The Bank of England and European Central Bank will announce monetary policy decisions today at 12:00 and 12:45 pm GMT, respectively. Rate decisions from the United Kingdom will be closely watched following yesterday's CPI data release that showed a major acceleration in price growth in November. Interest rate derivatives are currently pricing in 25-30% chance for a rate hike today. While inflation spike does not guarantee a rate hike, some forward guidance from BoE on rates would be more than welcome. When it comes to the ECB, no change is expected. There is a feeling that European central bankers will attempt to lower market expectations for rate hikes next year. Banks current guidance is to end emergency pandemic programmes in March 2022 and some started to believe that rate hikes may come some months later.

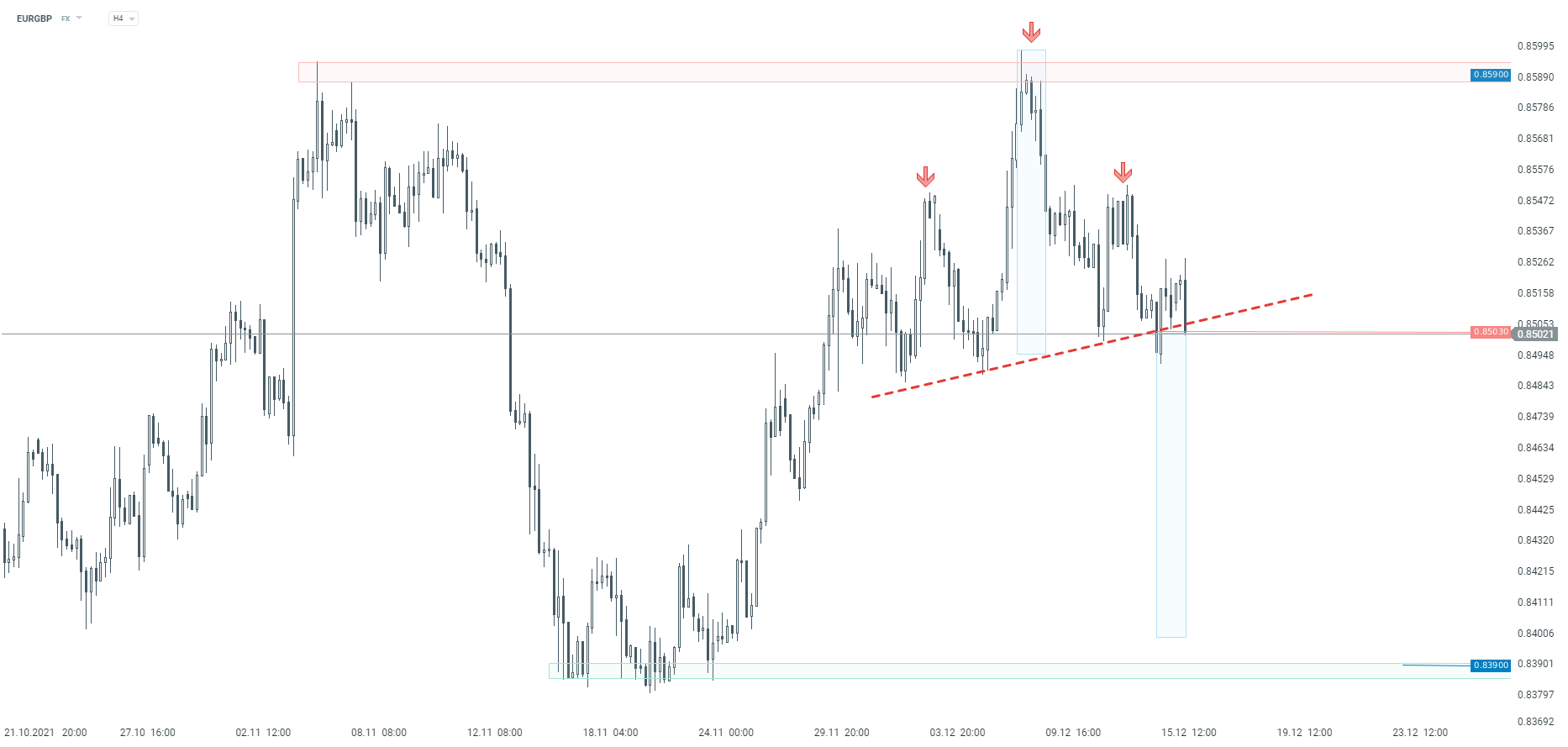

Taking a look at EURGBP pair at the H4 interval, we can see that a potential head and shoulders pattern is building up. The pair attempted to break below the neckline of the pattern in the 0.8503 area yesterday but bulls managed to defend the zone. Another attempt of breaking below the neckline can be spotted at press time. Should we see a break below, downward move may accelerate. The pair is expected to become more volatile around BoE and ECB decision announcement times.

Source: xStation5

Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.