Announcement of new UK fiscal measures last Friday triggered a massive sell-off on GBP and UK bond markets. Markets expected that the Bank of England will act to ease the situation but they expected an intra-meeting rate hike. However, BoE decided to delay QT, which was set to begin next Monday, and instead launched a temporary QE programme, vowing to purchase long-dated UK bonds in whatever quantity is necessary to calm the situation.

This has led to only short-term relief on GBP market but it should be said that the FX rate was not BoE's target. BoE's goal was to address the spike in UK yields and they managed to push 10-year UK yields down to beginning-of-the-week levels, near 4%. This eased the situation but underlying factors behind the bond meltdown remain unchanged and there is a lot of uncertainty over what will happen after October 14, when bond purchases are set to end. Moreover, scope for those reasons to change is rather slim given that UK Prime Minister Truss defended her policies today saying that this is a "right plan" for the United Kingdom and that difficulties are not limited to the UK only but rather are a global problem.

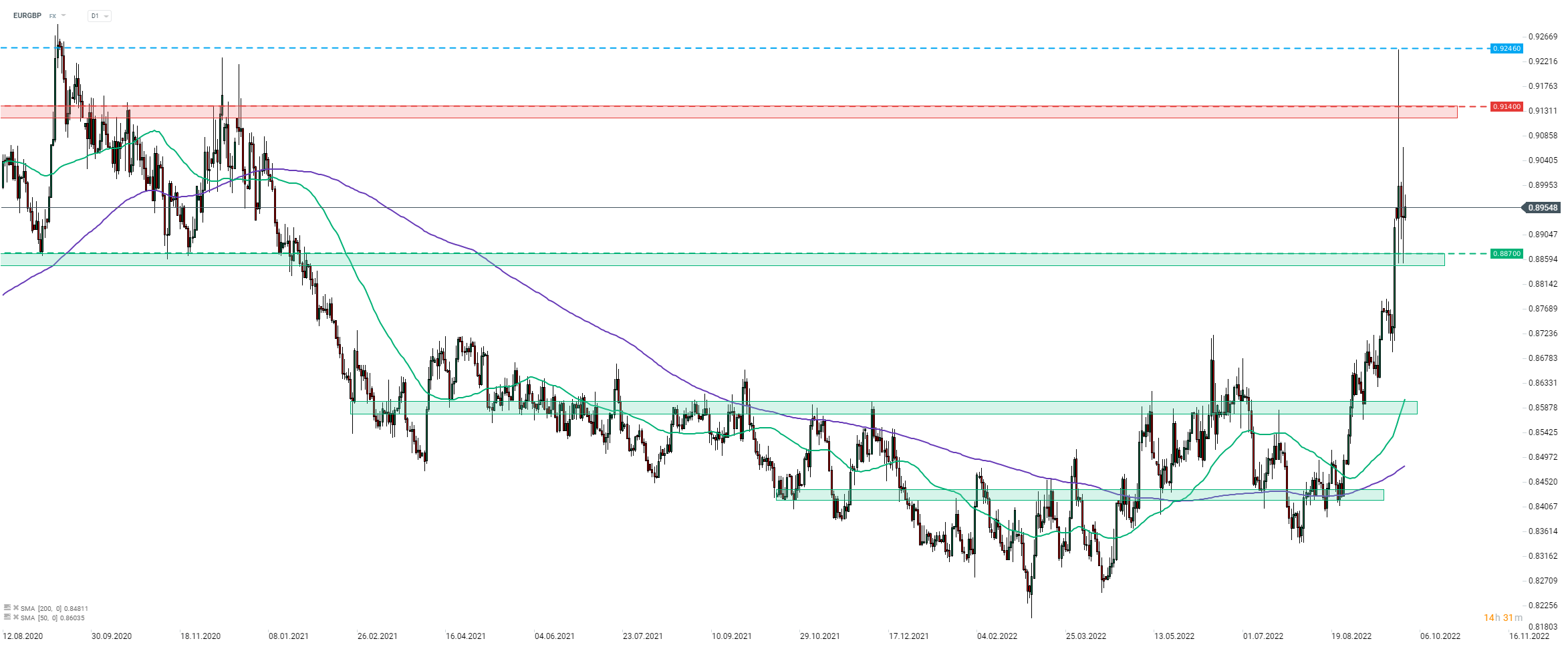

Taking a look at EURGBP chart at D1 interval, we can see that the pair jumped to the highest level since mid-September 2020 on Monday before pulling back. While the pair stays at elevated levels, a mid-term 0.8870 price zone provided support in recent days. The pair may experience elevated volatility later today during release of German CPI data for September (1:00 pm BST) as well as BoE speakers in the afternoon (Ramsden, Tenreyro and Pill). BoE speakers may be more interesting as they are likely to touch on the topic of the newly announced QE.

Source: xStation5

Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.