Yesterday, Donald Trump announced plans to impose a 25% tariff on Europe, with the tariffs also expected to cover cars imported from Europe to the United States. However, the EUR/USD reaction to the renewal of these 'threats' appears relatively muted, as the pair declined from around 1.052 to 1.047. Recently, the pair's gains have been supported by mixed data from the U.S. economy, where inflation expectations (as well as inflation itself) are rising—yet the economy appears to be experiencing at least a temporary slowdown.

This is reflected in the latest data on consumer sentiment from the Conference Board, weaker services PMI, a disappointing retail sales reading, and cautious forecasts from some U.S. companies (such as Walmart), which have long been considered a barometer of consumer health. As a result, we see that the outlook for an expected (albeit still uncertain) economic rebound in Europe—potentially supported by greater flexibility for monetary easing at the ECB (where inflation appears to be under better control)—is at least temporarily offsetting bond yield differentials and the structural challenges facing the European economy.

In a scenario where U.S. consumer sentiment weakens further and key economic data underperforms, the market might start interpreting higher inflation readings as negative for the dollar. Stronger price pressures could tie the Federal Reserve's hands, limiting its ability to cut rates to ease labor market conditions or stimulate the economy. For the euro's strength, global sentiment—particularly risk appetite and investment flows into emerging markets (EM)—along with better inflation control compared to the U.S., will be crucial. Such a scenario would give the ECB more room for monetary easing and potential economic stimulus.

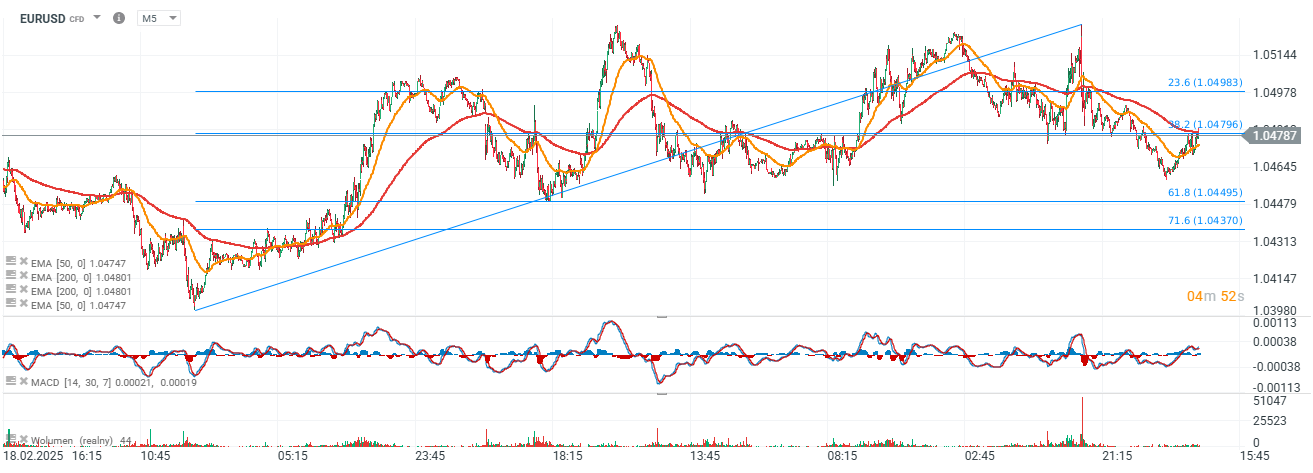

EUR/USD Chart (D1 Timeframe)

Looking at EUR/USD’s downward impulse, we can see that the pair rebounded after testing the 1.02 area, which aligns with the 61.8% Fibonacci retracement of the entire upward wave from 2022. The pair is also attempting to hold above the EMA50 (orange line). At least for now, the risk of a parity test has diminished, and investors have adjusted their positioning.

Source: xStation5

Source: xStation5

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily Summary - Powerful NFP report could delay Fed rate cuts

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.