USDCAD is trading higher today, thanks to the strength of the US dollar. However, it does not mean that the Canadian dollar can be named a laggard. In fact, Canadian currency is the second best performing in the G10 basket today, being supported by an increase in oil prices and a general improvement in risk moods. The day ahead is light in terms of macroeconomic releases but CAD will get a chance to move in the afternoon during speech from BoC Governor Macklem at 3:00 pm GMT.

Tiff Macklem, Governor of the Bank of Canada, will deliver a speech today at 3:00 pm GMT. It is rumoured that Macklem will present results of policy framework review. It is expected that the current framework, assuming a 2% inflation goal, will be renewed for another 5 years. This looks like a probable topic of today's speech, as a joint press conference of BoC Governor and Canadian finance minister is scheduled for 4:00 pm GMT (BoC policy framework is jointly agreed between BoC and Finance Ministry).

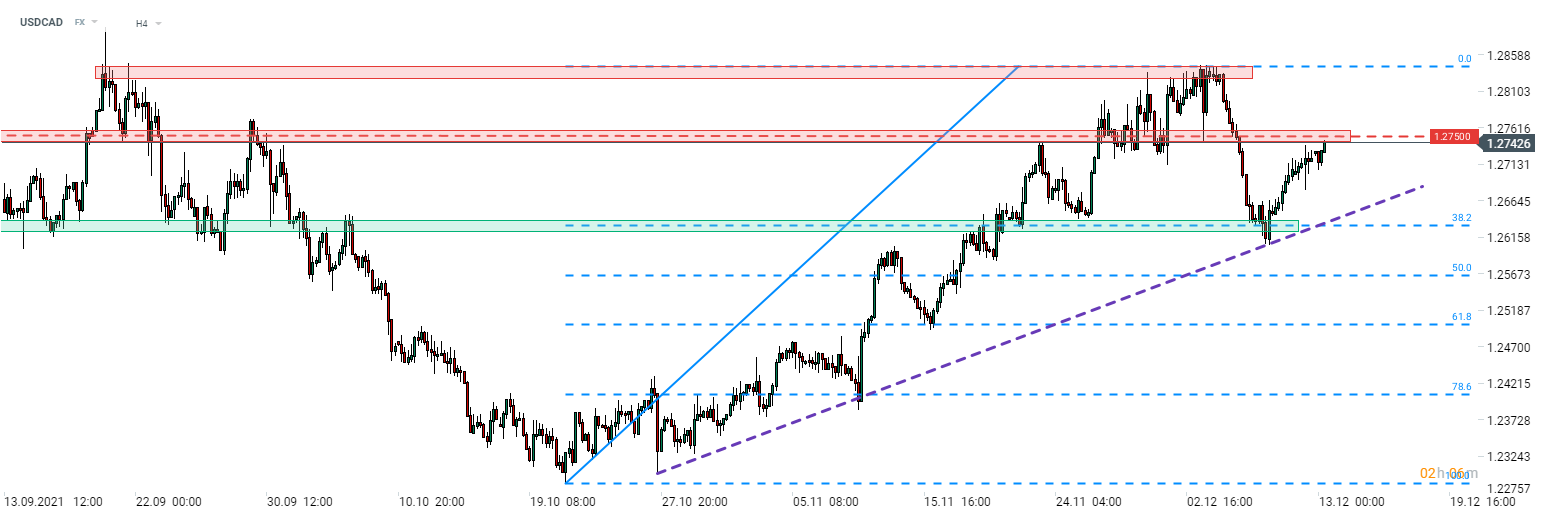

A look at USDCAD chart shows us that the pair halted short-term downward correction at the 38.2% retracement of recent downward impulse and started to regain ground later on. USDCAD climbed back and is now testing a key 1.2750 resistance zone, which is marked with the 61.8% retracement of the correction move from the beginning of last week. A break above this zone would pave the way for a test of recent highs at around 1.2840.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.