Chinese indices were top performers during the first Asian session of a new week. There are some good reasons behind the improved sentiment towards the Chinese stocks today:

- Comments from Chinese President Xi Jinping, who said that China will continue to open up to foreign capital and investments, are also supporting market moods

- Country Garden, Chinese developer on a brink of bankruptcy, won an appeal to extend payments on its onshore bonds and also secure over $500 million in additional financing

- Domestic banks in China have recently lowered rates on mortgage loans amid pressures from authorities and in an attempt to support economy

- Markets are expecting Chinese authorities to announce more support measures for property sector - including new measures for first home purchases and relaxed restrictions on mortgage lenders

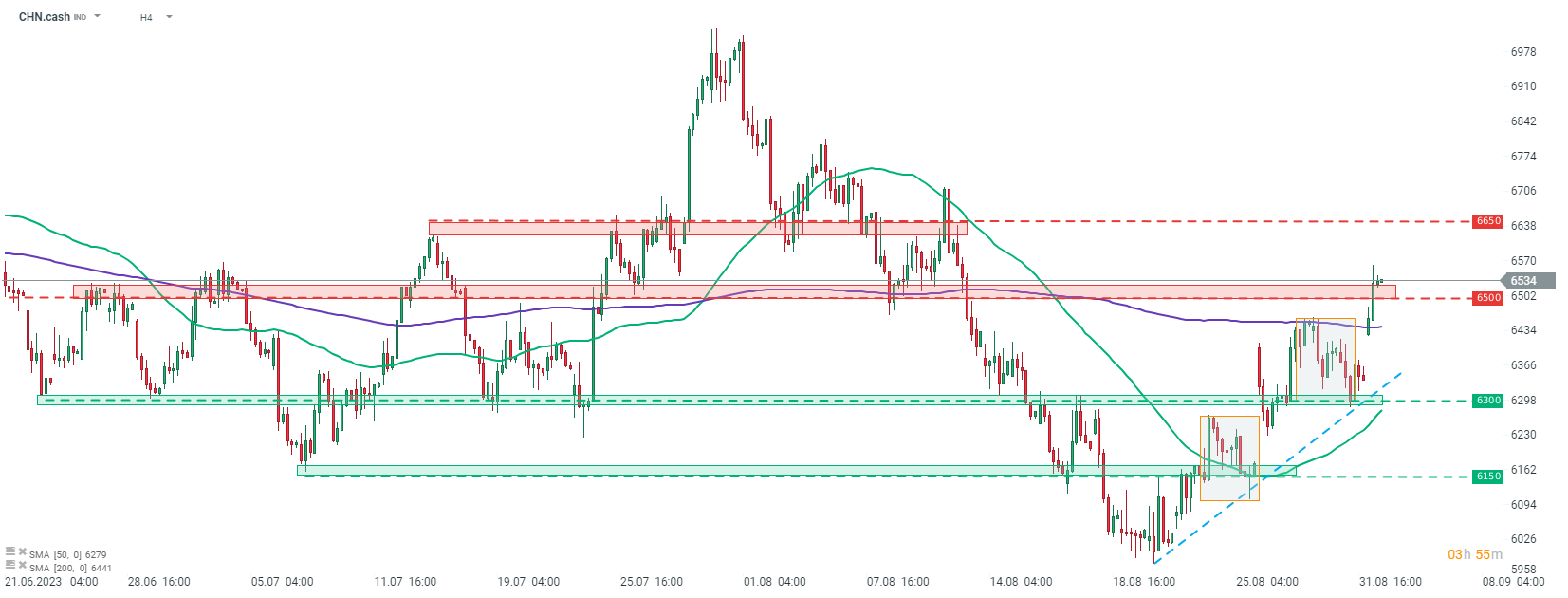

CHN.cash is extending its current recovery move today with an almost-3% gain. The index jumped over 9% over the past 2 weeks amid incoming news of economic support measures being undertaken by Chinese authorities. Taking a look at CHN.cash at H4 interval, we can see that the index is making a break above the 6,500 pts resistance zone today, reaching a fresh 3-week high in the process. Should upward move continue, the next near-term resistance to watch can be found in the area below 6,650 pts.

Source: xStation5

Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Daily summary: Weak US data drags markets down, precious metals under pressure again!

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.