Futures on ICE Arabica Coffee (COFFEE) gains almost 3% today as market prices in limited supply. Cold weather and frosts in top growing regions can hit supply this year, as weather change. According to McDougall Global View, not only 2025 but also 2026 crop could be limited due to the early stress flowering and further cold weather patterns. As we can see on the chart, coffee is resisting the falling price channel, rising above both - EMA50 and EMA200, where momentum may favour buyers.

Source: xStation5

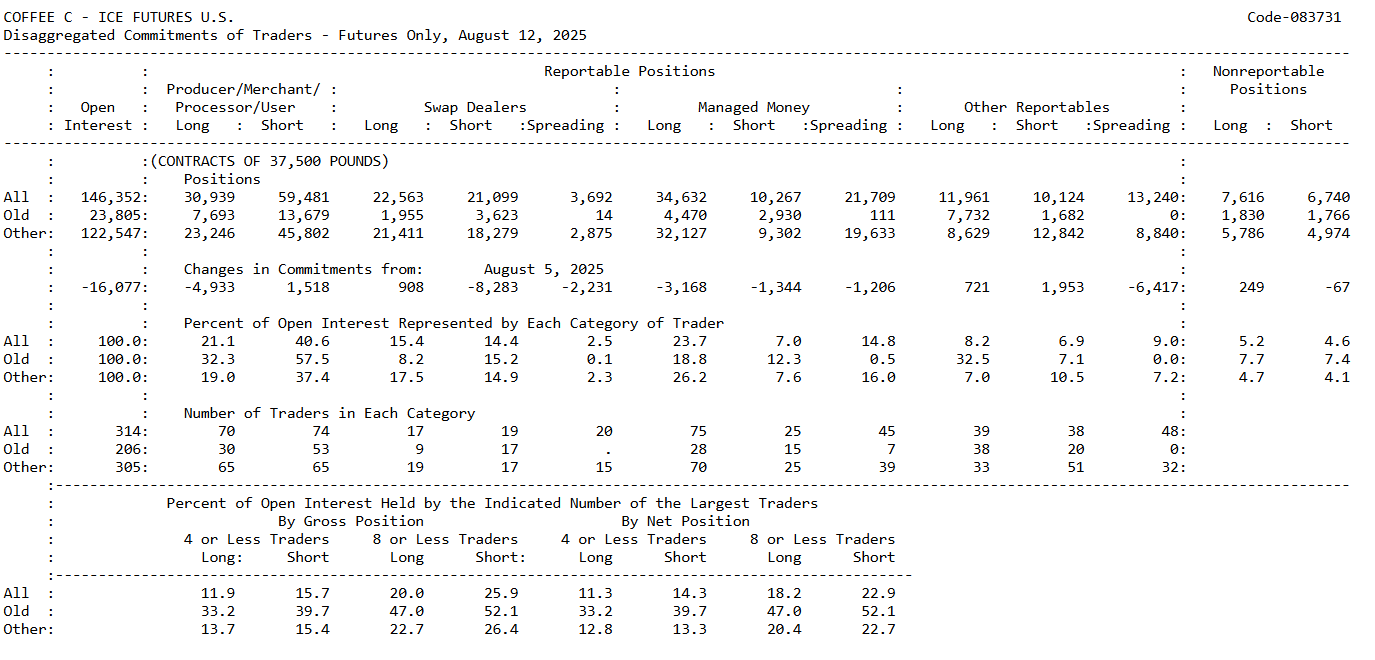

Coffee CoT Report Analysis

Open interest fell by around 16,000 contracts – this shows that some players have stepped away from the market, indicating a clear outflow of capital over the past week.

Producers/Merchants (hedgers):

-

Strongly net short, with roughly 59.5k shorts versus 30.9k longs.

-

This is a classic signal: farmers and exporters are hedging production because they fear lower prices ahead.

Swap dealers (often banks, structural hedging):

-

Significant reduction in positions, especially shorts (-8.3k).

-

This suggests they are offloading risk back into the market and are less willing to hold exposure themselves.

Managed money (speculative funds):

-

Still clearly long (34.6k longs versus 10.3k shorts), but they cut back on long exposure (-3.2k).

-

At the same time, they also reduced shorts, meaning overall participation is shrinking – less aggression on either side of the market.

Other reportables (e.g., CTAs, smaller funds):

-

A mixed picture: an increase in longs (+721) and shorts (+1.95k), but a sharp drop in spreading activity (-6.4k).

-

This indicates less arbitrage and fewer neutral strategies, translating into reduced technical liquidity in the market.

Market structure (share of OI)

-

Producers hold about 41% of open interest on the short side and only 21% on the long side – fundamentally, the market is heavily hedged against downside.

-

Managed money accounts for 24% of longs versus just 7% of shorts – speculators remain net bullish, but less so than a week earlier.

-

The largest players (top 4–8 traders) control up to 26% of total shorts – a high concentration that makes the market sensitive to their moves.

-

The most notable shift is that producers added shorts (+1.5k), while funds cut longs (-3.2k). Open interest fell overall, signaling position closures – likely profit-taking or risk reduction. The overall tone:a little less enthusiasm from funds, more hedging pressure from producers.

Trading implications

-

Fundamentals: producers are betting on lower prices, leaving a clear supply overhang in the market.

-

Speculators: still long, but with reduced conviction – bulls are less confident and may retreat under supply pressure.

-

Large trader concentration: heavy short exposure by the biggest players raises the risk of sharper declines if funds continue trimming longs.

-

Short term: the market looks weaker, with room for downside corrections.

-

Long term: unless fundamentals improve (Brazilian weather, crop yields, logistics costs), persistent hedging pressure will cap the market’s upside potential.

Source: CoT, CFTC

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Morning wrap (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.