The oil market has recently experienced a strong sell-off, spurred by concerns over the macro health of the US economy, from which weaker data has 'joined' long-observed weak data from Europe and Asia (especially China). Oil has failed to halt declines despite the expected escalation of tensions in the Middle East, with Brent prices hovering around $77 per barrel, after a rebound from $75 lows, although an Iranian attack on Israel according to many sources seems inevitable.

- It's hardly surprising that the market 'slept through' the possible flare-up of a broader regional conflict in the Middle East, following several, weaker macro readings from the US. Today, however, we are seeing a near 1.5% rebound in oil, and if the market begins to price in 'firmer' readings from the US (tomorrow's claims at 2:30 pm), with the risk of war rising, oil contracts could return above $80 per barrel.

- We have a situation where the market will either see another weak macro data from the US and no significant escalation in the Middle East, which could lead to resignation and a test of the May 2023 minima at $72 per barrel, or a war between Israel and Iran (an OPEC member) will eventually occur, causing tighter supply and a rebound in prices, even if macro data from the US fill the markets with uncertainty.

- At this point, Wall Street is not showing that it expects anything other than continued, repeated attacks by Huti, Hamas and Hezbollah militants. According to Reuters sources, anonymous sources with ties to the U.S. were said to be pressuring Israel not to decide on an escalatory response, to a possible Iranian attack, expected next Monday, or Tuesday.

- Stopping the war in the Middle East now seems crucial for U.S. diplomacy, ahead of the presidential election (keeping oil prices under control), and Trump's win could result in stronger U.S. involvement, in a possible war with Iran - if it decides to launch a full-scale attack. Oil prices show that the market does not see this scenario as likely at present, while if it materializes - oil could rebound.

Lower production at the Sharara oilfield, Libya (300,000 barrels per day) has raised concerns about supply; Libya's National Oil Corp has said it will begin reducing production due to protests. However, the oil market continues to receive mixed data. The much-anticipated seasonal rebound in Q3 demand still appears disappointing at this point in the US, cushioned by fears of a supply glut in Libya. Consumption of road fuels such as gasoline and diesel fell below initially optimistic forecasts according to the data, analysed by Onyx Capital. Saudi Aramco reported a 3.4% y/y drop in net profit, although the company noted that market fundamentals do not support a price decline, and demand in China is growing. Also, roday Chinese import report came in much higher than expected, signalling potentially improving momentum for oil. Today at 3:30 PM GMT we will learn the change in inventories according to the EIA.

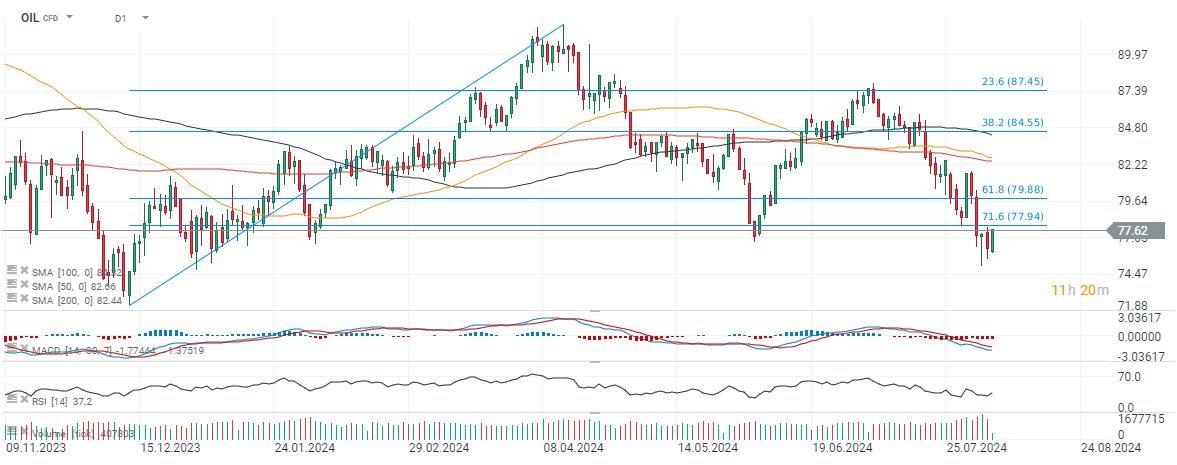

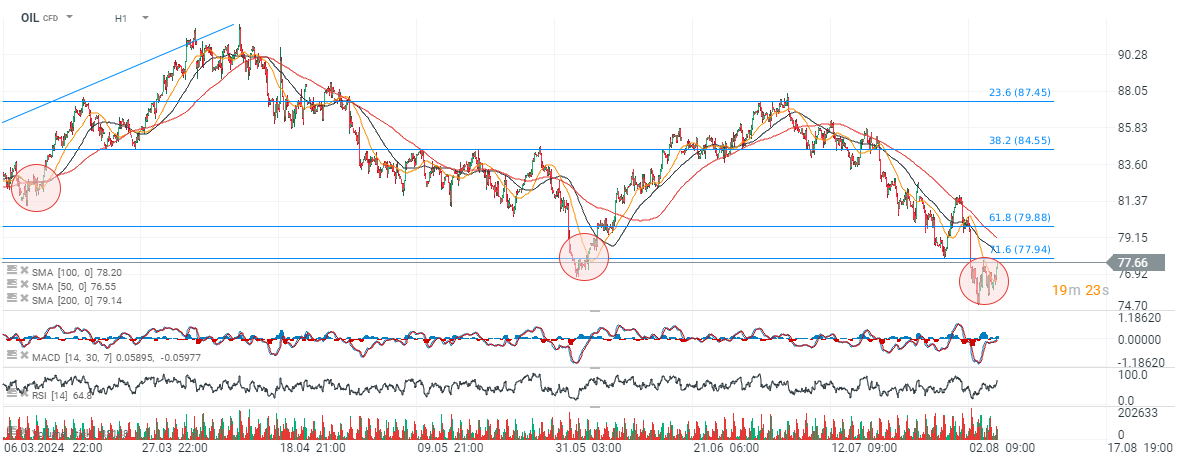

OIL (D1 and H1 chart)

Brent is approaching the 71.6 Fibonacci retracement of the December 2023 upward wave at $78 per barrel. The next key levels are between $79 and $82. Source: xStation5

Source: xStation5 Source: xStation5

Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74

US Raises Tariffs to 15%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.