The Reserve Bank of New Zealand (RBNZ) cut the official cash rate (OCR) by 25 bp to 2.25%, in line with expectations, likely marking the final step in the easing cycle that began in 2024.

The decision was made in an environment where CPI inflation stands at 3%, the upper end of the 1–3% target band. Forecasts project a decline toward 2% by mid-2026. New Zealand’s economy contracted by 0.9% in Q2. However, the RBNZ believes the decline was driven by temporary factors and seasonal distortions. The latest projections suggest a moderate rebound. The committee voted 5 to 1 in favor of a 25 bp cut while stressing that future decisions will depend on inflation dynamics and economic activity.

During the press conference, acting Governor Christian Hawkesby described the decision as the beginning of a return to a more “boring” monetary-policy environment. Hawkesby hopes that by 2026 the RBNZ will disappear from front-page headlines, inflation will move closer to 2%, and economic growth will normalize. He emphasized that risks to the forecasts are balanced: global inflation and political uncertainty remain challenges, but domestic inflation expectations are becoming more firmly anchored and the labor market shows signs of stabilizing. As he stated, every option remains “on the table,” but the central projection assumes no further cuts.

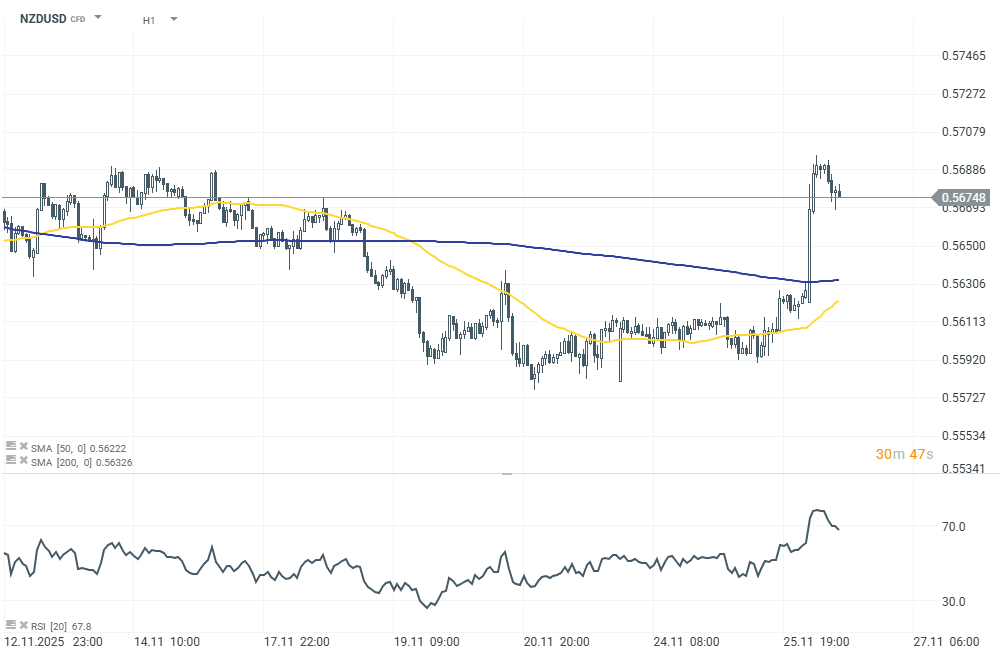

Markets interpreted the combination of a dovish move and balanced rhetoric as less dovish than expected, triggering a sharp strengthening of the New Zealand dollar. Following the announcement and press conference, the NZD strengthened by about 1.10% against the U.S. dollar, becoming the strongest currency in the G10 basket. The move reflects investors’ belief that the easing cycle is nearing its end and that the RBNZ is signaling macroeconomic comfort.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.