Global equity sentiment is clearly weaker today. Nasdaq 100 futures (US100) are down close to 0.7% as markets grapple with renewed uncertainty around US Europe trade relations.

- The current base case in the market is that tariffs on European goods could rise by 10% by February 1, and potentially to 25% on June 1 if Europe continues to block the United States from purchasing Greenland. Hardening transatlantic negotiations also increase the risk of penalties and higher taxes targeting US technology companies operating in Europe.

- After the US session, Netflix (NFLX.US) is set to report earnings. If the results disappoint, the market could see another downside impulse. Netflix shares are down nearly 30% from this year’s highs and have fallen more than 6% year to date. Later in the day, investors may also focus on a potential US Supreme Court decision regarding tariffs.

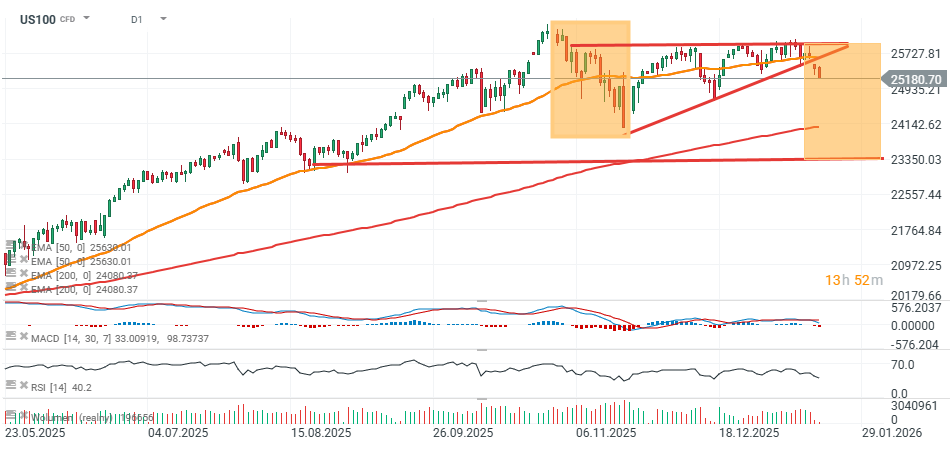

US100 (D1 timeframe)

Looking at the US100 chart, the index has broken to the downside from a rectangular triangle pattern. If the decline were to mirror the prior bearish impulse (a continuation move), it could imply a pullback toward the 23,350 area, where notable price reactions were seen around late July and early August 2025. The index has also dropped decisively below the 50 day exponential moving average on the daily chart (EMA50, orange line), while MACD and RSI indicators point to selling pressure remaining in control.

Source: xStation5

Market wrap: European and US stocks try to rebound rebound 📈

BREAKING: Oil falls after NYT report on talks between Iran and the CIA regarding a suspension of military action💡

Gold and silver rebound after the sell-off 📈

VIX struggle to rise higher despite uncertainty on Wall Street 🔎

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.