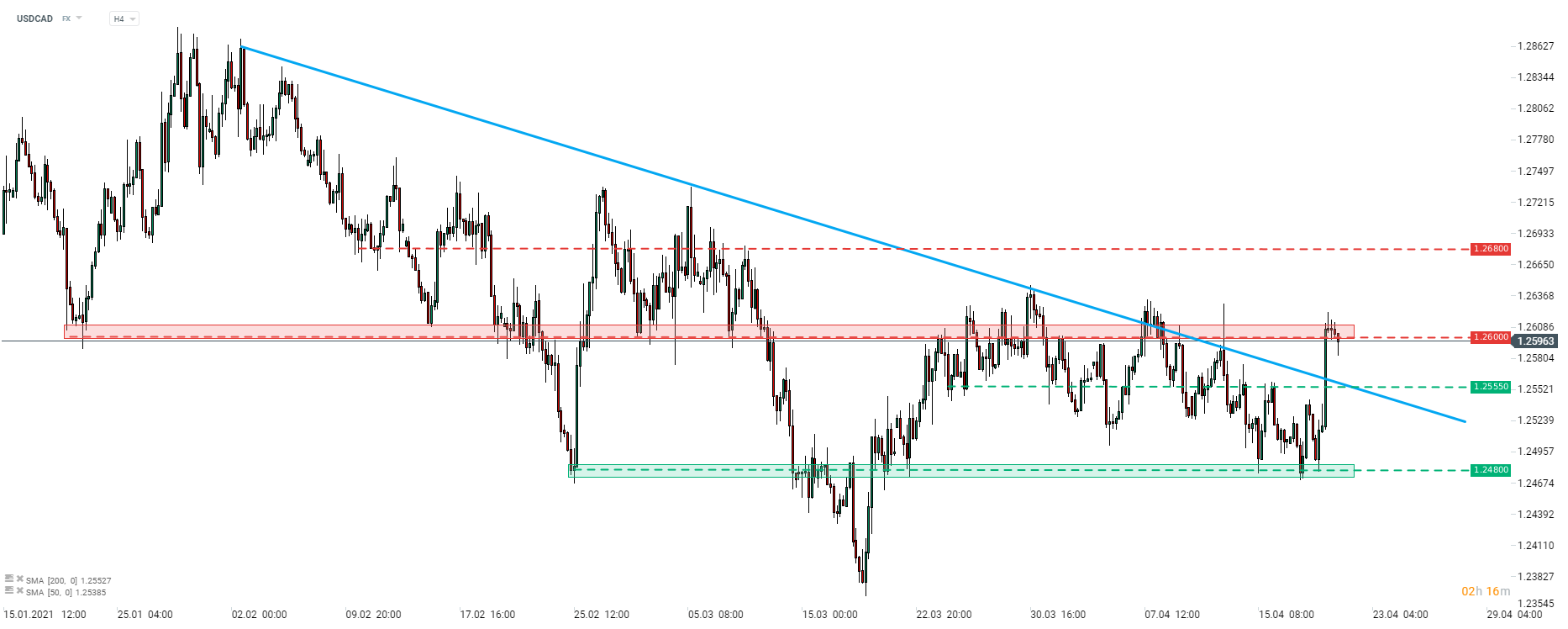

USDCAD brokke above a mid-term downward trendline yesterday in the afternoon. The pair continued to move higher until upward move was halted at the resistance zone ranging above 1.26 mark. Pair pulled back today and the near-term support to watch can be found in the 1.2555 swing area, which also coincides with the aforementioned downward trendline. In case of a break above 1.26 resistance, upward move may extend towards resistance at 1.2680.

USDCAD is likely to enjoy elevated volatility in the afternoon as the Canadian CPI data for March will be released at 1:30 pm BST and Bank of Canada will announce a rate decision at 3:00 pm BST. The latter is a much more important event as BoC is expected to start tightening policy. While rates are expected to be left unchanged, economists expect the central bank to scale down weekly government bond purchases from C$4 billion to C$3 billion. Expectations are reasoned with better-than-expected economic data from Canada. Apart from that, it is believed that the previous scale of central bank bond purchases is too big for the size of Canadian bond market. Bank of Canada Governor Tiff Macklem will hold a press conference at 4:00 pm BST.

Source: xStation5

Source: xStation5

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Morning wrap (05.03.2026)

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.