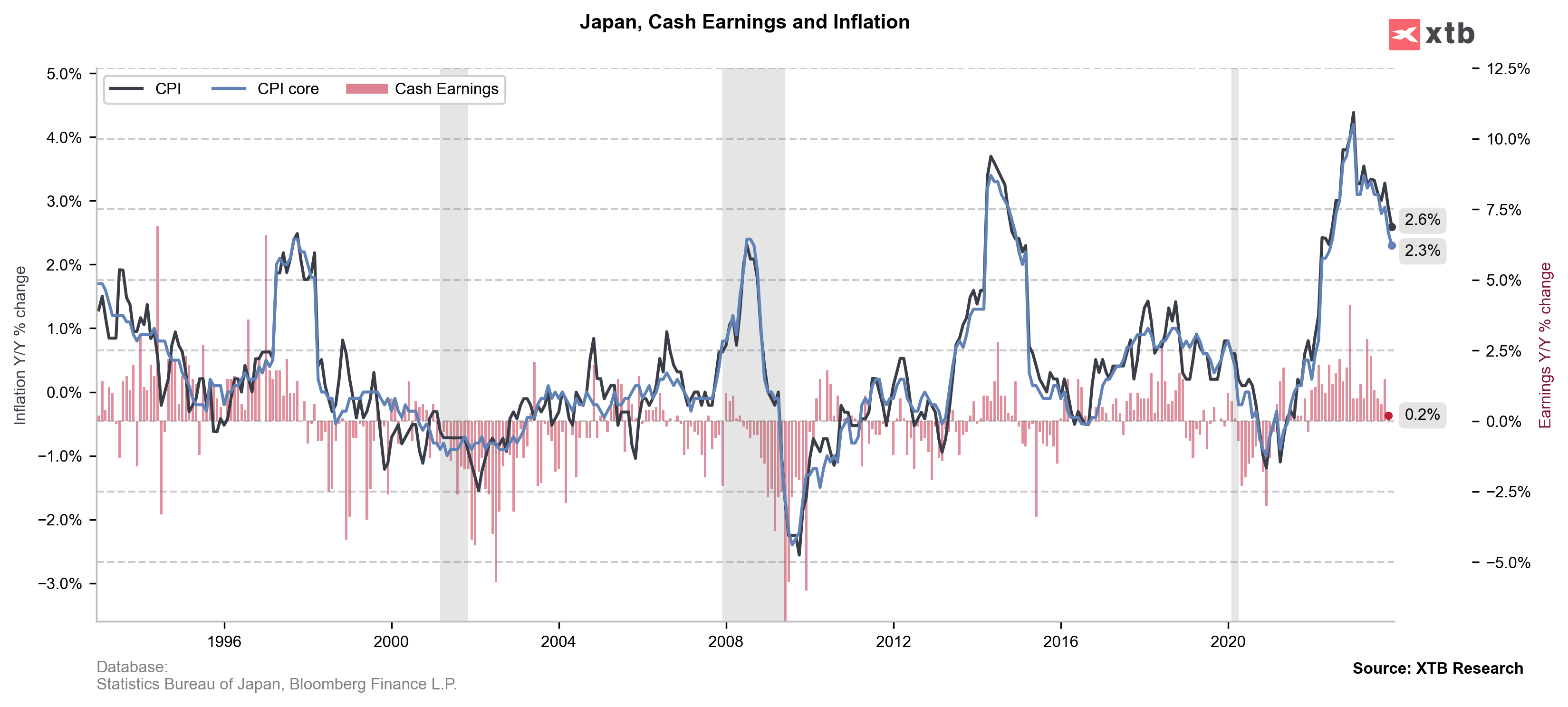

Japan's core inflation in December remained above the Bank of Japan's (BOJ) 2% target but showed a slowdown for the second consecutive month, reinforcing expectations that the BOJ will not rush to end its massive monetary stimulus. The core consumer price index (CPI) rose 2.3% year-over-year, the slowest since June 2022, primarily due to a 11.6% decrease in energy costs and government subsidies. The core CPI index, excluding both fresh food and energy, fell to 3.7% from 3.8% in the previous month, now well below the 40-year peak hit in 2023.

Japan - inflation data for December:

- Core CPI: current 2.3% y/y; forecast 2.3% y/y; previously 2.5% y/y;

- Headline CPI: current 2.6% y/y; previously 2.8% y/y;

The report supports the view that there is no urgent need for the BOJ to make its first rate hike since 2007 at its January meeting, with many economists pointing to April as a more likely time. Cost-push inflation in Japan is easing, as predicted by the BOJ, with consumer price gains in Tokyo also slowing.

Easing inflation, coupled with recent signs of sluggish wage growth, suggests the BOJ will maintain its ultra-dovish policy in the upcoming meeting, despite potential near-term inflationary pressures from increased fiscal stimulus and yen weakness.

Looking at the USDJPY chart, we see that the pair has returned to an upward trend since the beginning of this year. The current upward movement is likely to encounter its first resistance at the 150.000 level, where there is a psychological resistance zone and the lower limit of the last upward trend. Source: xStation 5

Three Markets to Watch Next Week (26.12.2025)

Morning wrap (26.12.2025)

BREAKING: US jobless claims below expectations!🚨

Chart of the day: USDJPY (24.12.2025)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.