Monetary policy decision from the Bank of England at 12:00 pm BST is a key macro event of the day. The UK central bank is expected to deliver a 50 basis point rate hike, putting the main interest rate at the highest level since late-2008 (1.75%). Market prices in an 82% chance of a 50 basis point rate move and an 18% chance of a 25 basis point rate move.

BoE said at the previous meeting that it is ready to act forcefully if inflation does not show signs of easing and recent data did not show it does. A 50 basis point rate move looks warranted and market pricing reflects it. As such, market attention will be mostly focused on forward guidance. Apart from showing continued inflationary pressures, recent data from the United Kingdom also pointed to further weakness of the UK economy. There is a growing consensus that BoE will signal that pace of tightening will ease with future rate hikes being of 25 basis point magnitude, rather than 50 basis point magnitude. On top of that, BoE said in May that it will provide an update on its strategy for balance sheet run-off at the August meeting so this is also a thing to watch.

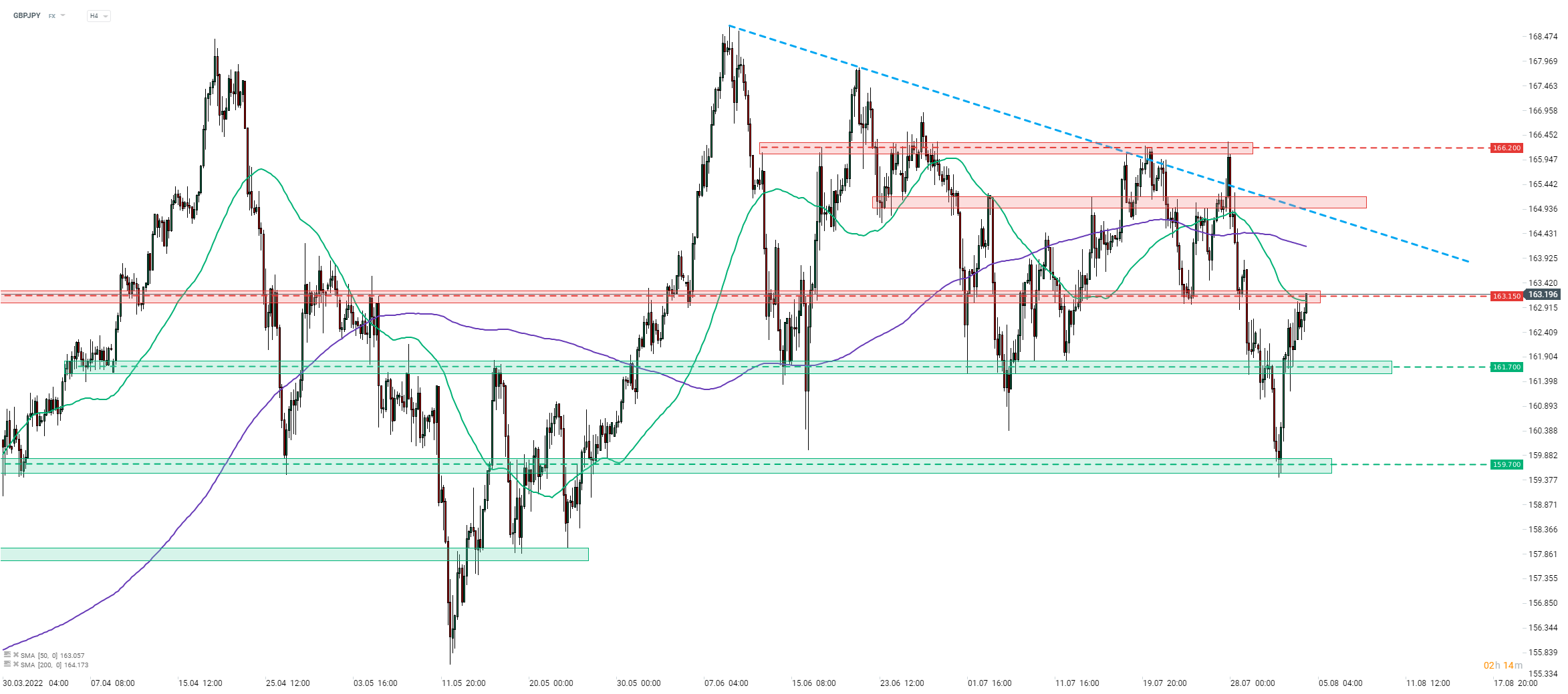

Taking a look at GBPJPY chart, we can see that the pair bounced off the 159.70 support zone earlier this week. Pair subsequently broke above the 161.70 price zone and is now testing resistance in the 162.15 area. This price zone is marked with previous price reactions as well as 50-period moving average on the H4 interval (green line). A break above would pave the way for a test of 200-period moving average (164.20 area currently) and possibly of downward trendline as well (164.90 area currently).

Source: xStation5

Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.