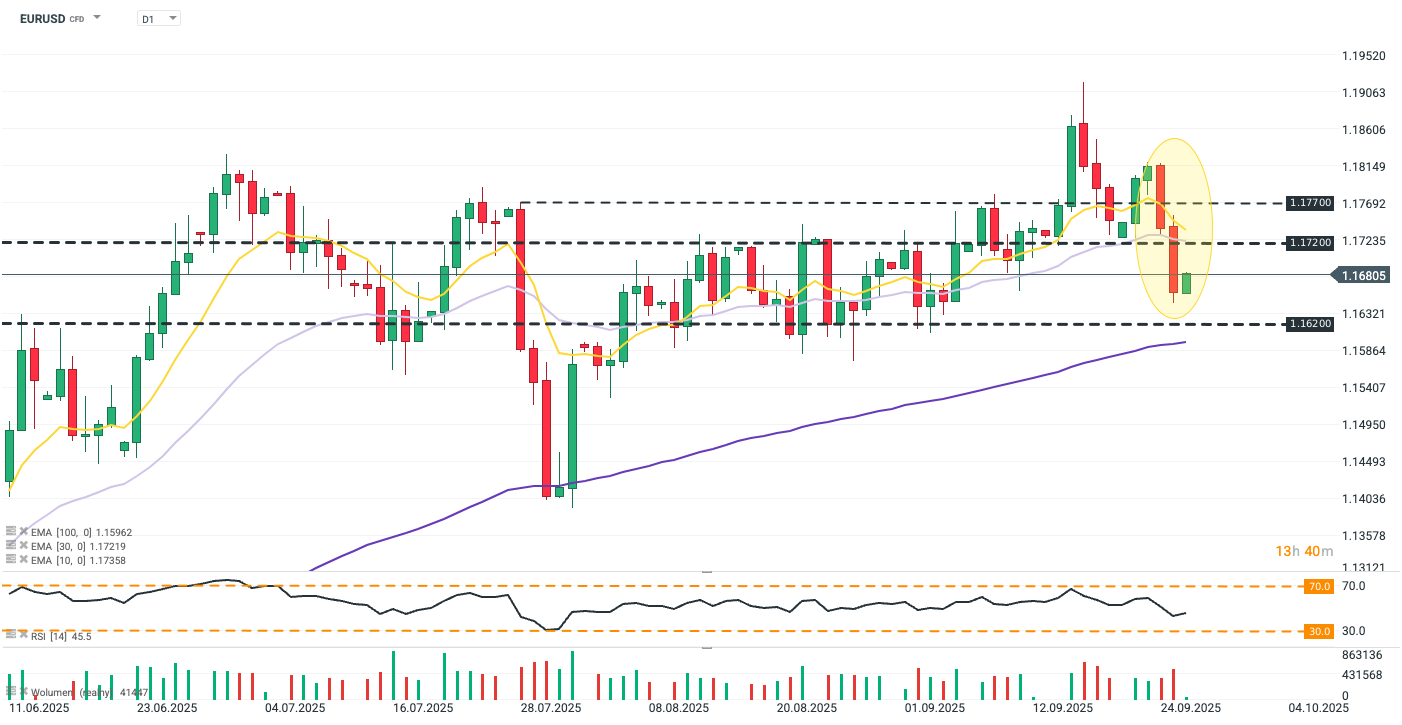

The euro is today the strongest G10 currency, rebounding about 0.15% against the dollar after two days of the deepest correction in two months. Nevertheless, EURUSD still trades below the psychological level of 1.1700, and the recent upward trend may be challanged by the latest U.S. GDP data and Donald Trump’s new wave of tariffs.

EURUSD lost 1.3% over the past two sessions, the steepest decline since the sharp selloff at the end of July in reaction to the EU–U.S. trade agreement. The pair plunged below the 30-day exponential moving average, but held safely above key support at 1.162. The scale of today’s rebound, however, will largely depend on the PCE report. Source: xStation5

What is shaping the EURUSD today?

-

Annualized U.S. GDP in Q2 was revised upward from 3.3% to 3.8%, the strongest reading since Q3 2023. A major driver was a tariff-driven boost in net exports, but private consumption — the main engine of the U.S. economy — also strengthened (revised from 1.6% to 2.5%) despite inflation and labor market concerns, as well as weak survey data.

-

The show of strength from the American consumer tempers expectations of further Fed rate cuts, especially combined with the latest labor market data, thus supporting the USD. Jobless claims unexpectedly fell below the 4-week average (218k vs. forecast 233k, prior 232k), easing fears of a rapid deterioration in the labor market. Overall, the data supports caution on the Fed’s side, but tension and uncertainty will grow ahead of today’s PCE report and next week’s NFP.

-

The core PCE index is expected to remain at 2.9%, and an in-line print should help the euro catch its breath after recent losses. On the other hand, uncertainty about Fed policy could amplify the market’s reaction in the event of higher-than-expected inflation, especially given Jerome Powell’s recent hawkish remarks about no risk-free rate path.

-

Donald Trump has announced a new round of tariffs effective October 1: 100% on branded pharmaceuticals, 50% on kitchen and bathroom cabinets, 30% on upholstered furniture, and 25% on trucks. However, details about possible exemptions are lacking — important in the context of EU and Japan agreements, which assumed no additional tariffs beyond those negotiated. The pharmaceutical tariff will not apply to companies that have begun building production lines in the U.S. (e.g., AstraZeneca, which announced a new plant in Virginia).

Daily summary: Wall Street tries to stop the sell-off 📌Gold down 1.8%, Bitcoin loses 4.5%

Wheat drops amid higher than expected WASDE report

NATGAS slightly gains after the EIA inventories change report

US Open: US100 initiates rebound attempt 🗽Micron shares near ATH📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.