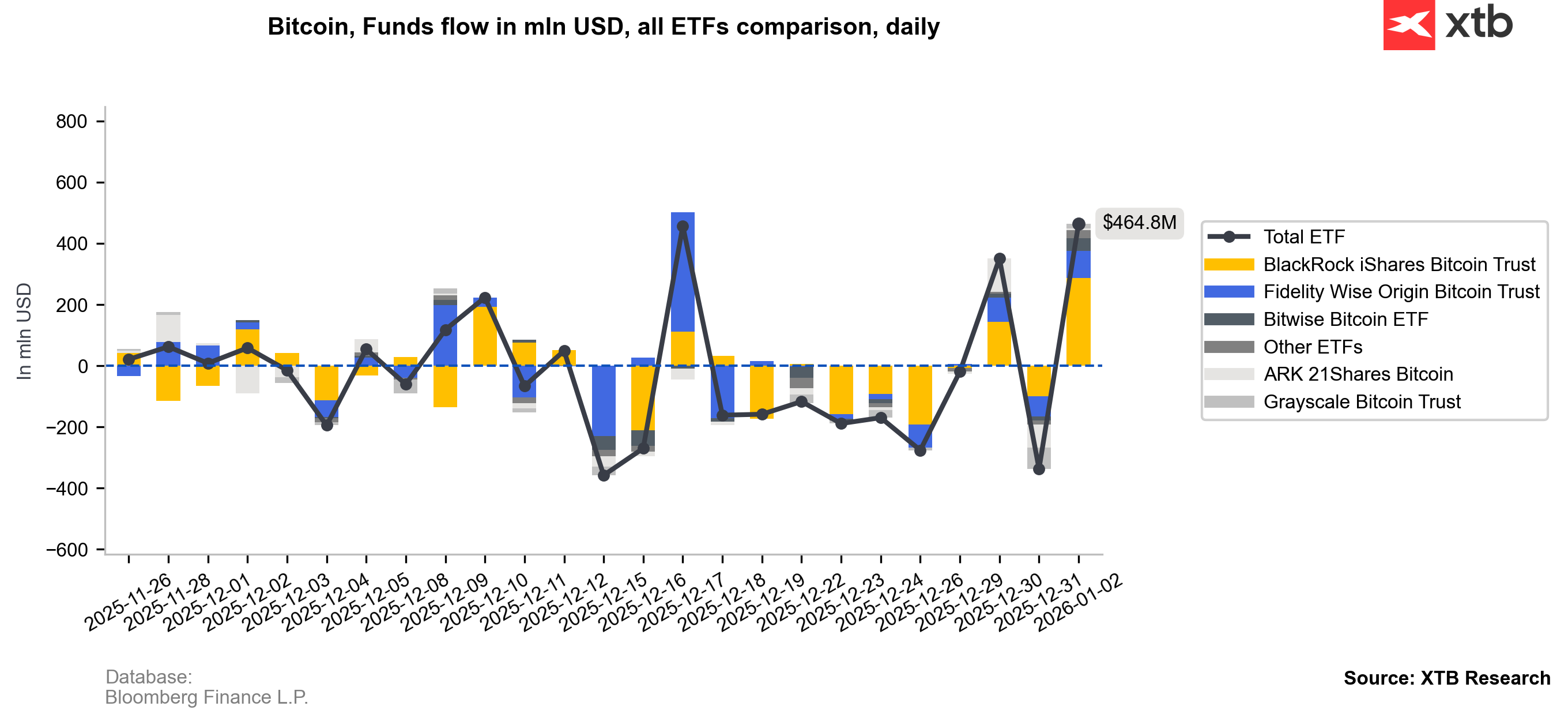

- CoinShares data indicate that global inflows into cryptocurrencies in 2025 amounted to USD 47.2 billion, compared with USD 48.7 billion in 2024. During the last session of the previous week, on Friday, BTC and ETH ETFs recorded inflows of USD 464 million and USD 124 million, respectively.

This week, Bitcoin will remain primarily sensitive to U.S. labor market data (NFP on Friday), but the market is increasingly convinced that Trump’s influence on the Fed will be decidedly dovish, regardless of macro data. Consequently, solid economic readings do not necessarily have to curb the future Federal Reserve chair’s appetite for interest rate cuts.

Bitcoins from Venezuela – what’s next?

According to research by analysts Clara Preve and Bradley Hope, Venezuela currently holds BTC and stablecoins worth between USD 56 billion and USD 67 billion; media reports have circulated about a potential 600,000 BTC. The country is said to have begun purchasing BTC and cryptocurrencies in 2017, when Venezuela was selling gold mined in the so-called Orinoco Mining Arc and converting the proceeds away from the U.S. dollar. Estimates suggest that USD 2 billion worth of gold could have been exchanged for Bitcoin priced at around USD 5,000 at the time, which would imply that the country now holds about 400,000 BTC worth roughly USD 37 billion. Venezuela may also have disposed of Tether (USDT) received as payment for oil and used it to buy Bitcoin, seeking to avoid sanctions and diversify risk away from a USD-linked stablecoin.

If the U.S. were to seize Venezuela’s wallet, these Bitcoins would most likely be transferred to the so-called U.S. strategic reserve and would not be sold, in line with the Trump administration’s pledge of “not selling any seized Bitcoins.” If the United States were truly to take over Venezuela’s reserves—nearly 3% of the total global BTC supply (21 million)—this supply could disappear from the market, supporting prices over the longer term. On the other hand, there is a chance that Venezuela could use the BTC it still holds, converting it into funds to potentially purchase weaponry or cover other expenses if a devastating U.S. ground operation were to take place in the country.

Source: CoinPedia

Bitcoin and Ethereum charts (H1, D1)

Both Bitcoin and Ethereum are trading within an upward price channel, and on the hourly timeframe we can see a potentially bullish saucer formation emerging. For Bitcoin, key support is currently around USD 91.8k, where we see the lower boundary of the price channel and the EMA50.

Source: xStation5

On the hourly timeframe, Bitcoin has reached a key resistance level in the form of the exponential moving average EMA50 (orange line).

Source: xStation5

Similar to Bitcoin, Ethereum is also climbing today to levels not seen since mid-December. Key short-term support is indicated by the EMA50 on the hourly timeframe (around USD 3,100), while the lower boundary of the channel is around USD 3,050, where we also see the EMA200 (red line).

Source: xStation5

On the daily timeframe, Ethereum’s price has reached the 50-session exponential moving average EMA50 (orange line) and, like BTC, is struggling to break above it.

Source: xStation5

ETF inflows are rising

Source: Bloomberg Finance L.P., XTB Research

Source: Bloomberg Finance L.P., XTB Research

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.