Governor of the Bank of Japan Kazuo Ueda said that the central bank will act cautiously to anchor inflation expectations at 2% during his speech at the BOJ's annual conference.

- some challenges are exceptionally difficult for the BOJ compared to other central banks worldwide;

- assessing the neutral interest rate is particularly challenging in Japan, considering the prolonged period of nearly zero short-term interest rates over the past three decades;

- deputy Governor Shinichi Uchida mentioned that although the end of deflation is near, anchoring inflation expectations is a challenge;

- former board member Takako Masai suggested that the BOJ could raise its benchmark interest rate to 0.5% by the end of the year if current economic conditions persist;

- Ueda and Uchida gave no clear indications of immediate monetary policy actions.

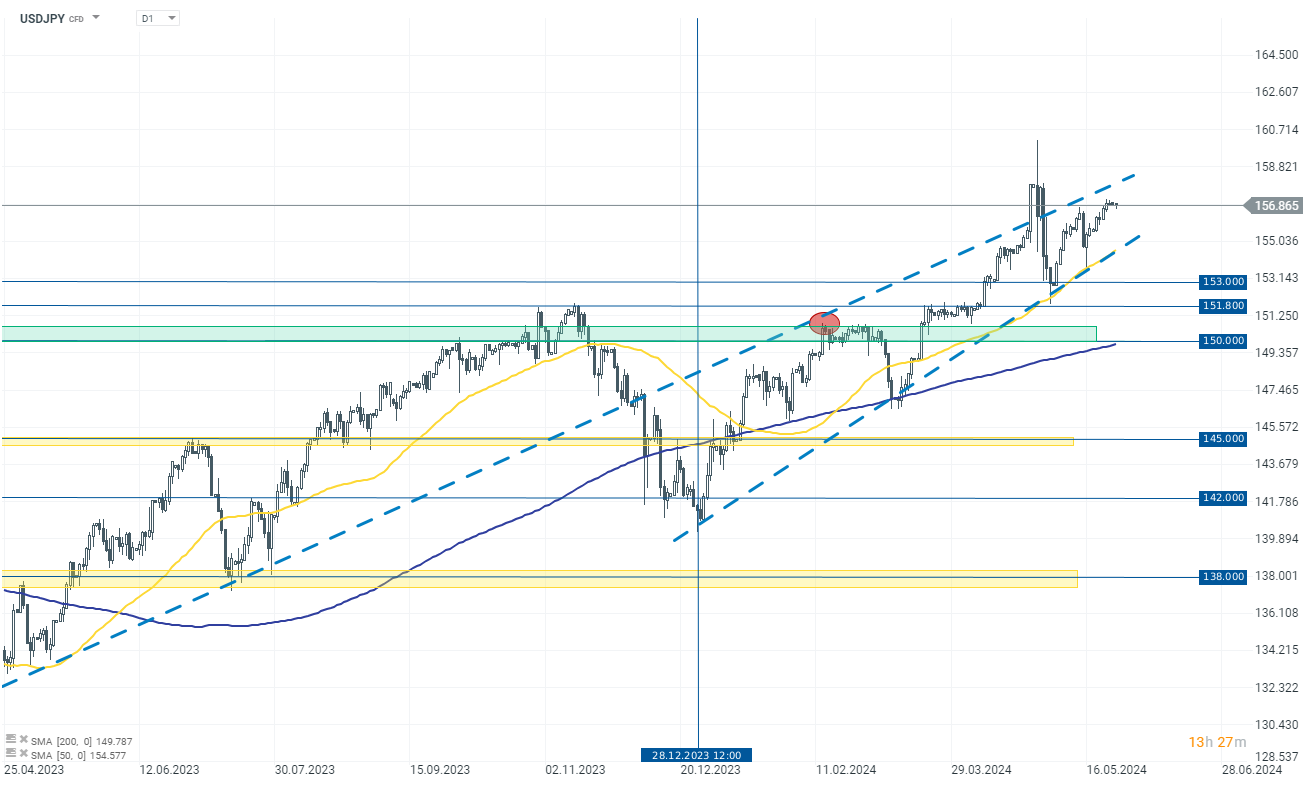

The Japanese yen is consolidating around historical highs at 157.0000 per USD. Recent statements from BOJ officials emphasize further mobilization in normalizing monetary policy. However, the bank's actions alone are insufficient to revive demand for the Japanese currency. Investors still lack clear assurances of the Bank of Japan's subsequent actions, and this uncertainty contributes to the continued weakening of the JPY. Currently, on the daily interval chart, we can observe a rising wedge formation on USDJPY, which may signal a potential reversal in an uptrend. It is characterized by converging trend lines, where the upper trend line (resistance) is rising, and the lower trend line (support) is rising at a steeper angle.

Source: xStation 5

Chart of the day: EURUSD under pressure after PMI data! 📉

BoJ maintains rates despite hawkish shift in outlook. What next for the USDJPY?

Morning wrap (23.01.2026)

BREAKING: EURUSD reacts 🗽US jobless claims lower than expected

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.