The EURUSD has plunged to 1.0428, marking a sharp 0.7% decline against a broadly strengthening U.S. dollar, as President Trump's aggressive stance on trade tariffs triggers a flight to safety. The greenback's surge gained momentum after Trump's announcement of plans for "much bigger" universal tariffs, dismissing the Treasury's proposed 2.5% rate as insufficient.

Dollar Dominance

The U.S. dollar has strengthened across the board, with the Dollar Index climbing 0.4% following Trump's latest comments. The broader market impact has been significant, with risk-sensitive currencies retreating and safe-haven flows benefiting the dollar. Market participants are rapidly adjusting positions, with hedge funds increasing their long-dollar exposure amid expectations that protectionist policies will continue to support the greenback.

Tariff Impact

The proposed escalating tariff structure, potentially reaching 20%, poses a particular threat to the eurozone's export-driven economy. European automakers and industrial manufacturers are especially vulnerable, with the potential tariffs on semiconductors and metals threatening to disrupt crucial supply chains. Market analysts estimate that a 20% universal tariff could reduce eurozone GDP growth by 0.3-0.5 percentage points in 2025.

European Economic Challenges

Adding to the euro's woes, the eurozone economy continues to show signs of weakness, particularly in its largest member state. Germany's flatlining Q4 GDP and disappointing IFO business expectations have reinforced concerns about the region's growth trajectory. The eurozone's significant trade surplus with the U.S. makes it particularly vulnerable to any escalation in trade tensions, creating additional headwinds for the common currency.

ECB Rate Cut Path

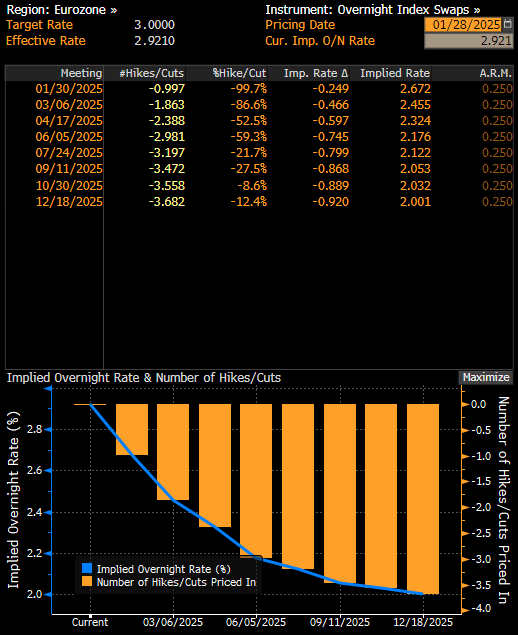

The European Central Bank finds itself in an increasingly complex position as it balances weak economic data against its inflation mandate. Market pricing now reflects expectations for more aggressive monetary easing, with three 25-basis-point cuts fully priced in for 2025. The ECB's President Christine Lagarde faces mounting pressure to address both growth concerns and the potential impact of U.S. trade measures at this week's meeting.

Implied rate cuts in Eurozone. Source: Bloomberg

Market Outlook

Near-term direction appears heavily skewed toward further euro weakness as dollar strength persists.The currency pair remains highly sensitive to U.S. trade policy headlines, with volatility expected to remain elevated as markets digest the implications of potential tariff increases of up to 20%. The traditional yield advantage that might normally support the euro has been overshadowed by these broader macro concerns and the dollar's renewed safe-haven appeal.

EURUSD (D1 Interval)

The EURUSD is approaching the 23.6% Fibonacci retracement level, which coincides with the 50-day SMA. This level is expected to act as strong support, having played a significant role in trading over the past two months. If a reversal occurs, the 38.2% Fibonacci retracement level, followed by the 100-day SMA, will become key resistance levels to watch.

The RSI is attempting to break an upward divergence, while the MACD is tightening and shows signs of potential bearish divergence, signaling caution for bulls. Source: xStation

Chart of the Day: EURUSD – Why is the Euro Losing to the Dollar?

Morning Wrap: Conflict Escalation Pushes Oil to $100 (12.03.2025)

🚨EURUSD fights for 1.16 ahead of US CPI

AUDUSD: Is the RBA the first central bank returning to rate hikes? 🪙

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.