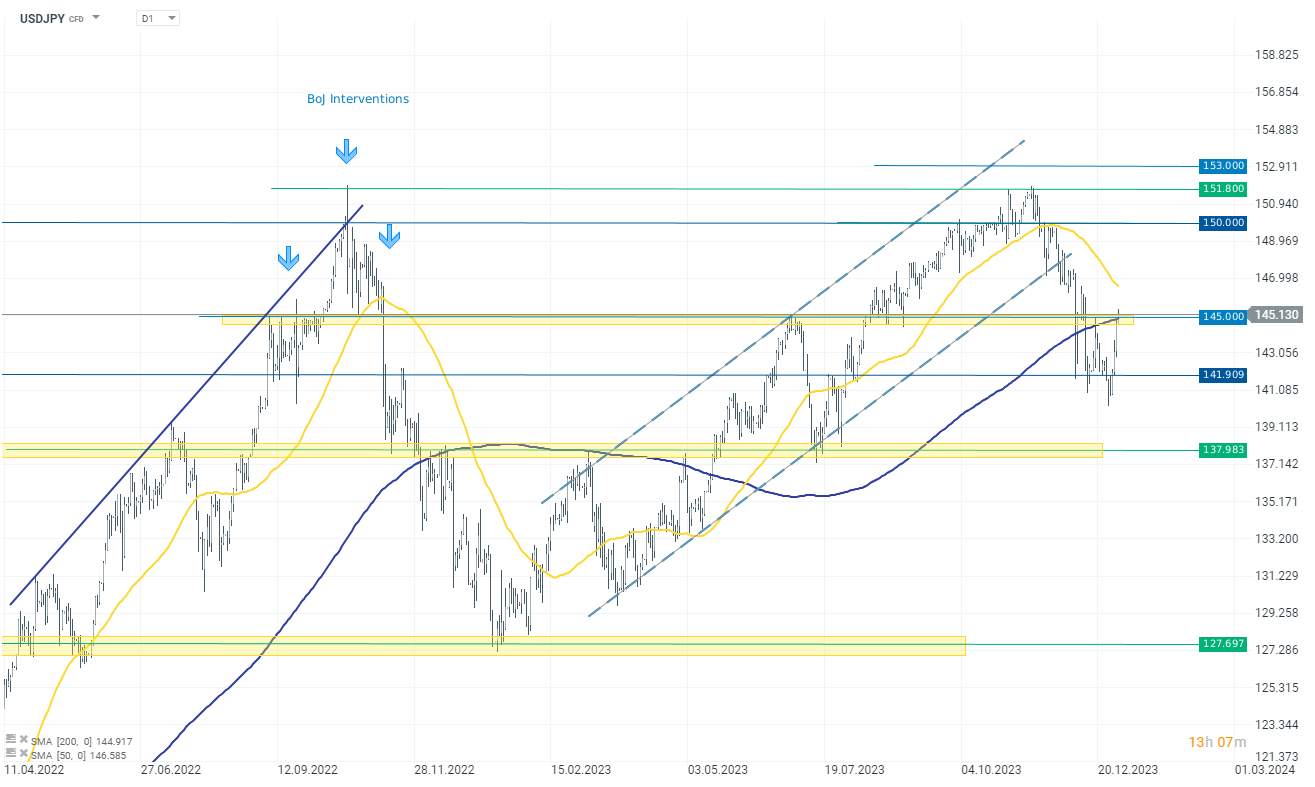

USDJPY is in a key resistance zone at the level of 145. Today we had several interesting publications from Japan, but the significance of these data was rather secondary:

- Household confidence index: 37.2 (expectations 36.6; previously 36.1)

- Monetary base y/y: 7.9% (expectations 9.0%; previously 8.9%)

- PMI for services (au Jibun Bank): 51.5 (expectations 52.0; previously 50.8)

Data from Japan suggest a good condition of the economy. PMI is performing much better than data from Europe, and even from the USA. The household confidence index indicates good sentiment in this sector. Worse for the Yen are the data on the monetary base, which, after reaching a local peak in November 2023, is currently gradually decreasing. This theoretically leads to less pressure on price increases.

Looking at the recent behavior of USDJPY, we see a decisive reaction after reaching a local bottom around 140 JPY per USD. The basis for the current upward movement is mainly the increase in the value of the dollar, but we can also observe short-term weakness on the yen. Currently, USDJPY is at a key resistance zone at the level of 145, which in July 2023 effectively halted the increases and marked a local peak in the rate. If this zone is broken, we may see an upward movement even around 147-149,000.

Source: xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.