Gold

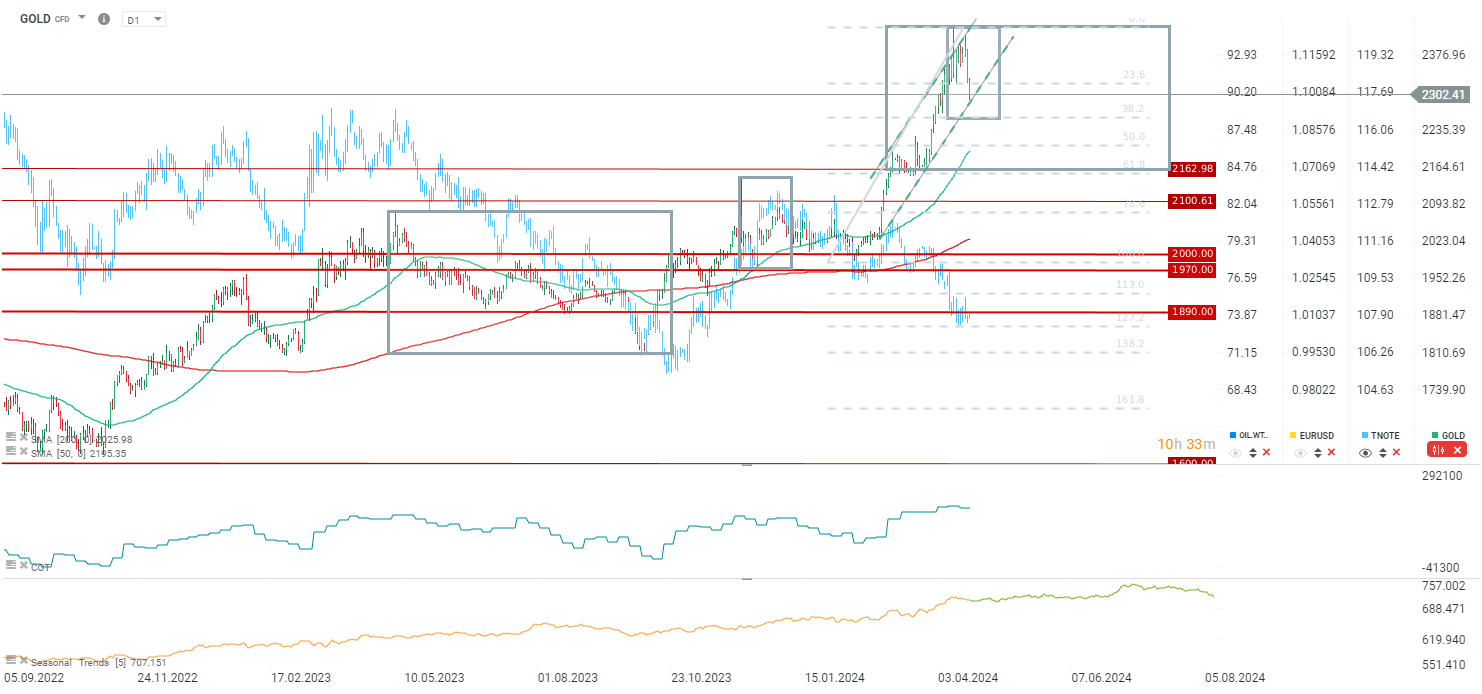

- Gold dropped over 100 USD per ounce from the peak last week, most likely due to the calming of the situation in the Middle East. After Israel's recent actions, there was no response from Iran

- The current correction is the largest since December. The range of the December correction suggests a decline even to 2260 USD per ounce. Matching the range of the largest correction in the trend since autumn 2022 would mean dropping to around 2165 USD per ounce

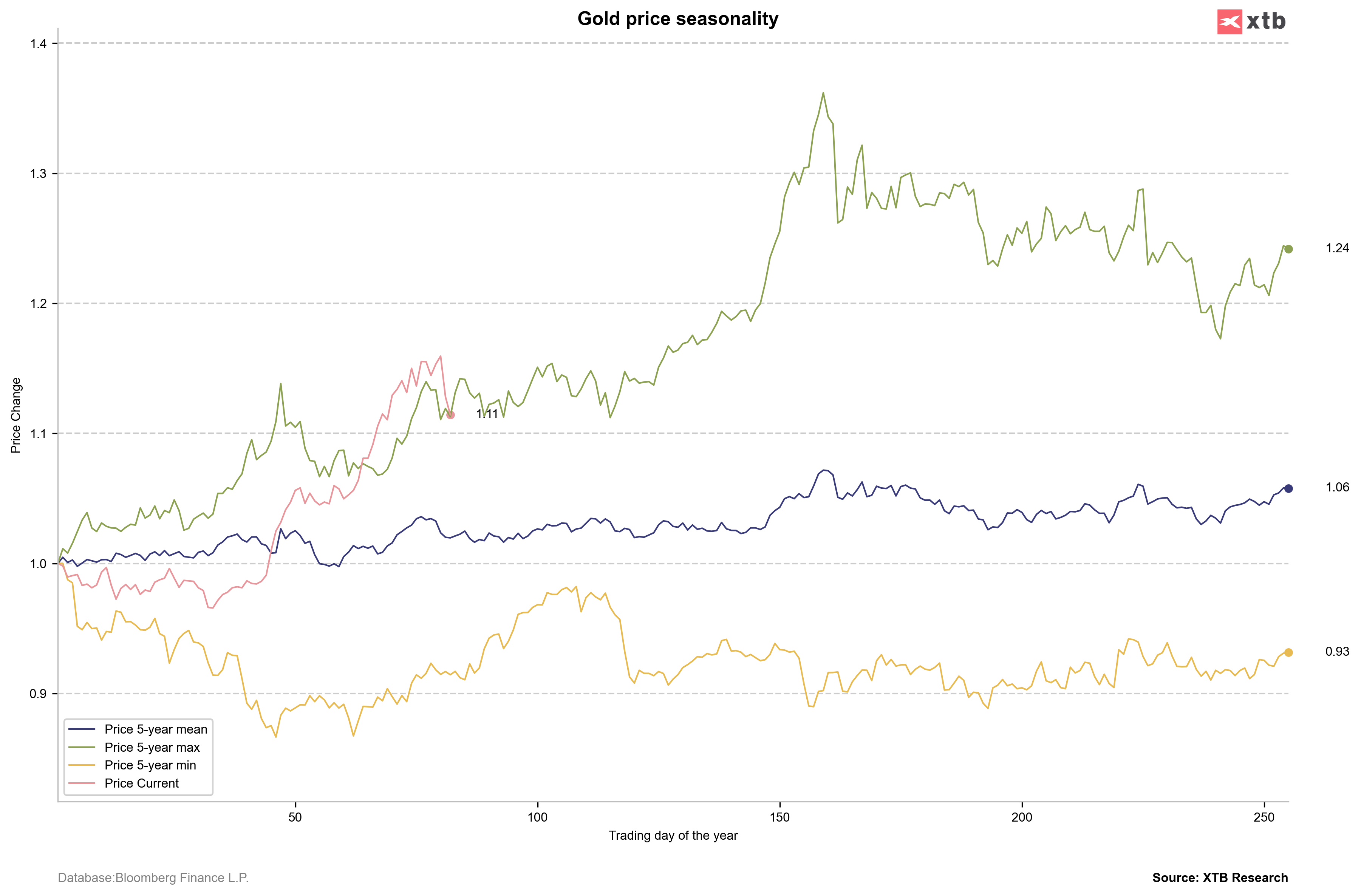

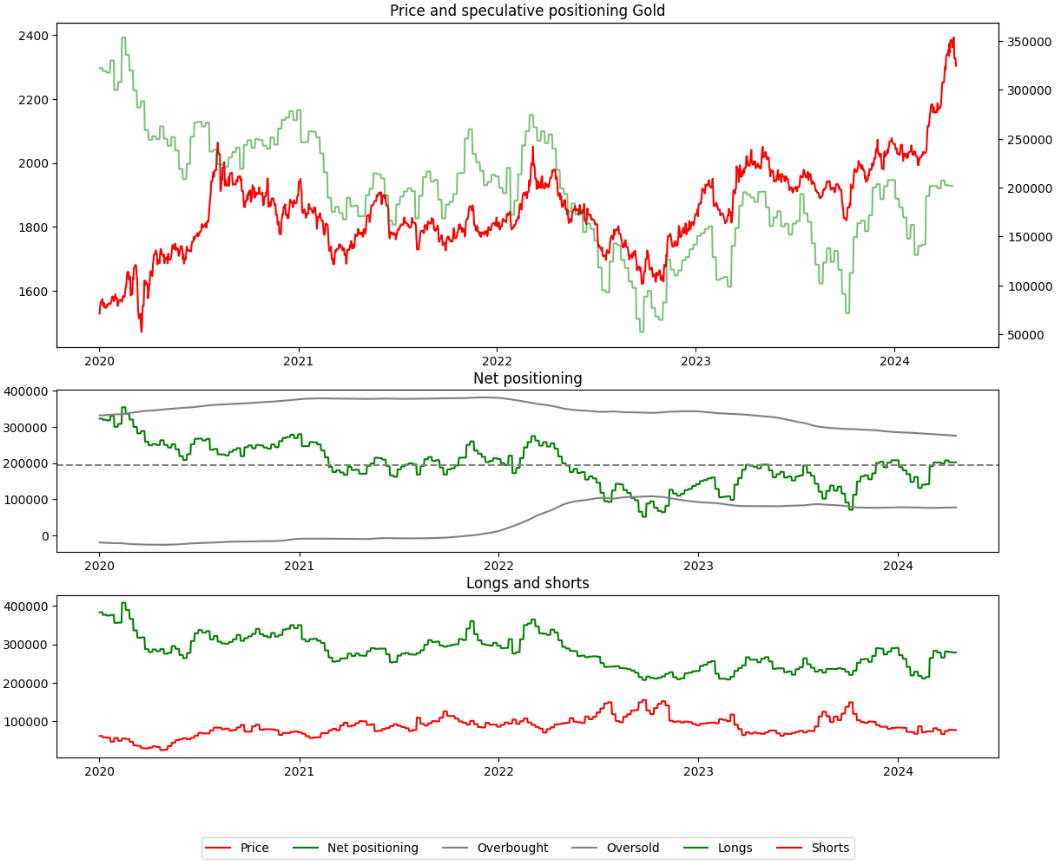

- Seasonality currently indicates consolidation. Speculative positions remain high

- Expectations for interest rate cuts in the USA are decreasing. The market isn't even pricing in a full cut for September. There is a lack of data that would in any way add certainty to the Fed regarding the direction of inflation

- The market is currently pricing in an around 60-70% chance of a rate cut in September

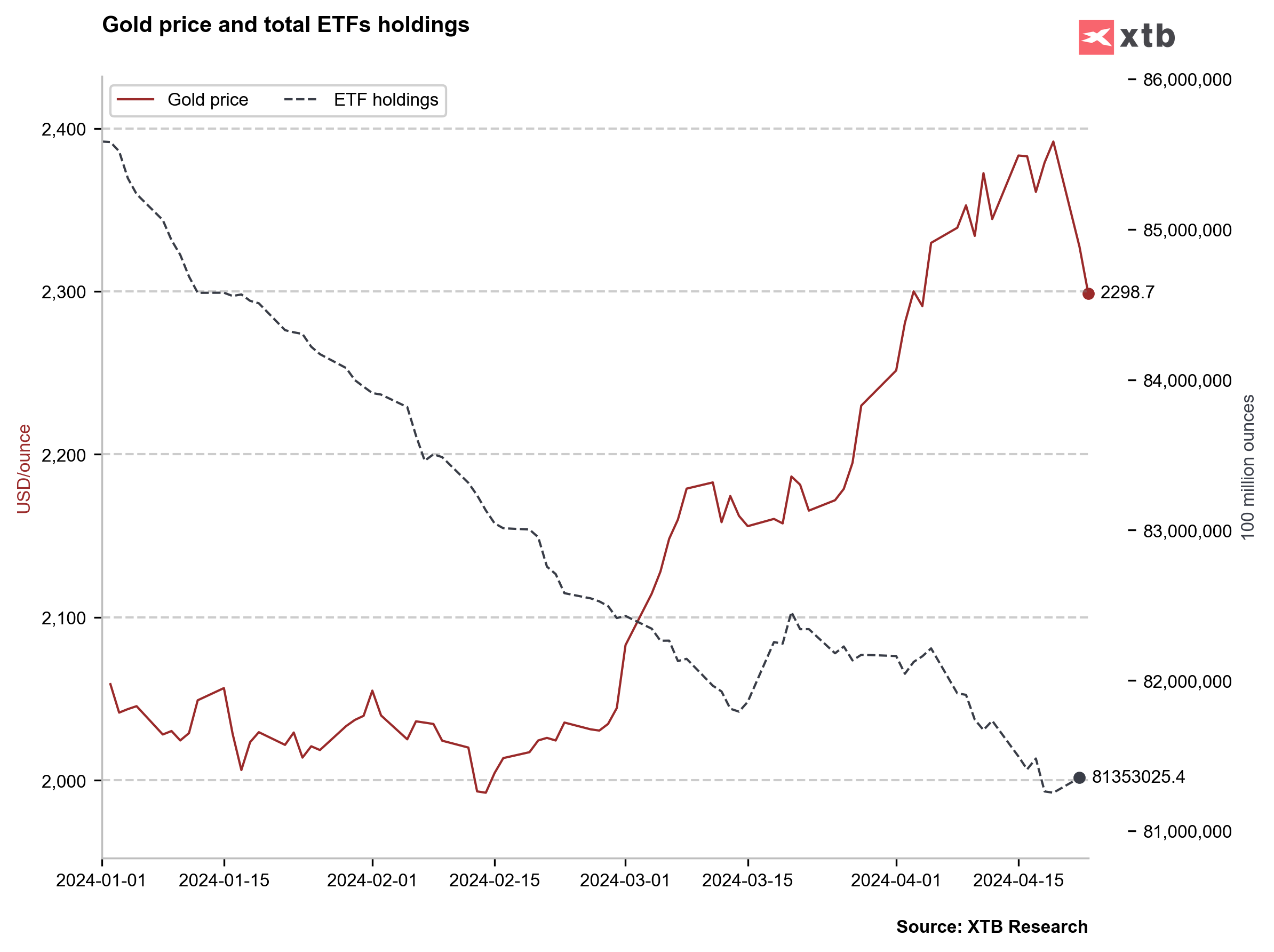

- As reported by the World Gold Council, ETFs experienced an inflow of funds amounting to 104 million USD last week. This is a very small amount of funds. Nevertheless, the inflow is mainly due to the activity of Asian investors. This is the first weekly net inflow since the end of 2023

Start investing today or test a free demo

Create account Try a demo Download mobile app Download mobile appThe price is currently undergoing the largest correction since December. It cannot be ruled out that the level of 2260 USD per ounce will be tested. On the other hand, we still have good information about demand from Asia, the potential revival in ETF demand, and rising production costs. Source: xStation5

WGC data shows that we had the first weekly net inflow into gold ETF funds last week. There are no major changes visible on the chart, but if the likelihood of cuts increases and cuts finally begin, investors should look for profit opportunities in gold. Source: Bloomberg Finance LP, XTB

On the seasonality chart, we observe a correction that is nothing out of the ordinary. Theoretically, maximum and average behaviour suggests consolidation. Source: Bloomberg Finance LP, XTB

Net positions do not seem high compared to history, but they are high compared to the last 1.5 years. Source: Bloomberg Finance LP, XTB

Natural Gas

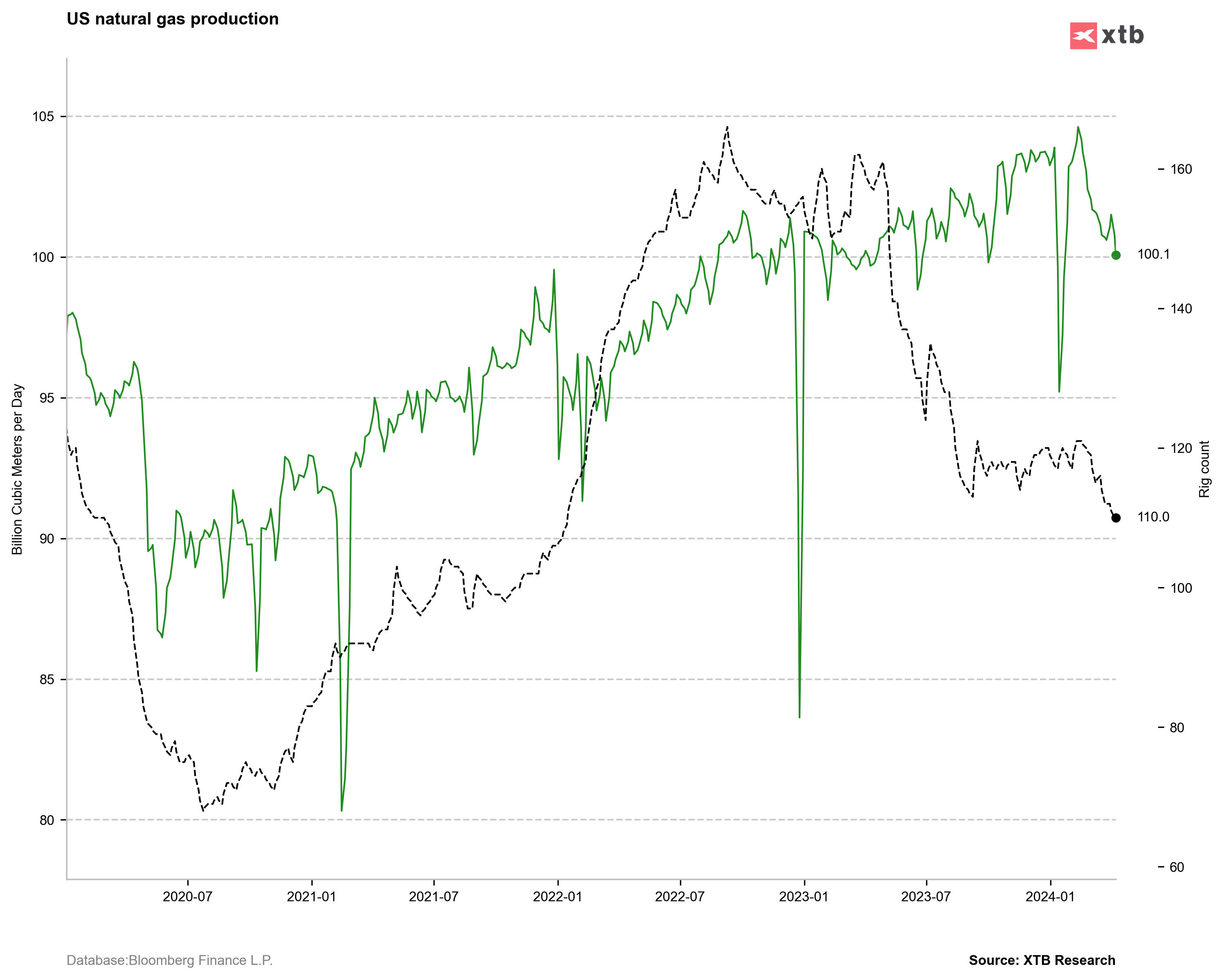

- EIA indicates that low gas prices may cause a decline in production in the US, although this is expected to be only a marginal decrease to the average level of 103.6 bcf. A drop below 100 bcf would be needed to trigger slower stockpiles growth during the summer period

- In Europe, the heating season ended with a record level of reserves. Currently, the inventories are over-60% full

- Currently, we observe lower production in the US, which remains minimally above 100 bcf per day

- Seasonality in the gas market (average) suggests that we should expect slightly higher prices in the near future. Gas behaves very similarly to the "worst" gas price behavior in the last 5 years

Gas production has declined, which may be hopeful for bulls during the stock rebuilding period. The number of drilling rigs is also decreasing. Source: Bloomberg Finance LP, XTB

Seasonality still gives hope to bulls, although current price changes rather resemble the worst price behavior in the last 5 years, which is the result of massive oversupply. Source: Bloomberg Finance LP, XTB

Cocoa

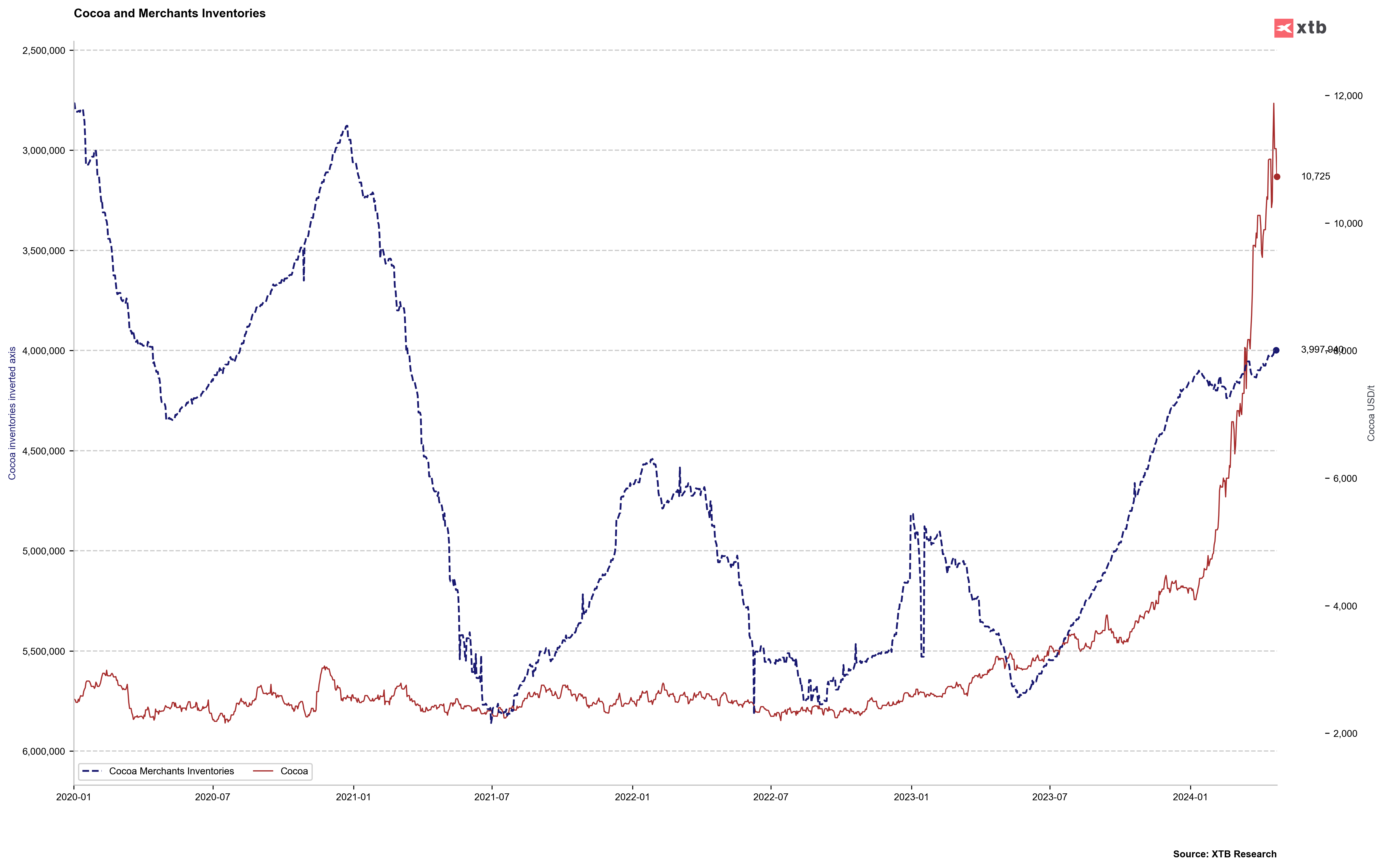

- Data on cocoa grinding for Q1 was strong. Of course, cocoa that was processed in Q1 2024 was contracted a few months ago, when prices were at 4-5 thousand USD per ton. This price is still high compared to historical standards, but is twice as low as the current price. The impact of current prices should be observed in the data for Q2 or even Q3

- Stockpiles on exchanges are declining, although they are not yet extremely low compared to history. The decrease in stocks indicates that there is still higher and demand for cocoa

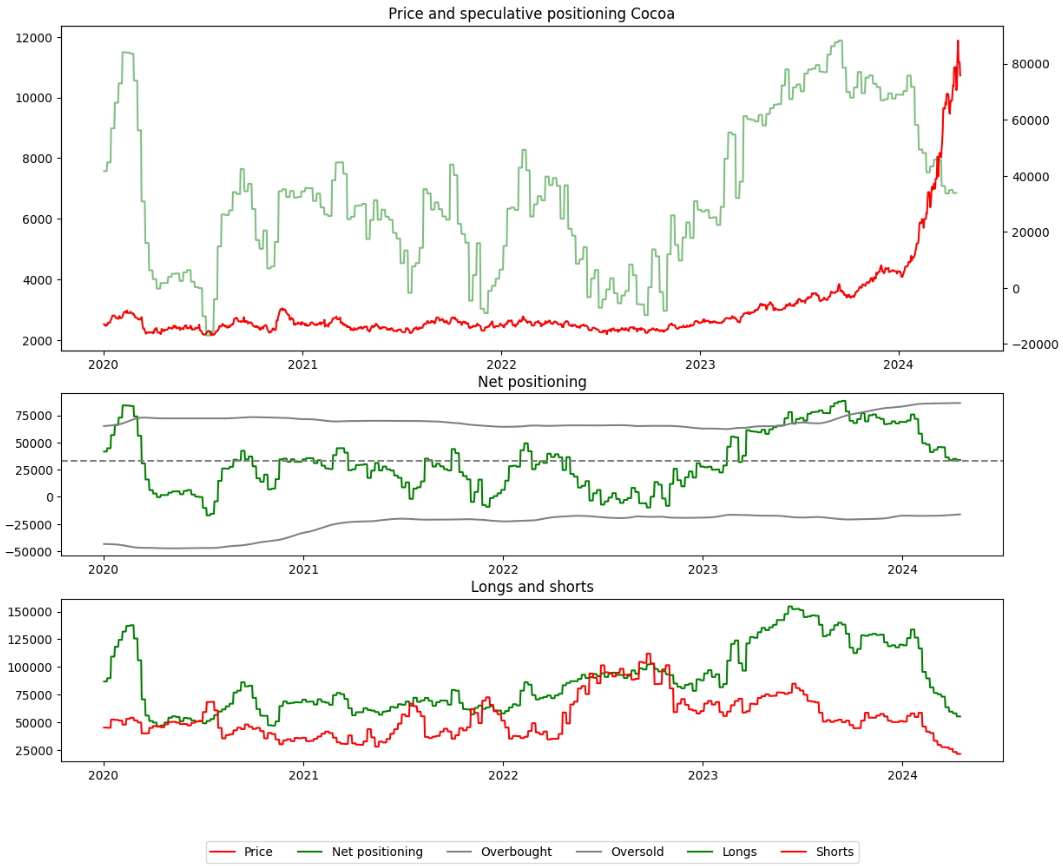

- Net positions basically remain unchanged for several weeks. Long and short positions are being reduced evenly

- Short positions are also being reduced due to high risk of failing to fulfil delivery obligations on futures contracts in the coming months. If this problem was to become widespread, spot prices could skyrocket even more than they are now

Net positions in cocoa futures contracts have remained unchanged for several weeks, although long and short positions are still being reduced. Low open interest is not good for maintaining high prices, but the reduction in short positions is related to the significant risk of failing to fulfill delivery obligations on contracts to ports in West Africa. Cocoa futures in New York or London are mostly cash-settled. Source: Bloomberg Finance LP, XTB

Net positions in cocoa futures contracts have remained unchanged for several weeks, although long and short positions are still being reduced. Low open interest is not good for maintaining high prices, but the reduction in short positions is related to the significant risk of failing to fulfill delivery obligations on contracts to ports in West Africa. Cocoa futures in New York or London are mostly cash-settled. Source: Bloomberg Finance LP, XTB

Cocoa stocks continue to decline. Only a rebound in stocks could suggest a destruction of demand. Source: Bloomberg Finance LP, XTB

Cocoa stocks continue to decline. Only a rebound in stocks could suggest a destruction of demand. Source: Bloomberg Finance LP, XTB

Coffee

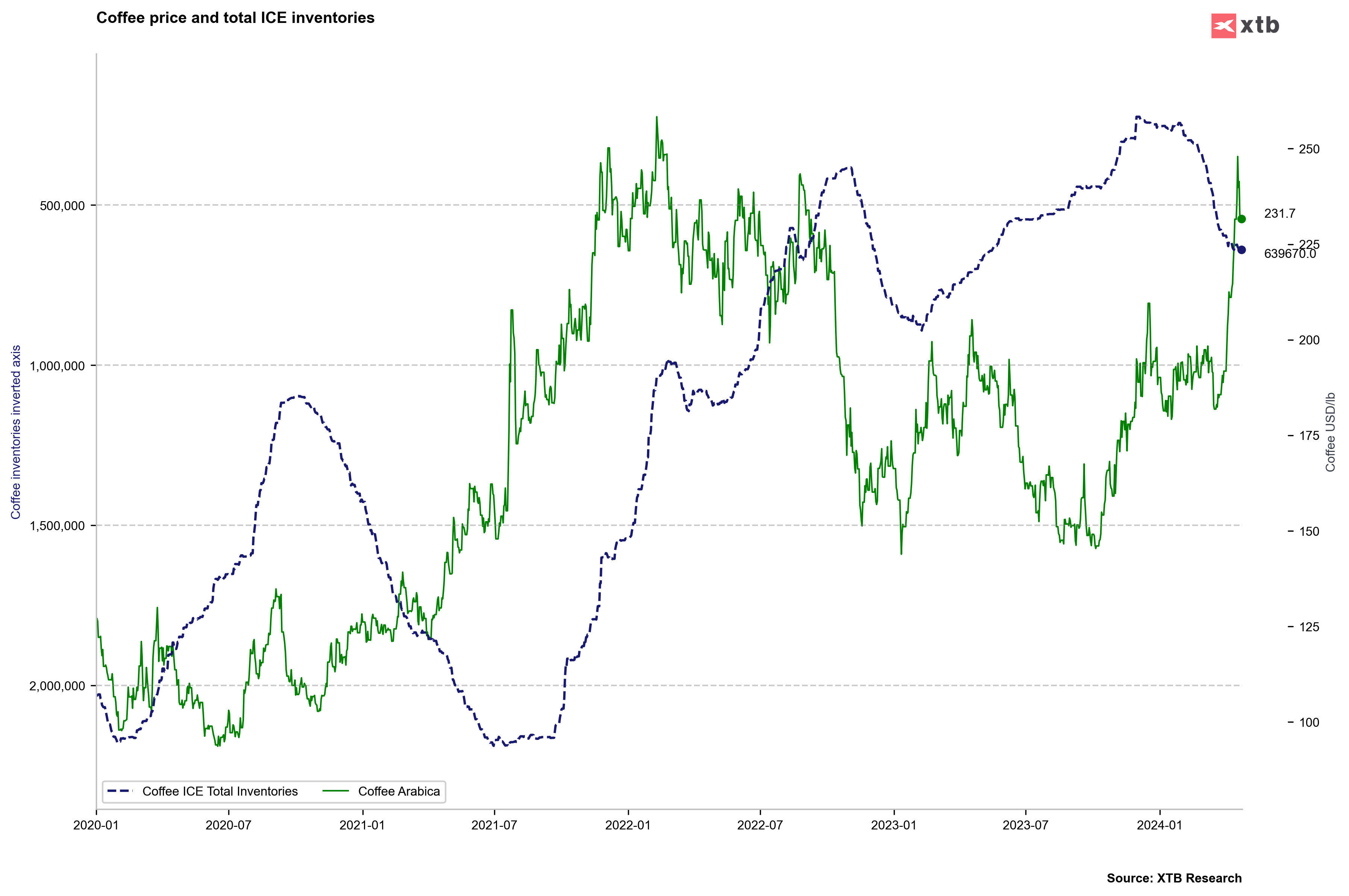

- Stockpiles of Arabica coffee are growing. Coffee started a correction the day after rollover of futures contracts

- We also observe a revival in the Brazilian real, and divergence between BRL and coffee market is slowly diminishing

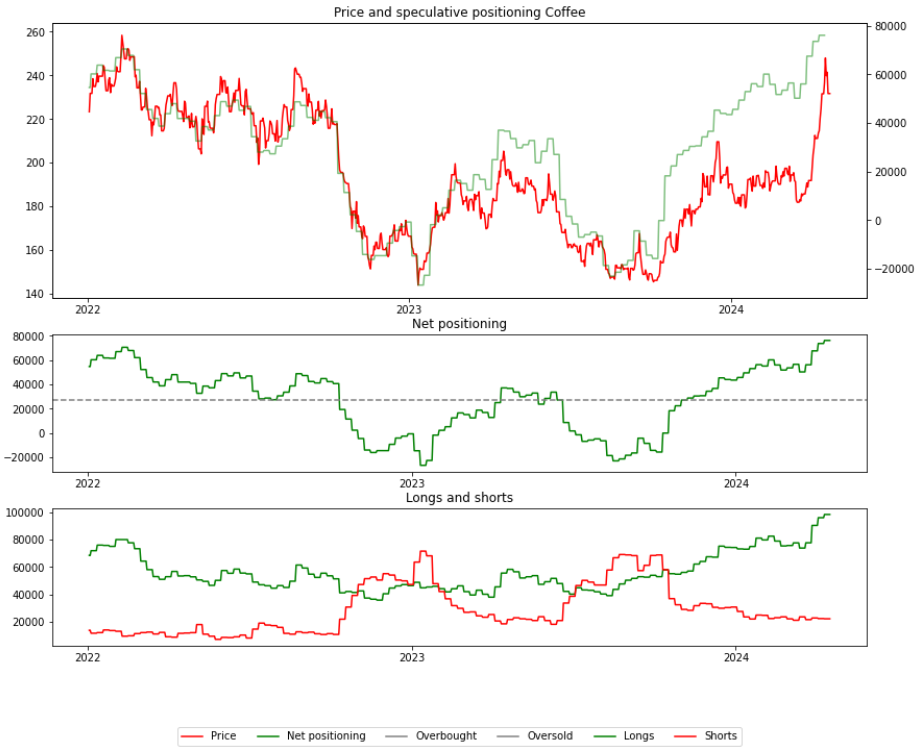

- Speculators have once again increased the number of net long positions in coffee

- Regarding Robusta, there is no expected improvement in production in Vietnam. According to the Vietnam Coffee Cocoa Association, a 20% decline in coffee production is expected this season

- There are also concerns about production in Brazil, although there are no changes in forecasts at the moment. The most significant weather changes are occurring in Minas Gerais, where Arabica is the main product

Coffee stocks continue to rise. Source: Bloomberg Finance LP, XTB

The largest correction in the current uptrend indicates significant support at the level of 217 cents per pound. It is worth noting that there is also a fairly high divergence with USDBRL. Additionally, if sugar (sugarcane) were to indicate direction (similar growing conditions), Arabica coffee could appear overvalued. Source: xStation5

Long positions continue to grow. As seen, a larger correction would require an increase in short positions, which remain extremely low. Source: Bloomberg Finance LP, XTB

Long positions continue to grow. As seen, a larger correction would require an increase in short positions, which remain extremely low. Source: Bloomberg Finance LP, XTB

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.