Cocoa futures on ICE (COCOA) are down almost 3.5% today amid markets focusing on 2025/2026 season, expecting strong supply improvement. The start of the crop season in the Ivory Coast scheduled at October 1 (world’s largest cocoa producer), brought the prospect of fresh supply to the market. In the effect, cocoa prices are down more than 50% from the ATH.

Now markets await grinding data from key cocoa markets, scheduled next week. In the data will be lower than expected, which is a probable scenario, we may expect the head and shoulders technical pattern confirmation, and increase sell-side pressure on cocoa futures amid speculators and market participant focus shifting from tight supply to low demand environment, and a significant improvement of cocoa production, next year.

Source: xStation5

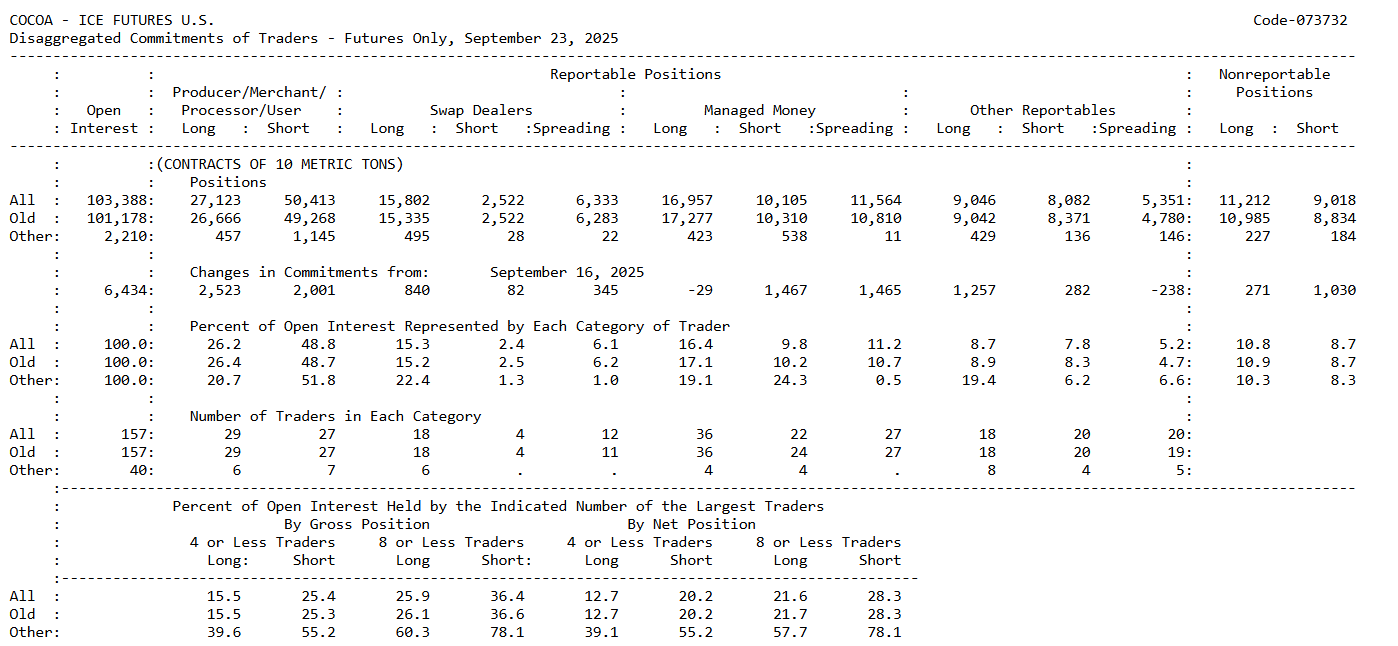

Cocoa Market Outlook (CoT – September 23, 2025)

Commercials (Producers/Merchants/Processors/Users)

-

Positioned strongly on the short side: about 50.4k short contracts vs. 27.1k long.

-

This is a classic hedging stance – producers and processors are protecting themselves against the risk of further price increases by selling futures.

-

The rise in commercial short positions suggests the supply side of the market expects high prices and is actively hedging.

Managed Money (Speculative Funds)

-

Clearly on the long side: 16.9k long vs. 10.1k short.

-

This indicates speculative capital is still betting on higher cocoa prices, despite heavy commercial shorting.

-

Over the past week, speculative funds added around +1.5k new short contracts, hinting at growing caution.

Takeaways from the Positioning

-

A classic clash of roles is visible: producers remain defensive (short), while funds maintain the upper hand on the long side.

-

Such a setup often means the market stays under supply pressure, but speculative money still supports the upside.

-

With commercials increasing shorts and funds cautiously adding to shorts as well, the market may enter a consolidation phase, with some risk of profit-taking after recent gains.

Commercials are heavily hedging against high prices, while managed money continues to bet on further upside – though with slightly more caution than before. This points to a potentially more pressure on managed money (large speculators) positioning, if the grinding data would signal slowing processing demand on chocolate and other cocoa-related products.

Source:CFTC

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.