-

China’s rare-earth exports fell 31% m/m in September, reaching their lowest level since February amid tighter export controls.

-

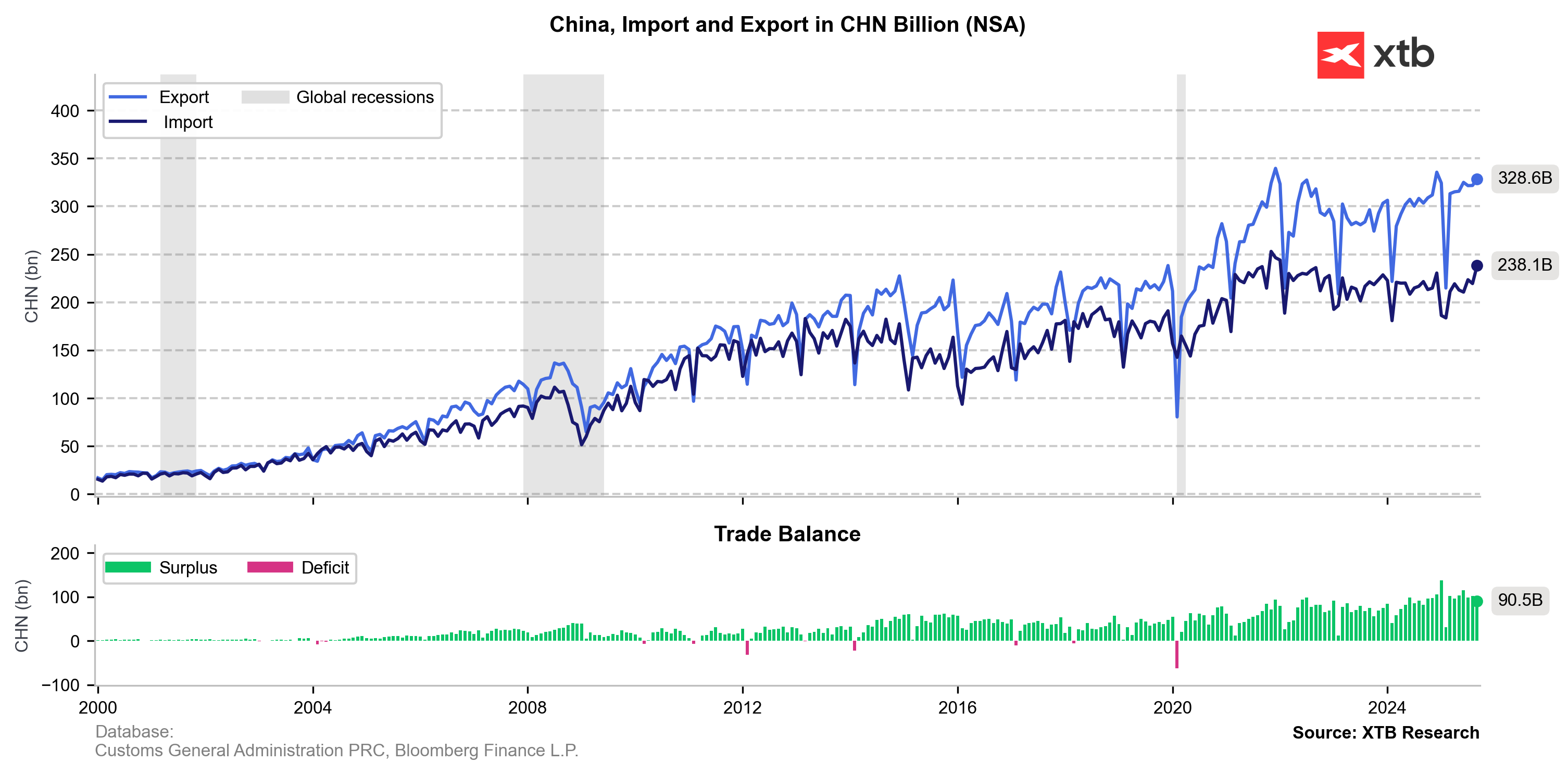

China’s exports rose 8.3% YoY (the strongest in six months), and imports climbed 7.4% YoY (the most in 17 months).

-

Record monthly imports of iron ore and soybeans highlight resilient demand.

-

The trade surplus came in at $90.5 billion, slightly below expectations due to strong import growth.

-

China’s rare-earth exports fell 31% m/m in September, reaching their lowest level since February amid tighter export controls.

-

China’s exports rose 8.3% YoY (the strongest in six months), and imports climbed 7.4% YoY (the most in 17 months).

-

Record monthly imports of iron ore and soybeans highlight resilient demand.

-

The trade surplus came in at $90.5 billion, slightly below expectations due to strong import growth.

Earlier today, we received China’s September trade data, which came in stronger than expected. Exports rose 8.3% YoY to $328.6B (the highest in six months), while imports increased 7.4% YoY (the strongest in 17 months). The trade surplus widened to $90.45B.

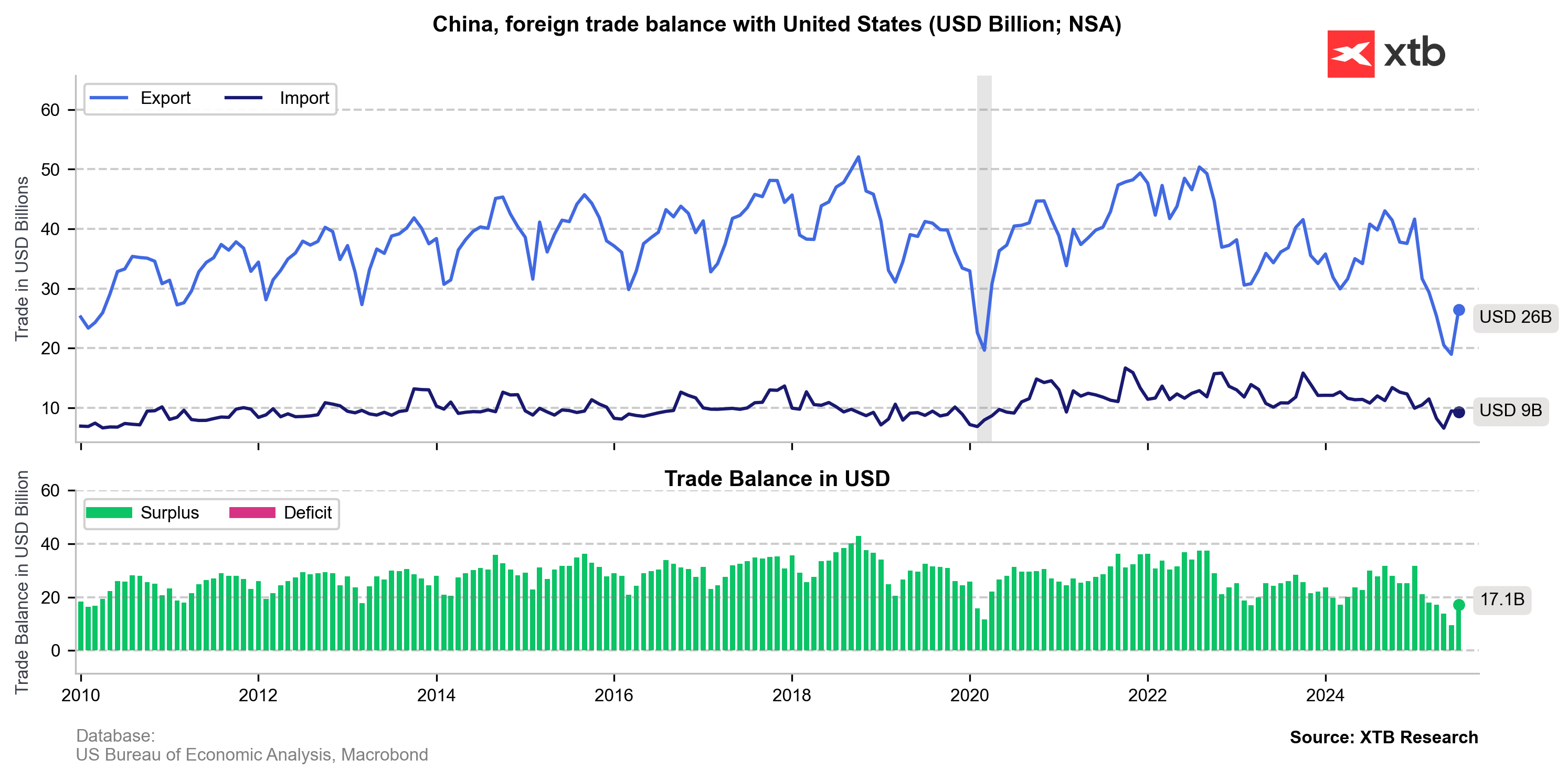

The composition of exports is key for investors. Shipments to the U.S. fell 27% YoY, but this was more than offset by double-digit growth to the EU (~14%), ASEAN (~15–16%), Africa (~56%), and other non-U.S. markets (+14.8% overall). This diversification has helped China maintain a GDP growth rate near 5%, despite earlier tariff hikes.

Exports to the U.S. have dropped sharply since the trade war began in April, while other regions have compensated for the decline. Imports from the U.S. to China, however, have remained relatively stable.

Over the past week, political risk has risen sharply. Beijing expanded export controls on rare earths and magnets, where it holds a near monopoly. The move was met with strong discontent from the U.S. administration. Trump threatened to reinstate 100% tariffs and introduce additional software export restrictions. As a result, Chinese futures fell nearly 6% by the end of Friday’s session. Investors began to fear further escalation and renewed supply-chain disruptions across industries such as automotive, EVs, batteries, aerospace, and renewable energy.

A mild de-escalation followed over the weekend after a Donald Trump post assuring that the U.S. and China will reach an agreement, noting that the trade war benefits neither side. Markets still hope for a potential Xi–Trump meeting during APEC later this month, though the range of possible outcomes has widened. In the short term, rising exports to non-U.S. markets, stockpiling of commodities (steel, coal, soybeans from South America), and trade rerouting through hubs such as Vietnam are cushioning the impact of tensions — but triple U.S. tariffs would be a major deflationary shock to China’s export sector and a blow to global risk markets.

Chinese indexes are posting a sharp rebound today, up around 3.50–4.00%. The CHN.cash index gains 3.75% to 9,175 points. Despite improved market sentiment, indexes remain more than 2.25% below Friday’s opening levels.

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

India: New battleground of the trade war?

Another US Gov. Shutdown: What can it mean this time?

Mercosur: Farmers’ fears are exaggerated, industry triumphs - facts vs. myths

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.