The temporary rebound in the Chinese stock market from the end of December 2023 was again quickly erased after weaker PMI readings from the Chinese economy. China's PMI reading, for December, indicated 49 points versus 49.6 forecast by Bloomberg analysts and appeared to coincide with the data, from June 2023. The year 2023 was a dismal one for the Hang Seng, with overseas equity market investment at its lowest in eight years, and the opening of 2024 is taking place in a weak mood. Also emerging markets are under pressure from a strengthening US dollar.

- Sub-index readings for services pointed to an ongoing slowdown, below 50 points with a slight positive surprise in the non-manufacturing reading, which came in at 50.4 versus 50.2 in November thanks to higher activity in the construction sector, driven mainly by government investment. The construction activity index rose to 56.9 from 55 in November, driven by state investment. Chinese factory activity according to official data fell to its lowest level in six months in December. The Factory Orders Index fell to 48.7 and the index measuring export orders fell to 45.8.

Caixin vs. official data

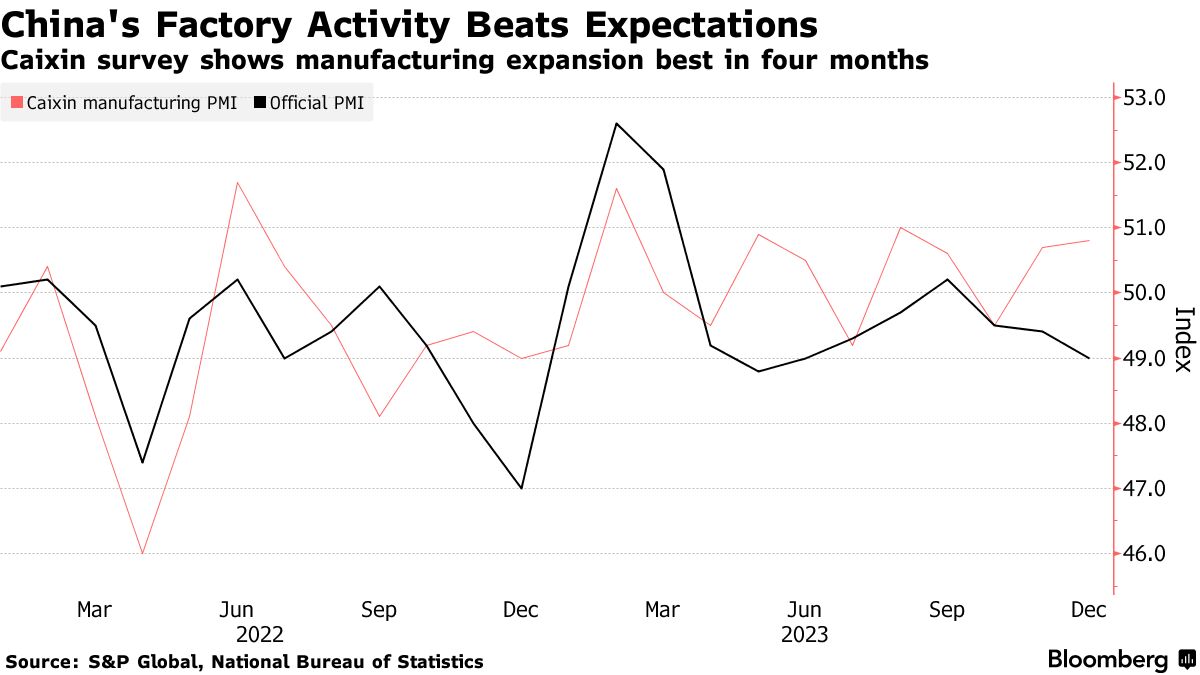

- Data reported by the private Caixin agency stood in opposition to the official readings, and suggest a slight rebound in factories. Caixin's manufacturing managers' index rose to 50.8 in December from 50.7 in November.That's the highest reading since August, better than Bloomberg's estimate.

- However, both surveys include different sample sizes, geographic locations and types of companies. So far, Caixin data has tended to outperform the official results, last year. Caixin's better reading may be due to medium-sized and smaller companies omitted from the official survey, but it still doesn't change the overall picture of uncertainty.

- The real estate crisis is likely to hit the white goods and furniture sectors. NBS analysts stressed that in addition, the cold weather recently has put pressure on some services, such as air transport and hospitality. Some analysts expect the PBoC to cut rates in January to support the economy.

The CHN.cash index is losing sharply today and losing the bullish momentum from the end of last year. Source: xStation5

The CHN.cash index is losing sharply today and losing the bullish momentum from the end of last year. Source: xStation5

China's service sector is recording its second weaker month in a row, and factory activity is at its lowest in six months. Source: Bloomberg Finance LP

Private agency Caixin's PMI survey, in contrast to official data, suggests the strongest rebound in factory activity in 4 months. Source: S&P Global, Caixin

Private agency Caixin's PMI survey, in contrast to official data, suggests the strongest rebound in factory activity in 4 months. Source: S&P Global, Caixin

Economic calendar: US CPI in the spotlight (13.02.2026)

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.