- The PBoC set a stronger-than-expected daily reference rate for the yuan

- Reverse repo operation injects liquidity into the offshore yuan

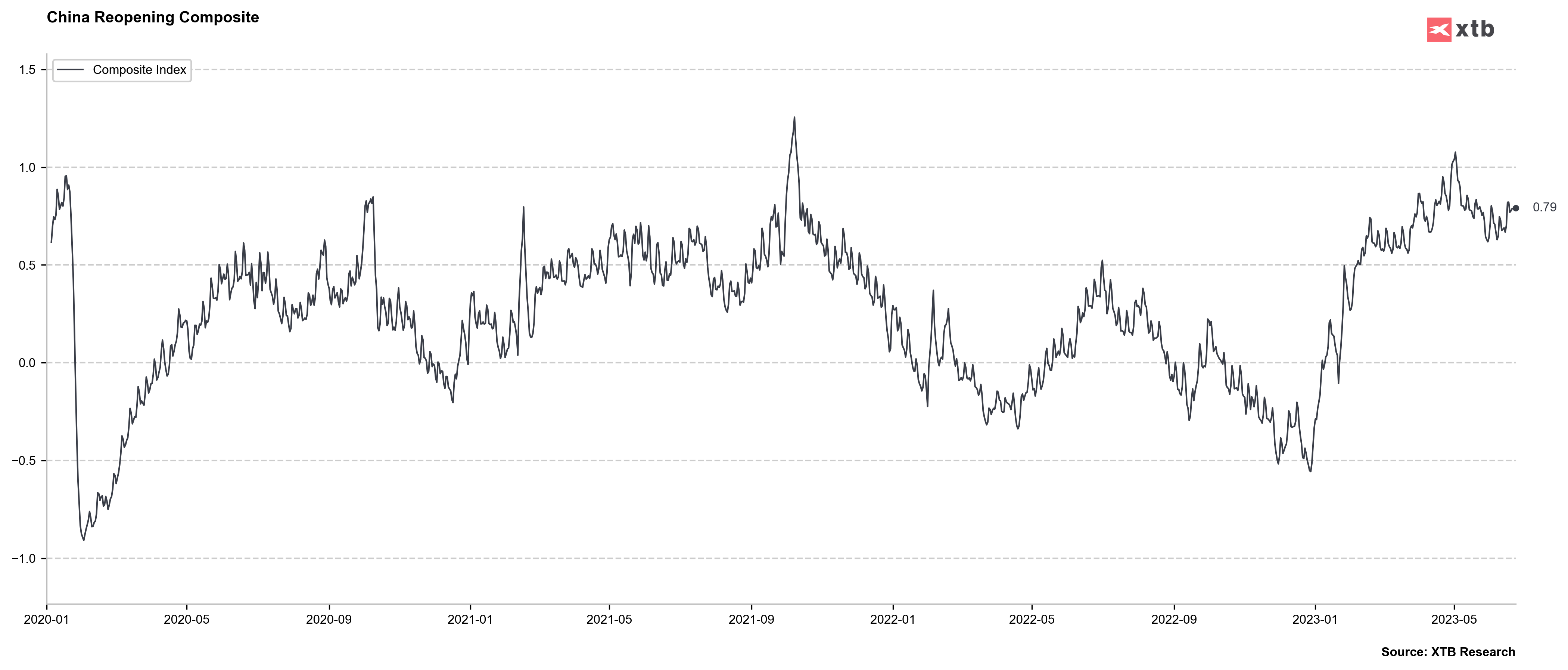

- Economic challenges persist in China, with weak growth and rising youth unemployment, but robust measures are being taken to support the yuan

In an attempt to counter investor pessimism surrounding China's economic challenges, including weak growth and surging youth unemployment, the People's Bank of China (PBOC) has taken decisive action. The PBoC set the daily reference rate for the yuan stronger than market expectations, aiming to bolster the currency and exhibit its control over monetary policy.

-

The PBoC set the midpoint rate USDCNY at 7.2098 per US dollar prior to market open, weaker than the previous fix of 7.2056, but nearly 100 pips stronger than consensus estimates and compared with the last close of 7.2425.

This move was interpreted as a sign of the PBOC's reluctance to let the yuan depreciate rapidly, despite the bearish pressure on the currency due to the weakening economic outlook.

Complementing the PBOC's intervention, the bank carried out a reverse repo operation last night injecting liquidity worth 37 billion yuan. This action, combined with previous interventions, has added a total of 219 billion yuan (equivalent to USD 30.4 billion) during the last seven days. The reverse repo operation was conducted at an interest rate of 1.9%.

Complementing the PBOC's intervention, the bank carried out a reverse repo operation last night injecting liquidity worth 37 billion yuan. This action, combined with previous interventions, has added a total of 219 billion yuan (equivalent to USD 30.4 billion) during the last seven days. The reverse repo operation was conducted at an interest rate of 1.9%.

The USDCNH price is currently at 7.2097, experiencing a decline of 0.45% for the day. The price has been following a strong uptrend channel since the beginning of the year 2023. It's worth noting that the multiyear high for this currency pair was reached last year at 7.3602. In terms of future price movements, the next resistance level can be identified as the level above the multiyear high, which is 7.3602. On the other hand, the support level is situated at 7.1918, which coincides with the previous peaks observed in 2019 and 2020.

The USDCNH price is currently at 7.2097, experiencing a decline of 0.45% for the day. The price has been following a strong uptrend channel since the beginning of the year 2023. It's worth noting that the multiyear high for this currency pair was reached last year at 7.3602. In terms of future price movements, the next resistance level can be identified as the level above the multiyear high, which is 7.3602. On the other hand, the support level is situated at 7.1918, which coincides with the previous peaks observed in 2019 and 2020.

BoJ maintains rates despite hawkish shift in outlook. What next for the USDJPY?

Morning wrap (23.01.2026)

BREAKING: EURUSD reacts 🗽US jobless claims lower than expected

Chart of the day: AUDUSD Eyes Multi-Year Highs 🇦🇺 📈 Rate hike in February❓(22.01.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.