OPEC+ members announced massive voluntary oil output cuts over the weekend, triggering a spike in oil prices at the beginning of new week's trade. A total cut of 1.157 million barrels was announced by 8 OPEC and non-OPEC countries. Those cuts will take effect from May and will remain in force until the year of the year. On top of that, Russia announced that its 500 thousand barrel output cut, which was set to end by the end of June 2023, will be extended until the end of 2023. This is a massive reduction in supply, amounting to more than 1% of global output, and it should not come as a surprise that oil prices jumped over 5% at the beginning of a new week. However, it should be noted that such massive oil output cuts may also hint that OPEC has some serious concerns about demand outlook. Having said that, this may not be bullish for oil prices in the long-term. OPEC+ Joint Minister Monitoring Committee is meeting today and will provide recommendations on policy. It was widely expected that recommendation will be for no change in the output but weekend announcements created uncertainty.

OPEC: 1,079k bpd

- Saudi Arabia: 500k bpd

- Iraq: 211k bpd

- United Arab Emirates: 144k bpd

- Kuwait: 128k bpd

- Algeria: 48k bpd

- Oman: 40k bpd

- Gabon: 8k bpd

OPEC+: 578k bpd

- Kazakhstan: 78k bpd

- Russia: extension of 500k bpd cut until end of the year (was set to end in June)

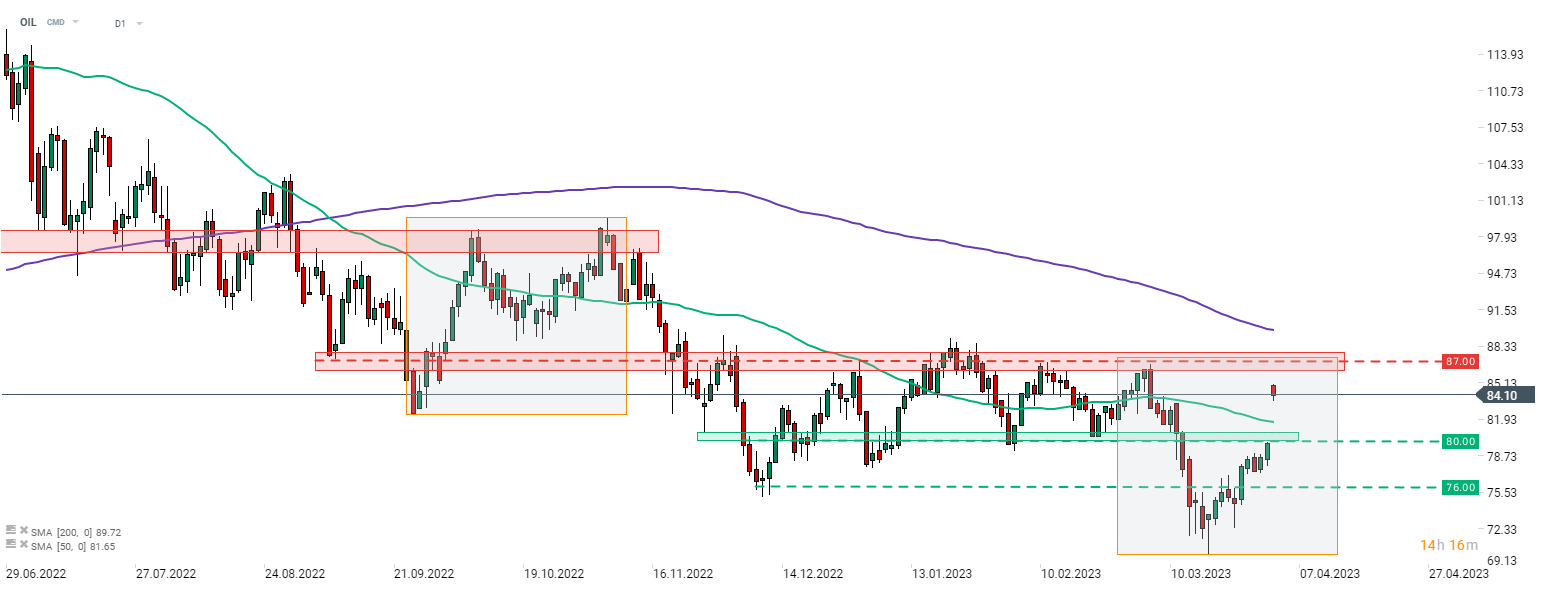

Brent (OIL) launched this week's trading with a big bullish price gap but those gains started to be erased later on. Nevertheless, oil continues to trade around 5% higher on the day. A point to note, however, is that price did not manage to reach a key resistance zone in the $87 area, marked with previous price reactions and the upper limit of the Overbalance structure. This means that the outlook remains bearish and an attempt to fill the bullish price gap cannot be ruled out. The $80 area is the first support to watch in such a scenario.

Source: xStation5

Source: xStation5

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.