- Japan’s Nikkei 225 index surpassed the 50,000 mark for the first time in history on Monday

- On a monthly basis, the JP225 index has logged its strongest month for the last 15 years

- On a yearly basis, 2025 marks the second-strongest year of gains

- Japan’s Nikkei 225 index surpassed the 50,000 mark for the first time in history on Monday

- On a monthly basis, the JP225 index has logged its strongest month for the last 15 years

- On a yearly basis, 2025 marks the second-strongest year of gains

Japan’s Nikkei 225 index surpassed the 50,000 mark for the first time in history on Monday, closing up 2.46% at 50,512 points. The rally reflected optimism over easing U.S.–China trade tensions and strong global risk appetite following record gains on Wall Street.

Investor sentiment in Japan was further supported by expectations that the Bank of Japan will maintain its ultra-loose monetary policy at this week’s BoJ meeting, as well as by political backing for Prime Minister Sanae Takaichi’s pro-growth reforms. Her government’s planned expansionary fiscal measures have drawn comparisons to “Abenomics,” raising hopes of escaping decades-long deflation. The yen remains unusually strong today, gaining around 0.10–0.20% against other G10 currencies, while USDJPY is down 0.17% to 152.820.

Risk appetite in the Asia-Pacific region was also buoyed by news that the U.S. abandoned plans to impose 100% tariffs on Chinese imports. Investors expect Prime Minister Takaichi to meet former President Trump during his visit to Japan later this week.

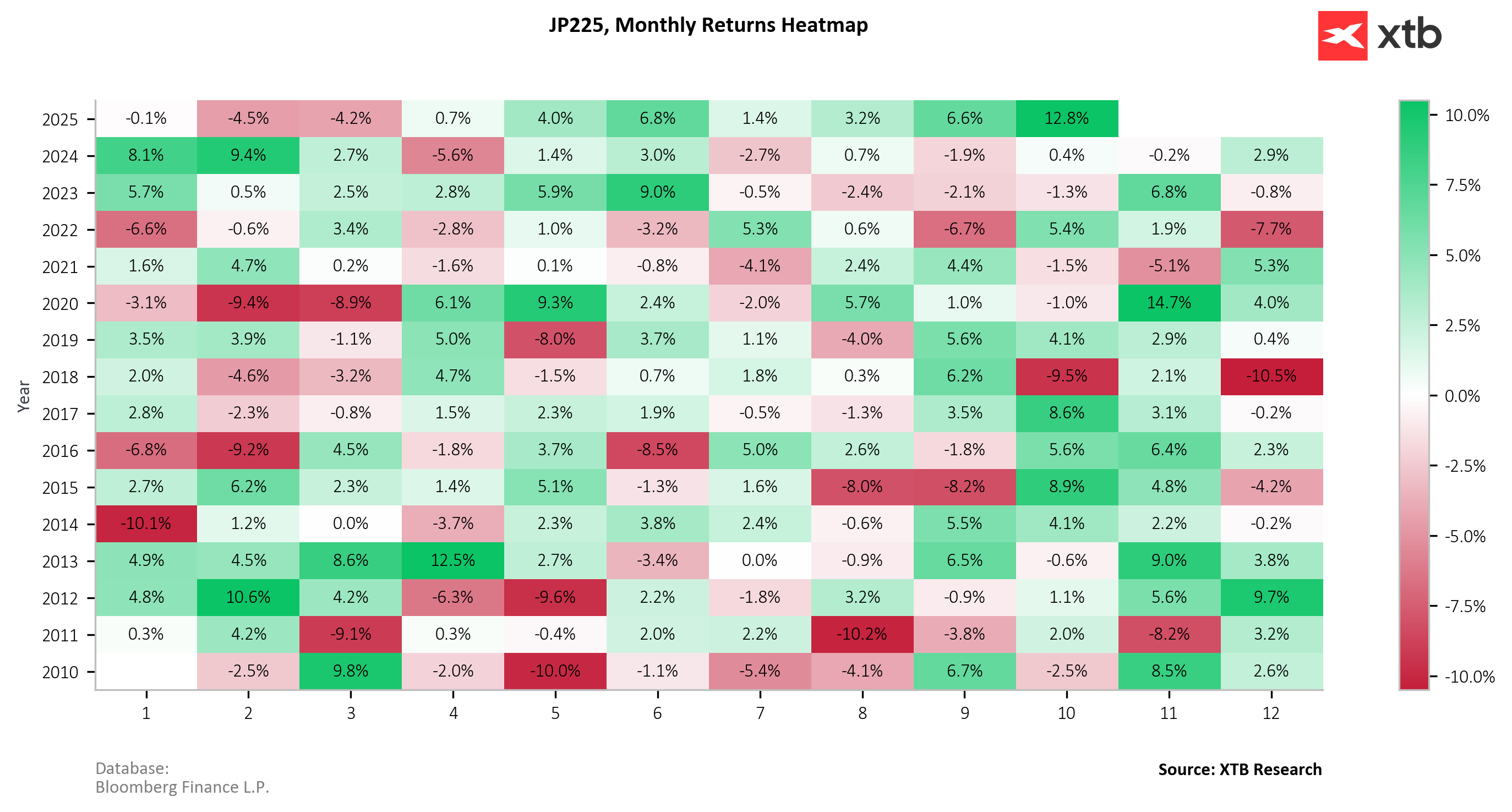

On a monthly basis, the JP225 index has logged its strongest month since data collection began in 2010, rising 12.8% in just one month (October).

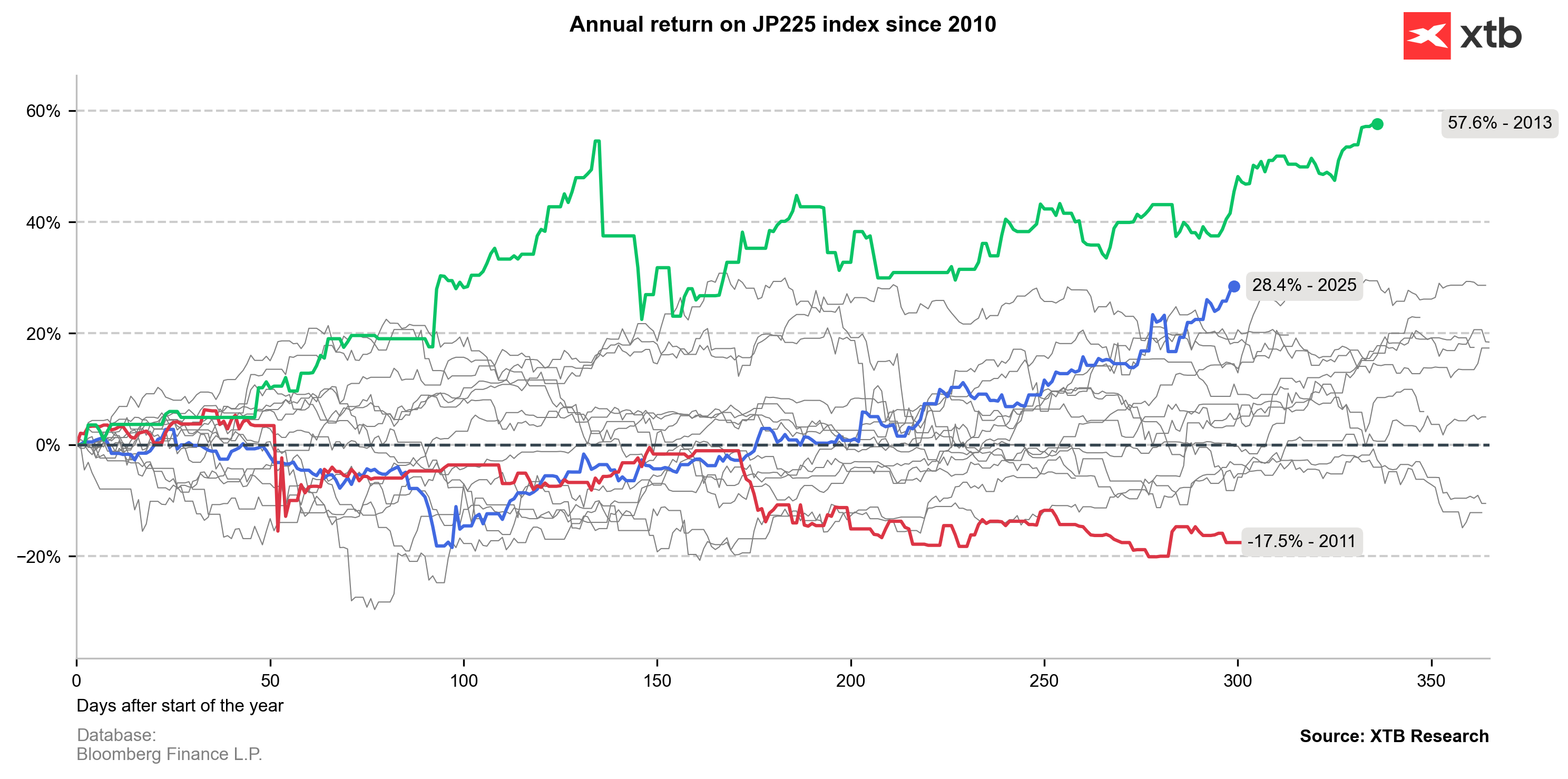

On a yearly basis, 2025 marks the second strongest year of gains in the past 15 years, although it’s worth noting that the rally accelerated only around midyear.

JP225 (D1 interval)

Surpassing the historic 50,000-point threshold — more than three decades after the 1989 bubble-era peak — signals a gradual revival of investor confidence in Japan’s economy. Nikkei 225 futures (JP225) traded on the XTB platform had already crossed 50,000 points late last week, following the close of Japan’s cash session.

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.