- The Japanese Yen is the best-performing currency

- USDJPY bouncing off a key resistance zone.

- Yen is appreciating amid growing concerns about intervention by the Bank of Japan (BoJ)

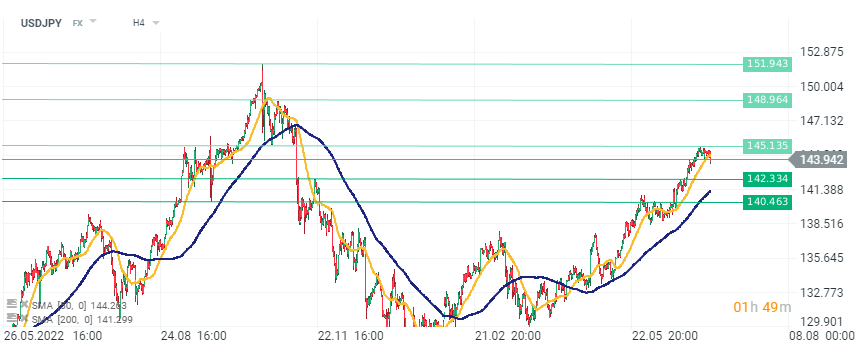

Last week, the Japanese Yen experienced significant losses against the US Dollar, and the USDJPY briefly crossed the 145 level. Since then, USDJPY has been consolidating for several days, but today selling pressure proved stronger, pushing the exchange rate down to 143, breaking below the consolidation channel.

Currency strength chart, the Japanese Yen (JPY) is currently the strongest currency among other major currencies, Source xStation 5

There could be two reasons for such a sharp strengthening of the Yen, not only against the Dollar but also other currencies. Firstly, recent strong gains may prompt investors to take profits, causing a short-term correction. However, the second, more fundamental reason is the market's fear of another intervention by the Bank of Japan. Downward pressure has increased following the statements by the country's leaders, including the finance minister, advocating for intervention against excessive depreciation of the domestic currency. The likelihood of another intervention is quite high, as evidenced by past experiences. In September and October 2022, the USDJPY experienced volatility after crossing the 145 and subsequently 150 levels. Intervention became necessary at those levels, significantly strengthening the Yen... however, only in the short term, as USDJPY started climbing again.

Currently, the USDJPY has rebounded from the 145 level and is trading at 143.8. If selling pressure does not weaken, the exchange rate could drop to around 142 or 140 levels. However, a return of USDJPY to an upward trajectory should be seen as an increasing probability of intervention by the Bank of Japan. In such a case, authorities will certainly resume their campaign to influence the currency market, which somewhat limits the upside potential. Nevertheless, a retest of the 145 level is still possible. Source xStation 5

Currently, the USDJPY has rebounded from the 145 level and is trading at 143.8. If selling pressure does not weaken, the exchange rate could drop to around 142 or 140 levels. However, a return of USDJPY to an upward trajectory should be seen as an increasing probability of intervention by the Bank of Japan. In such a case, authorities will certainly resume their campaign to influence the currency market, which somewhat limits the upside potential. Nevertheless, a retest of the 145 level is still possible. Source xStation 5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.