USDCAD is one of the pairs to watch in the early afternoon as the first Friday of a new month has come and therefore it is time for release of jobs data from the United States and Canada. Of course, report from the United States will be watched more closely than Canadian one but the fact that both will be released at the same time (1:30 pm BST) means that USDCAD is likely to become very volatile around that hour.

The US report is expected to show a 200k increase in non-farm payrolls, slightly lower than the 209k reported in June. Unemployment rate is seen staying at 3.6% while annual wage growth is seen slowing from 4.4 to 4.2% YoY. Fed Chair Powell stressed that the September decision will be data-dependent and there are 4 key US macro reports ahead of the September 20, 2023 meeting - 2 jobs reports and 2 CPI reports. NFP report for July is the first one of the four and will be watched closely. A higher-than-expected jobs gain and a smaller drop in wage growth would likely boost hawkish bets in the markets and may trigger gains on the USD market as well as declines on equities.

The Canadian report is not expected to have as much gravity as the Bank of Canada is largely seen as having already finished its rate hike cycle. Nevertheless, release is likely to trigger some short-term CAD-volatility.

US, NFP report for July

-

Non-farm payrolls. Expected: 200k. Previous: 209k

-

Private payrolls. Expected: 180k. Previous: 149k (ADP: +324k)

-

Unemployment rate. Expected: 3.6%. Previous: 3.6%

-

Wage growth: 4.2% YoY. Previous: 4.4% YoY

Canada, jobs report for July

-

Employment change. Expected: +22.0k. Previous: +59.9k

-

Unemployment rate. Expected: 5.5%. Previous: 5.4%

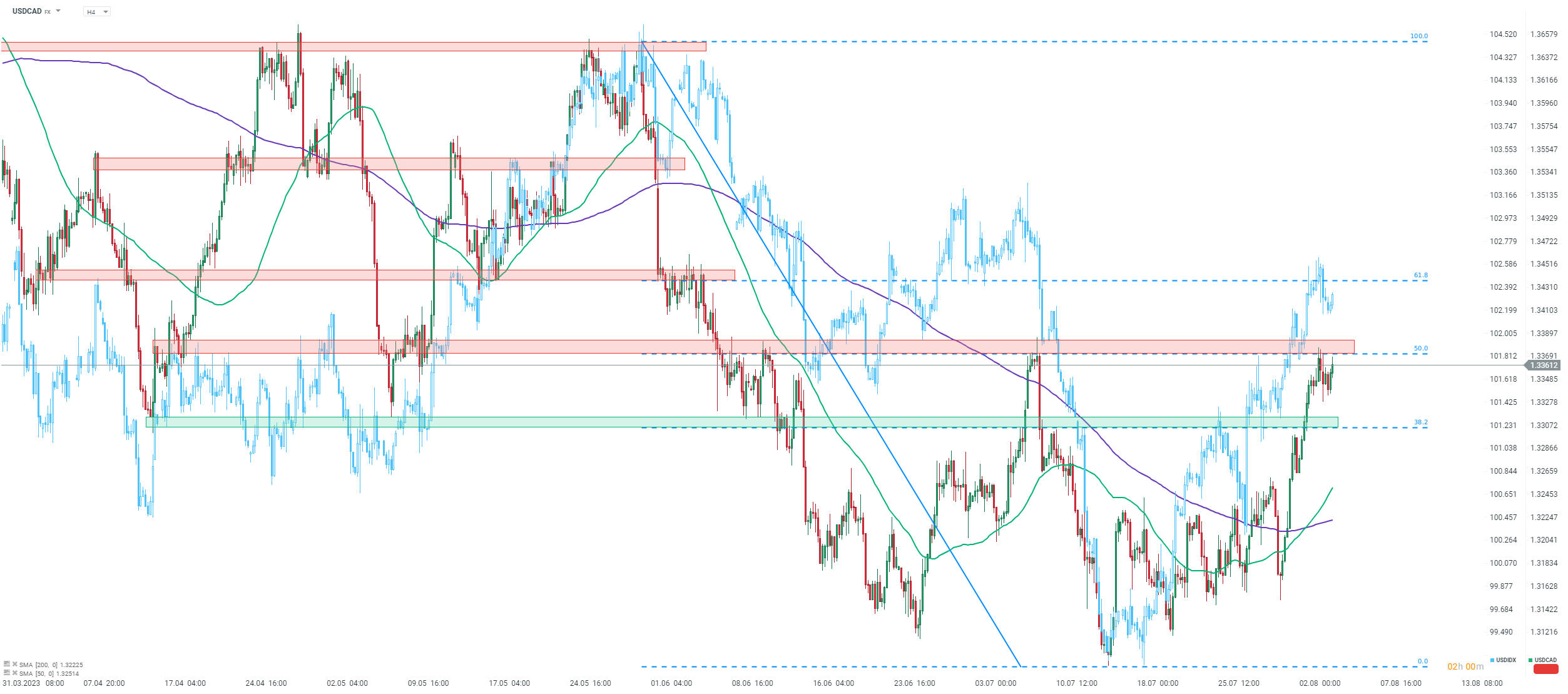

Taking a look at USDCAD chart at D1 interval, we can see that the pair has experienced strong gains recently, driven by strengthening of US dollar (USDIDX - light blue overlay). However, advance was halted after the pair reached resistance zone ranging above 50% retracement of the downward move launched at the turn of May and June 2023 (1.3370 area). This is a price zone that had halted advance in early-July as well. A strong US report combined with weaker Canadian data could trigger a break above the aforementioned 1.3370 area. In such a scenario, the next resistance to watch can be found ranging above 61.8% retracement (1.3440). On the other hand, should we see CAD gain against USD - drop in USDCAD - the support level to watch can be found at 38.2% retracement (1.3300 area).

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.