Americans will go to the poll stations today to vote in midterms elections. Control over the Congress is in the game and pre-election surveys suggest that Republicans may get a majority in the House of Representatives while Democrats will retain control over the Senate. When the voting ends depends on the state with the earliest closes being at 11:00 pm GMT and the latest at 6:00 am GMT on Wednesday, November 9. Key votes will be held in Georgia (end - 12:00 am GMT) and Nevada (end - 3:00 am GMT) as those are close calls and may be decisive for who wins control. However, it should be noted that Democrats and Republicans are not the only ones taking part in elections as in some states other political parties also have representatives on the ballots. This means that there is a possibility that neither of the candidates will get over 50% votes and it means that a run-off will be needed. As such, there is a chance that control over the Congress won't be fully determined until weeks after midterms when run-offs are held.

It is widely believed that divided Congress is beneficial for stocks as such an outcome limits risk of sweeping reforms that may increase uncertainty for businesses. However, it also should be noted that S&P 500 gained in the 12-month period following each midterms since 1942, regardless of who was in power and whether the power was split between two parties.

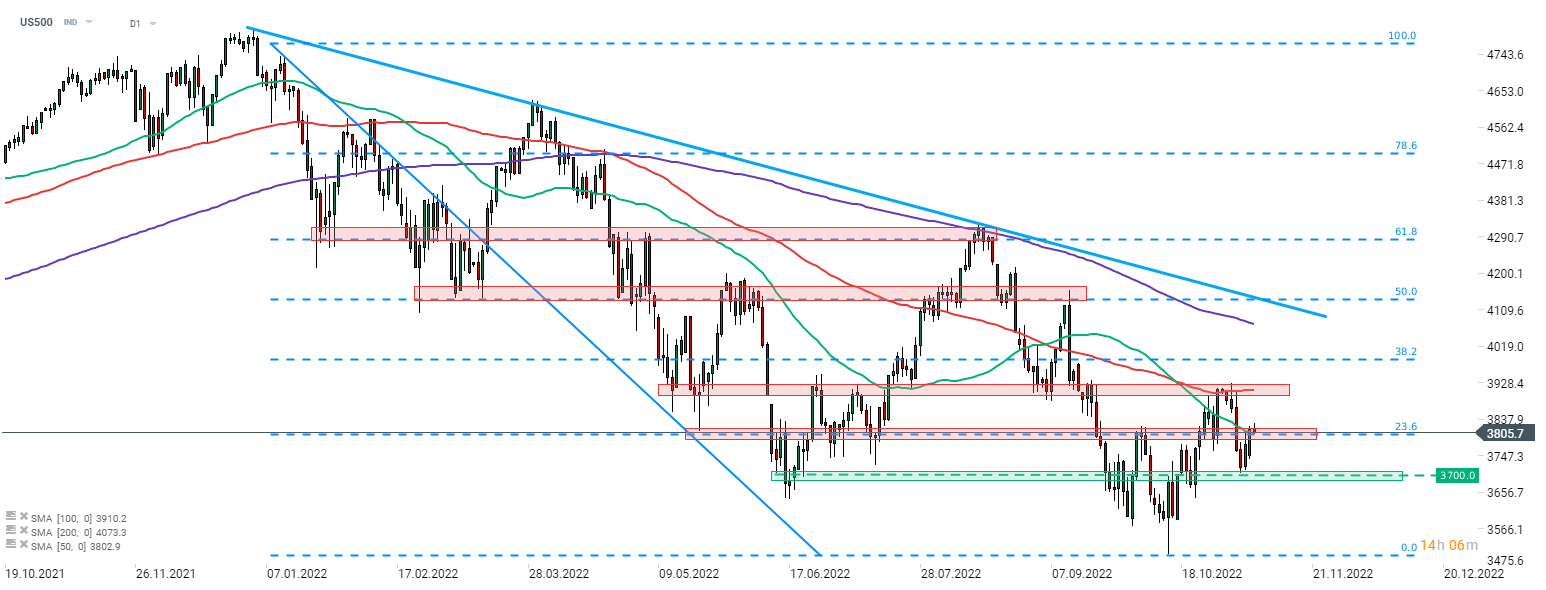

S&P 500 (US500) bounced off the 3,700 pts support zone last week and launched a recovery move. Index climbed above the 50-session moving average (green line) and 23.6% retracement yesterday but momentum faded today. However, should bulls regain control, a test of the swing zone marked with previous price reactions and 100-session moving average (red line) cannot be ruled out in near-term.

Source: xStation5

Source: xStation5

Will the defense sector keep European stock markets afloat❓

Chart of the day: JP225 (08.01.2026) 💡

Daily summary: Alphabet shares support sentiments on Wall Street 🗽Oil, precious metals and crypto slide

US Open: Nasdaq continue to climb📈Intel and Eli Lilly stocks surge

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.