EUR is the worst performing major currency today. While it was Japanese yen, who was top laggard during the Asia-Pacific session, euro took a big hit following release of dismal flash PMI data for June from Europe and is now underperforming against all other G10 currencies. Flash PMI data from France, Germany and euro area came in below market expectations.

While weaker outlook for France economy can be blamed on uncertainty relating to the upcoming parliamentary elections, disappointment in German PMIs is somewhat puzzling as one could expect that big event like Euro 2024 football championship would at least brighten the outlook for country's services sector.

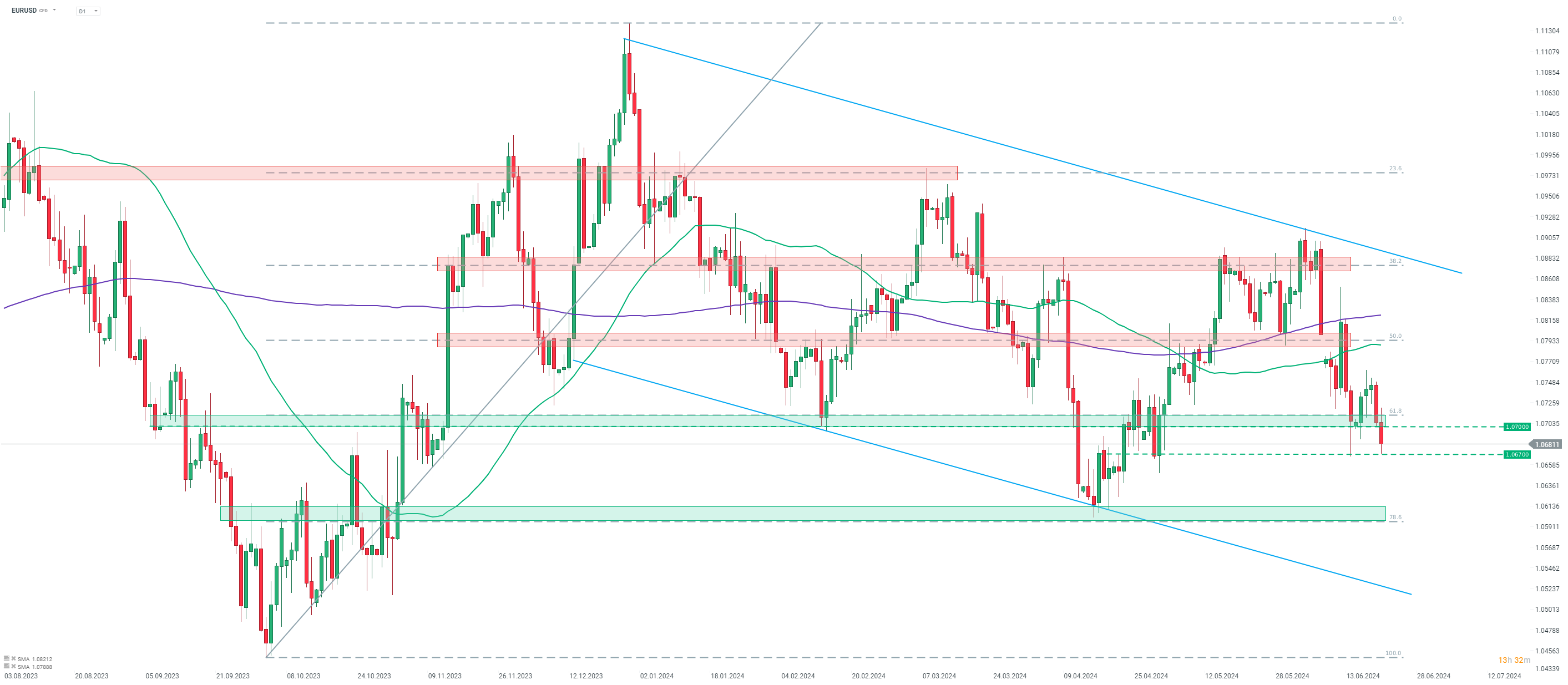

Taking a look at EURUSD chart at D1 interval, we can see that the pair has been trading in a wide downward channel since the beginning of 2024. Pair made a failed attempt at breaking above the upper limit of the channel at the beginning of June and has started to pull back. Today's post-PMI weakness plays into the overall technical picture, with the pair dropping below 61.8% retracement of the upward move launched in Q4 2023. Daily low today was reached near 1.0670 - a level marked with previous price reactions. However, should we see the pair deepen declines, the next support levels to watch are 78.6% retracement (1.06 area) and the lower limit of the channel (currently at 1.0525). Pair may see some additional volatility around 2:45 pm BST today, when flash US PMIs for June are released.

Source: xStation5

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.