EURUSD is making huge gains at the beginning of a new week with the main currency pair trading 1.5% higher at press time. EURUSD rose to a 4-week high just shy of 1.02 handle as sentiment in Europe improved.

There seem to be two reasons behind the solid performance of the common currency on Monday. The first one is comments from ECB members over the weekend. Nagel and Elderson noted that interest rates in the euro area will have to rise further in order for the ECB to get a grip over inflation even if the European economy may be heading for a recession. On top of that, Reuters reported that ECB members it spoke to acknowledged that rates will need to increase to restrictive levels.

The second reason behind improved sentiment in Europe are news from Ukraine, where a major Ukrainian counteroffensive in the Kharkiv region made substantial gains and liberated numerous villages. Russian setbacks on the Ukrainian front rise hopes that talks between Ukraine and Russia will commence soon or later. However, both sides repeat that they are not interested in negotiations right now.

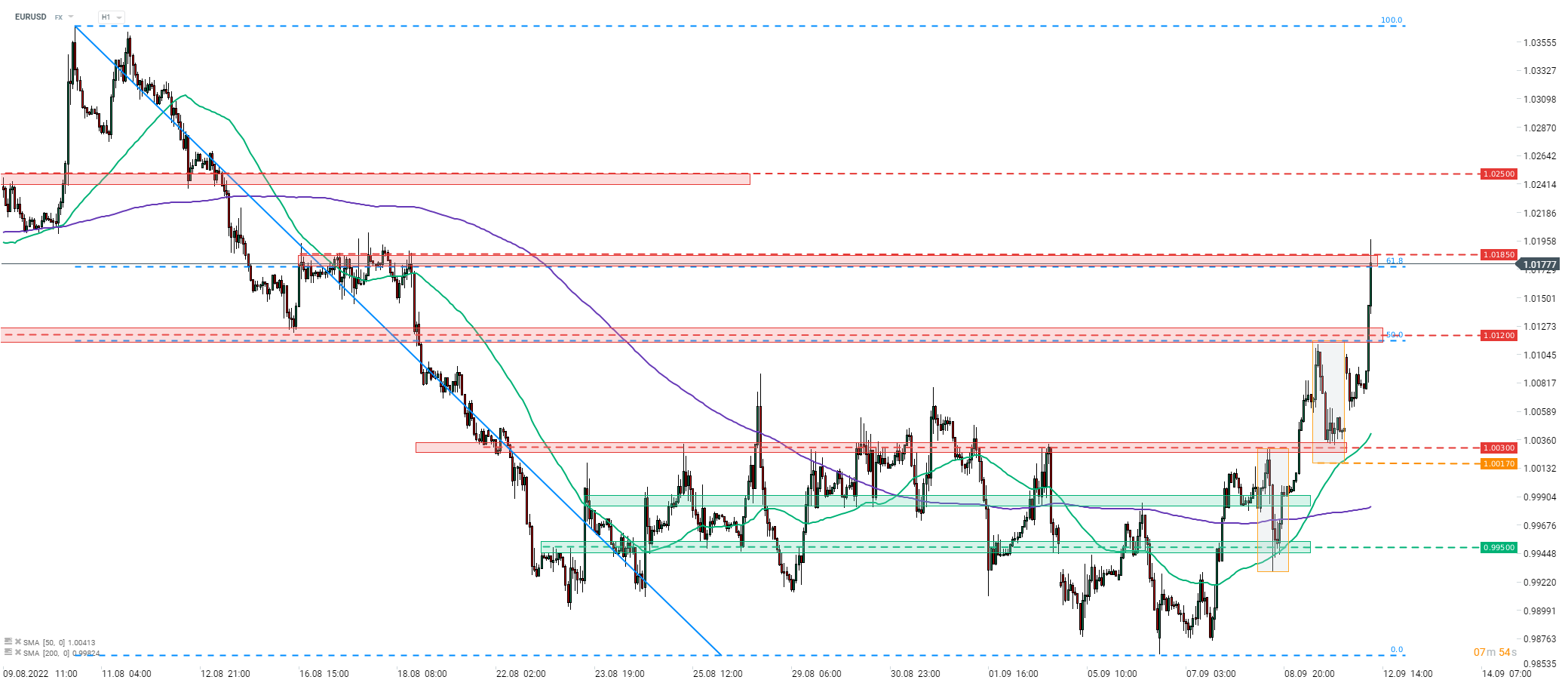

Taking a look at EURUSD chart at H1 interval, we can see that the pair jumped above the resistance zone marked with 50% retracement in the 1.0120 area and continued to move higher this morning. Pair even attempted to break above the resistance zone ranging between 61.8% retracement of late-August downward move and the 1.0185 handle but this advance was halted slightly below 1.02 mark. However, if bulls regain control and break above the 1.0185 handle, a move towards the next potential resistance at 1.0250 may come next.

Source: xStation5

Source: xStation5

Morning Wrap - Oil price is still elevated (07.03.2026)

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.