The Australian dollar is one of the best performing G10 currencies today. A stellar jobs report for February can be named as a reason behind the move as it turned out to be much better than expected. Employment gain reached 64.6k, while market expected 49.1k gain, and unemployment rate dropped from 3.7 to 3.5% (exp. 3.6%). Employment gain was not only higher-than expected and driven by full-time jobs, it was also the first increase in employment following two months of declines. While RBA Governor Lowe noted at the latest policy meeting that he is open to more rate hikes should data support such moves, money market's pricing shows that RBA is done with rate hikes. Nevertheless, Lowe said that jobs data is among key reports that it will monitor when making the next rate decision so positive reaction on AUD today should not come as a surprise.

Another G10 currency that is on watch today is EUR. The European Central Bank is set to announce a rate decision at 1:15 pm GMT today. Expectations are mixed - some still see a chance for a 50 basis point rate hike while others expect the ECB to deliver a smaller hike or even leave rates unchanged following recent turmoil in the banking sector. Having said that, the scope for a surprise today is large. A cautious message from ECB President Lagarde during the press conference at 1:45 pm GMT is likely.

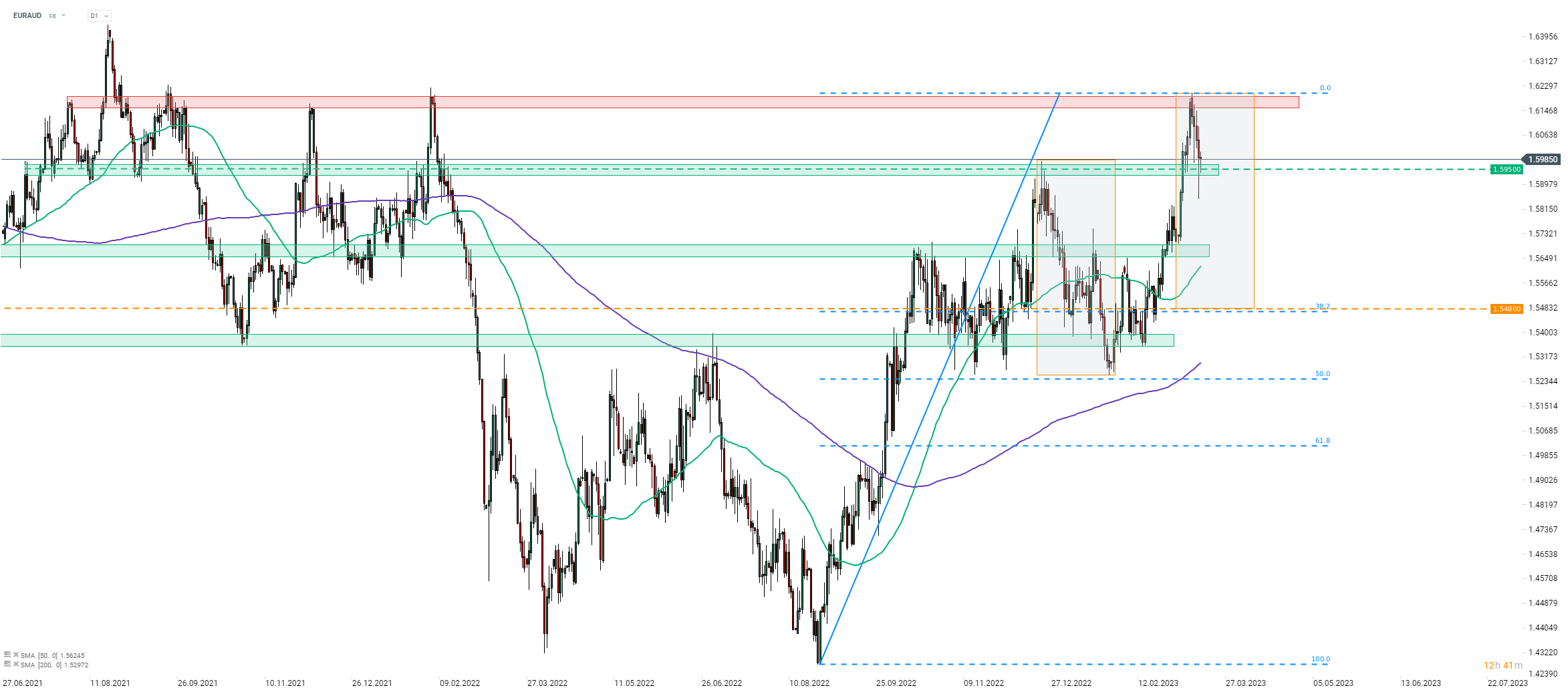

Taking a look at EURAUD chart at D1 interval, we can see that the pair has launched a pullback recently. The 1.5950 support zone was tested yesterday and again today but bears failed on both attempts. Whether the pair stays above or below this hurdle will likely depend on ECB policy announcement. A smaller than 50 basis point rate could trigger a dovish reaction on the market with EUR taking a hit and EURAUD potentially dropping below the aforementioned 1.5950 support. On the other hand, holding firm to 50 basis points and signaling that SVB-CS turmoil does not change policy view would likely be seen as a hawkish message.

EURAUD at D1 interval. Source: xStation5

EURAUD at D1 interval. Source: xStation5

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

Market Wrap: Capital Flees Europe 🇪🇺 📉

Morning Wrap - Oil price is still elevated (07.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.