Today, the minutes from the latest Bank of Japan (BoJ) meeting were published. However, the minutes did not provide any additional interesting information that could impact the forex market. As a result, volatility on the Japanese Yen (JPY) is limited today. Nevertheless, the current levels above 150 JPY per USD are again raising doubts among leading Japanese policymakers, increasing the likelihood of intervention if the JPY continues to weaken.

Below is a brief summary of the key conclusions from the BoJ minutes from January 22-23, 2024 Meeting:

-

Board members agreed that the stage of sustainably achieving the 2% inflation target has not been reached yet.

-

The members were of the view that the likelihood of hitting the 2% inflation target is gradually increasing. If a virtuous cycle of wages and inflation is confirmed, the BoJ would consider ending negative interest rates permanently and other unconventional easing measures.

-

A few members suggested it would be appropriate to stop purchasing ETFs and J-REITs if the achievement of the inflation target seems foreseeable.

-

Some members emphasized that the BoJ is not under pressure to accelerate rate hikes at the pace observed in Western countries.

Despite the release of these minutes, there was no significant reaction in the forex market, and the Japanese Yen (JPY) remains stable. However, recent development on the forex market has increased the frequency of verbal intervention from Japan's main policymakers. Recently, former top foreign exchange official Eisuke Sakakibara suggests that Japanese authorities might intervene if the yen falls to 155-160 against the dollar. He predicts the yen will strengthen to 130 by the end of this year or early 2025, expecting an inflationary period ahead. Japan’s chief of FX, Masato Kanda, indicated that the recent yen weakness is more due to speculation than fundamentals. He stated that the authorities are prepared to intervene against excessive fluctuations.

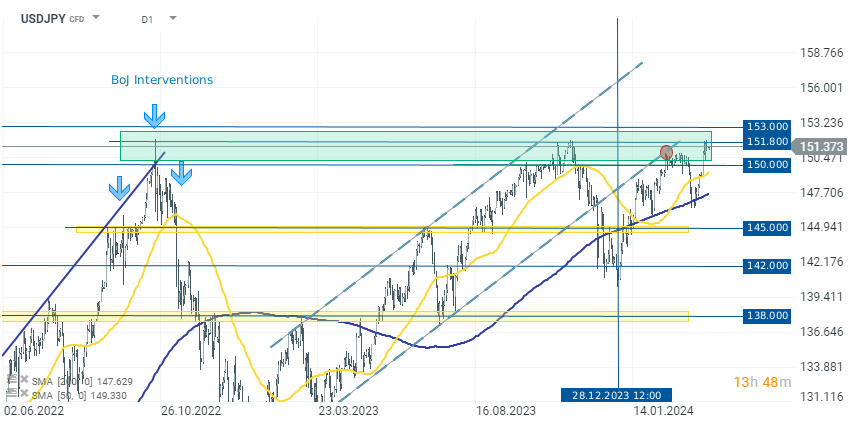

USDJPY (D1 interval)

As we can see, USDJPY is currently above the level of 151, which is in the historical intervention zone of the BoJ (marked on the chart in green). We are also observing initial attempts to strengthen the JPY through verbal interventions. Further depreciation of the JPY, and thus an increase in the USDJPY rate to 153,000 or even 155,000, may lead to intensified verbal interventions from Japan's main policymakers and even a higher probability of intervention in the forex market by the BoJ.

Source: xStation 5

Economic calendar: US CPI Inflation the Most Important Report of the Week 🔎

Market wrap (09.03.2026)

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Three markets to watch next week (06.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.