Oil

- Urals oil is to be sold to India at a discount of $3 per barrel, which at current prices would be a violation of the price cap set at $60 per barrel. However, Russian oil is cheaper for India than oil from Arab countries, especially after recent price hikes by Saudi Aramco

- India is becoming increasingly important from the perspective of Russian exports

- On the other hand, demand from China still seems to have problems. Oil imports in China fell by 8.7% year-on-year, while oil product imports fell by 3.6% year-on-year. Data for May

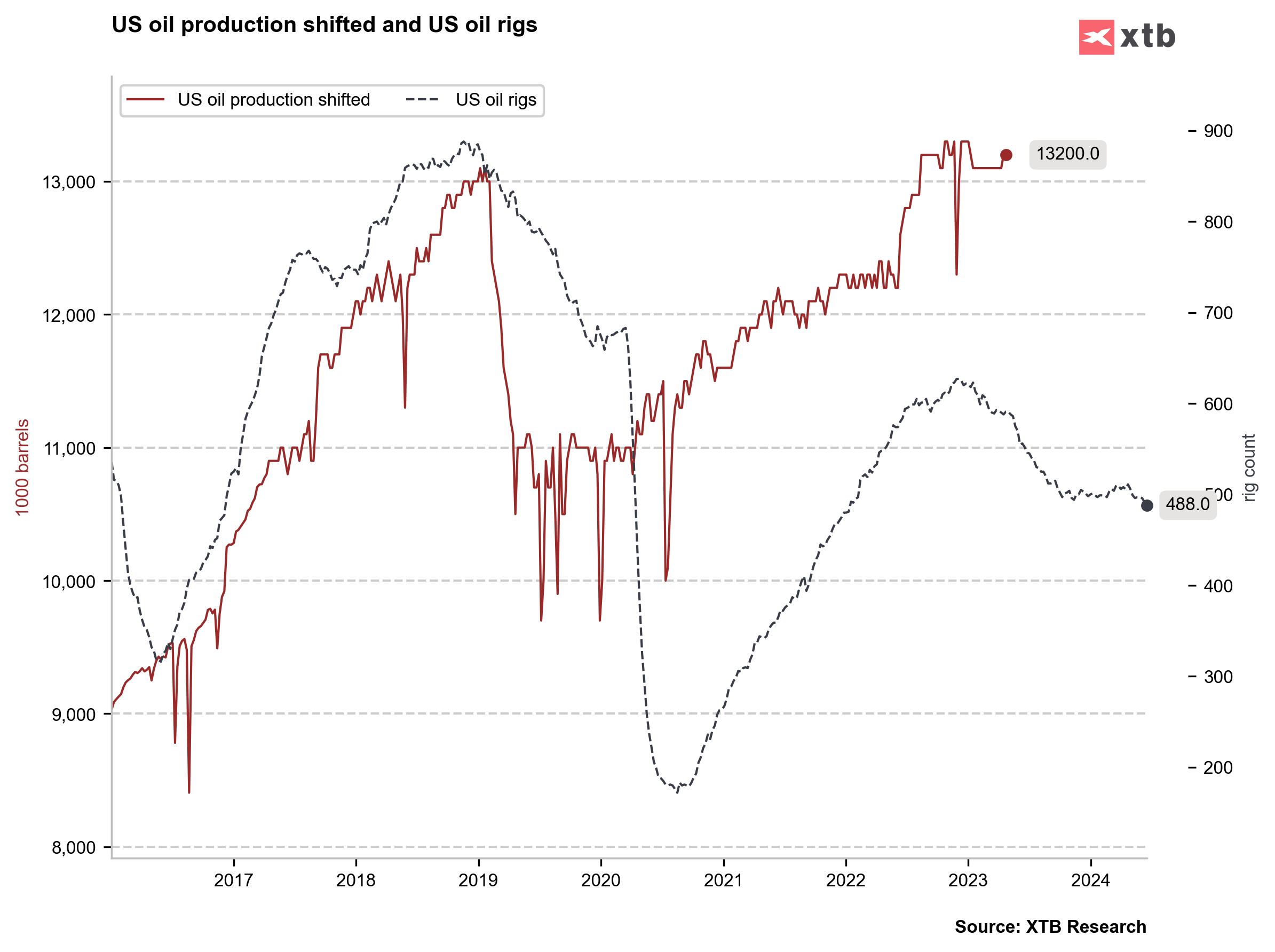

- Oil production in the US remains at a high level despite the continued decline in drilling rigs

- Although Saudi Arabia's oil minister indicated that recent actions are not aimed at fighting for market share, there are speculations that OPEC+ moves are once again aimed at "squeezing" US shale production. Production in the US remains around 13 million barrels per day

- It is worth remembering that the actions of 2014-2016 led to a significant decline in oil production in the US. At the same time, however, most OPEC+ countries need oil prices at $80-100 per barrel to balance their budgets

Start investing today or test a free demo

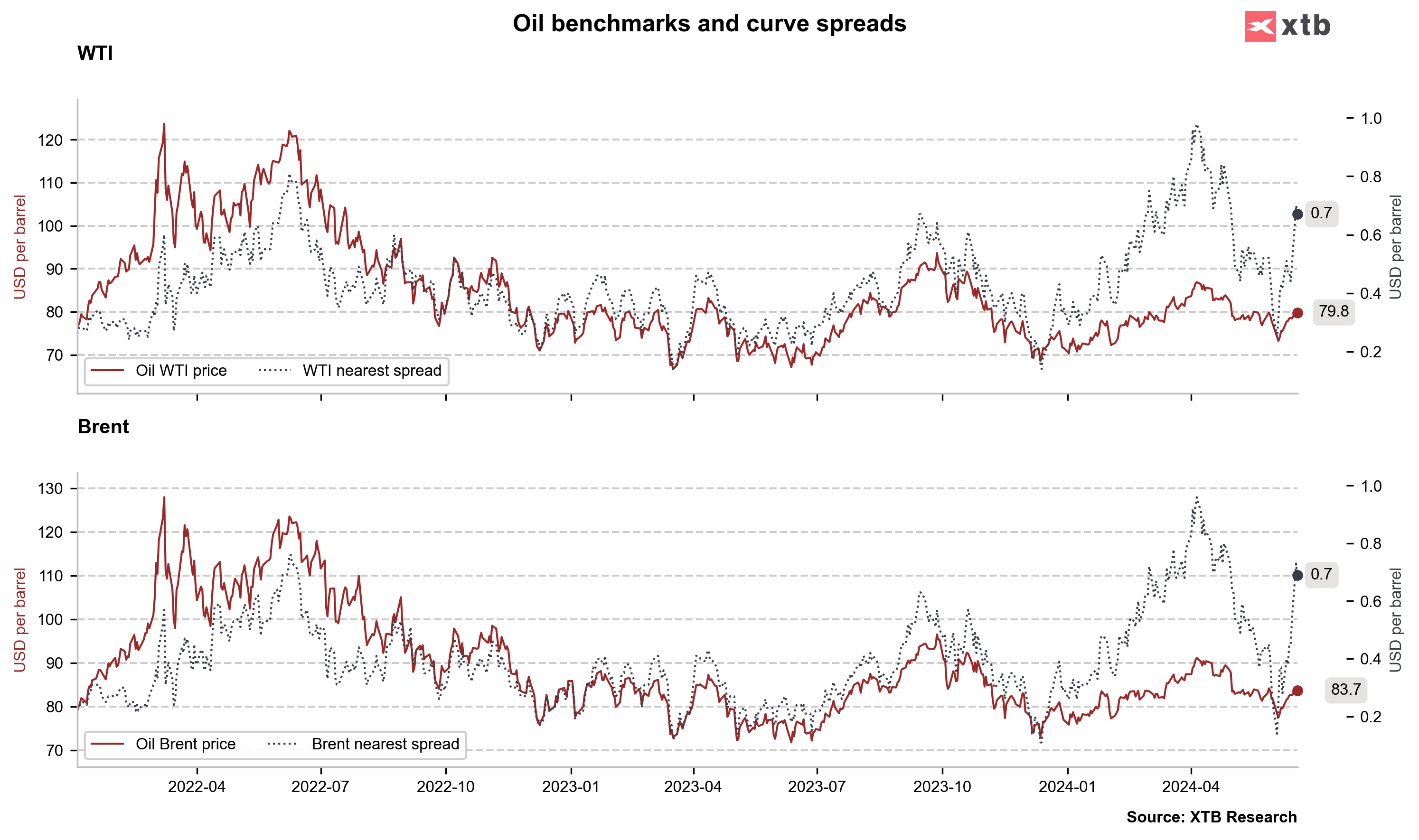

Create account Try a demo Download mobile app Download mobile appA rather clear backwardation has reappeared in the oil market. Theoretically, this begins to indicate potential overvaluation, although the price itself remains relatively low compared to prices from the last two years. Source: Bloomberg Finance LP, XTB

US production has remained flat in recent months, while drilling rigs continue to decline. Source: Bloomberg Finance LP, XTB

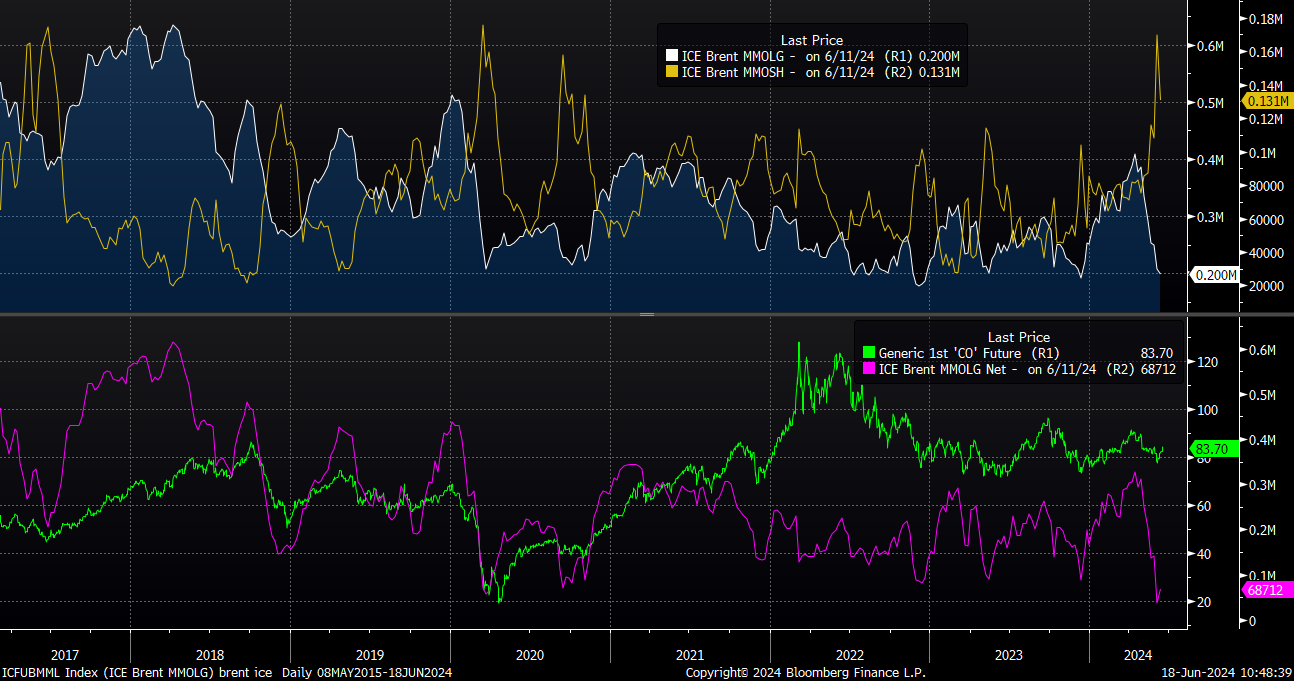

The number of short positions on Brent oil is decreasing, which may confirm the recent contrarian signal of excessive sell-off. On the other hand, the price itself remains relatively low, and long positions have fallen for another consecutive week. Source: Bloomberg Finance LP, XTB.

The price has rebounded by almost 10% from the local low. There may be pressure to close the gap after the next rollover. Source: xStation5

Gold

- Gold is currently holding an important support level at $2,300 per ounce, although several negative pieces of information for the gold market surfaced in recent weeks

- First and foremost, there is a possible collapse in demand in China. The People's Bank of China did not purchase gold in May, and investors on the Shanghai exchange have reduced the number of long positions in the market

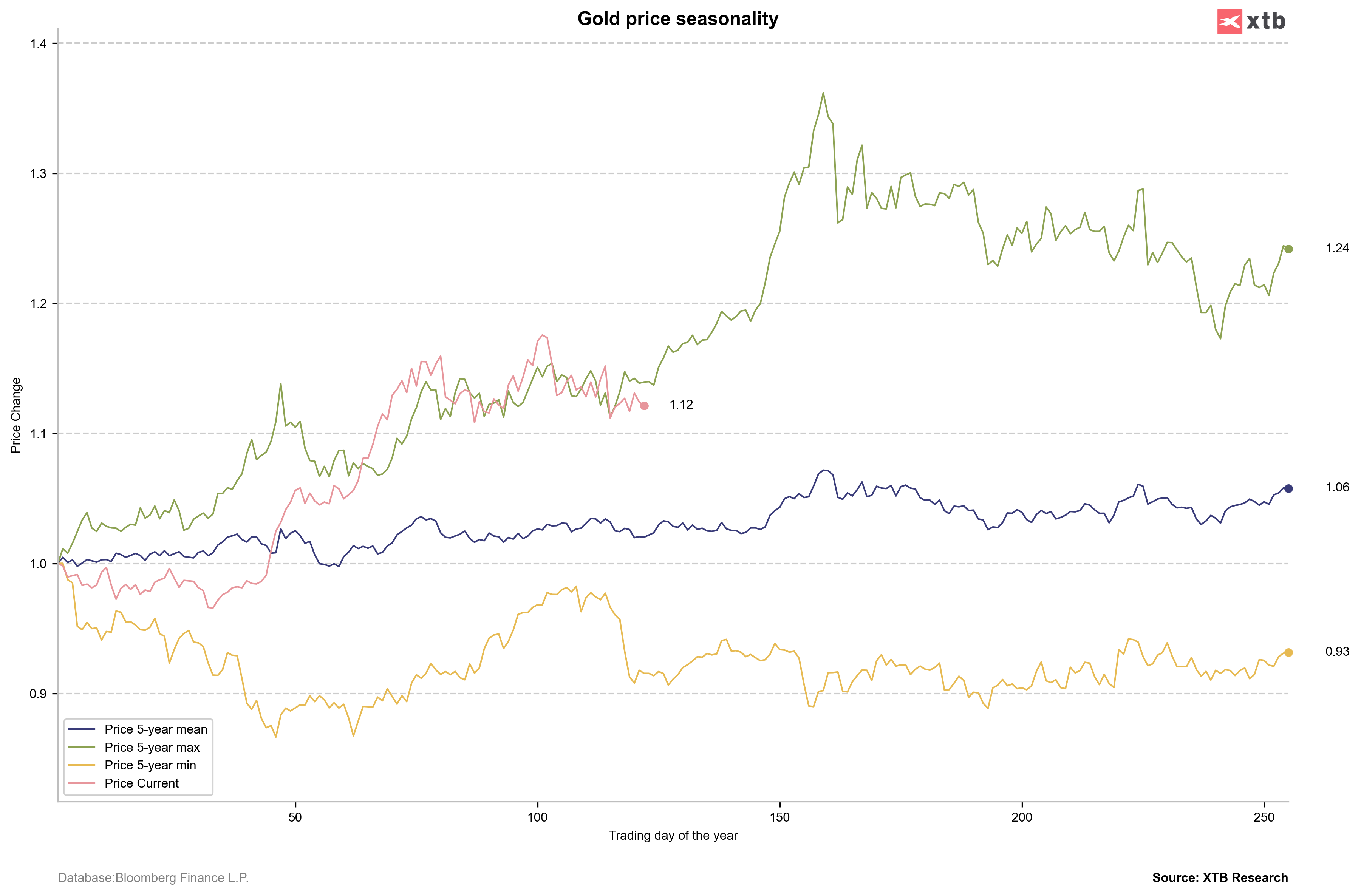

- Seasonality indicates that the coming weeks should not bring significant changes in the gold market, although, looking at the best performance of the last five years, one could theoretically expect increases

- Gold may gain primarily at the end of the summer period, when discussions about Fed rate cuts will begin again. Currently, 1.8 rate cuts (45 basis points of tightening) are being priced in for this year

Seasonality points to flat price performance in the coming weeks, but also to a possible revival at the end of the summer. This could happen when discussions about a September rate cut by the Fed resume. Source: Bloomberg Finance LP, XTB.

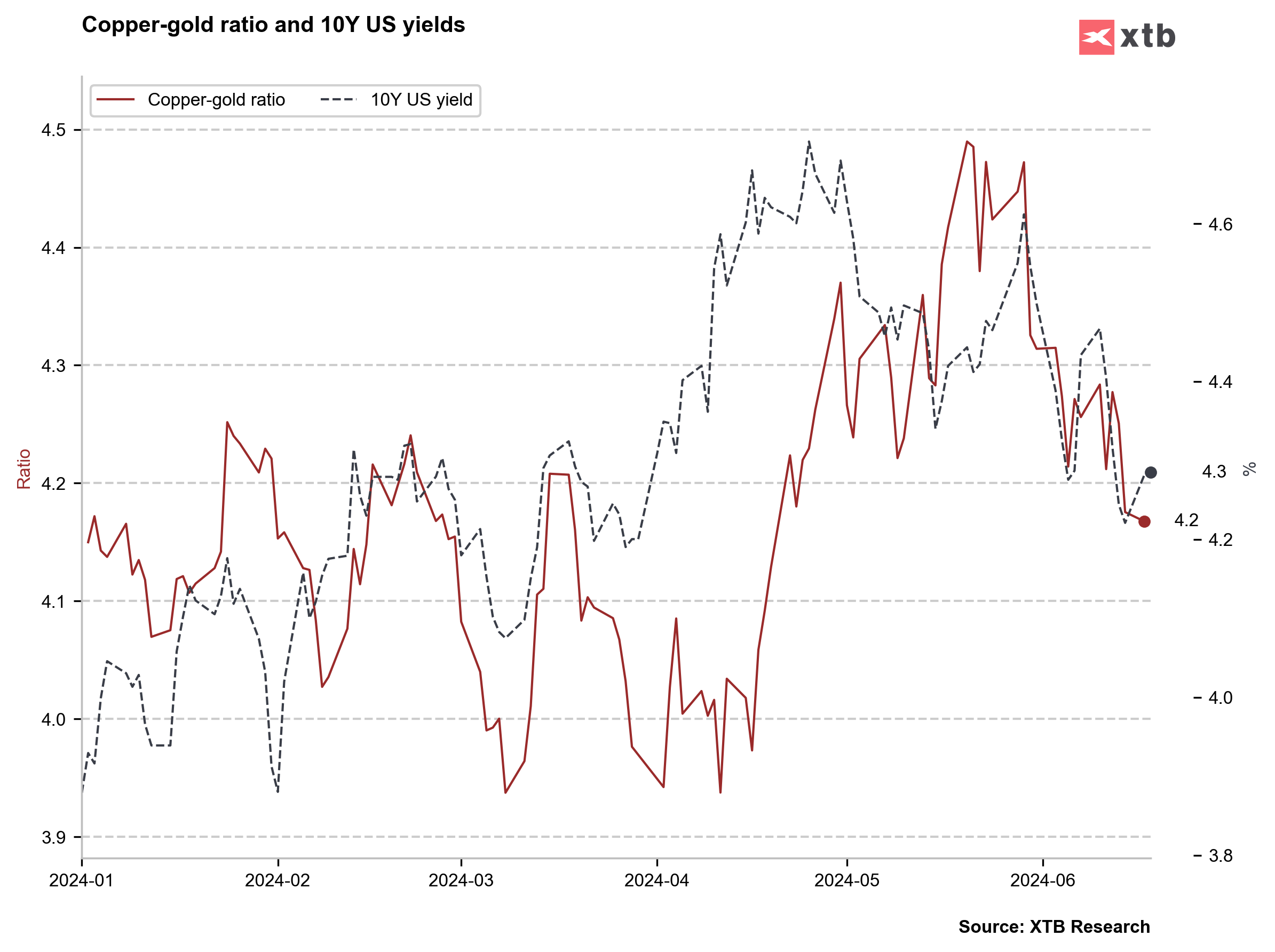

US yields have experienced significant declines recently, even despite hawkish Fed stance. Theoretically, further declines in yields would provide a chance for the continuation of the drop in the copper-to-gold price ratio towards the lows from March and April, when gold was trading above $2,400 per ounce. Source: Bloomberg Finance LP, XTB.

Maintaining support at $2,300 per ounce seems crucial from a technical perspective. Breaking this support could lead to a drop to levels of $2,250/$2,200/$2,150 per ounce. Source: xStation5

Natural Gas

- It is forecasted that gas demand, along with exports in the US, may exceed 100 billion cubic feet per day (bcfd) in the near future. It is worth noting that production itself is about 100 bcfd, which means that the entire inventory increase is related to imports

- The number of drilling rigs in the US has significantly decreased in recent months. Interestingly, despite a sharp decline last year, production rebounded during the summer

- Production at the beginning of this week exceeded the level of 100 bcfd per day and was 2% higher year-on-year. On the other hand, demand was almost 14% higher at nearly 75 bcfd. Total exports were close to 20 bcfd

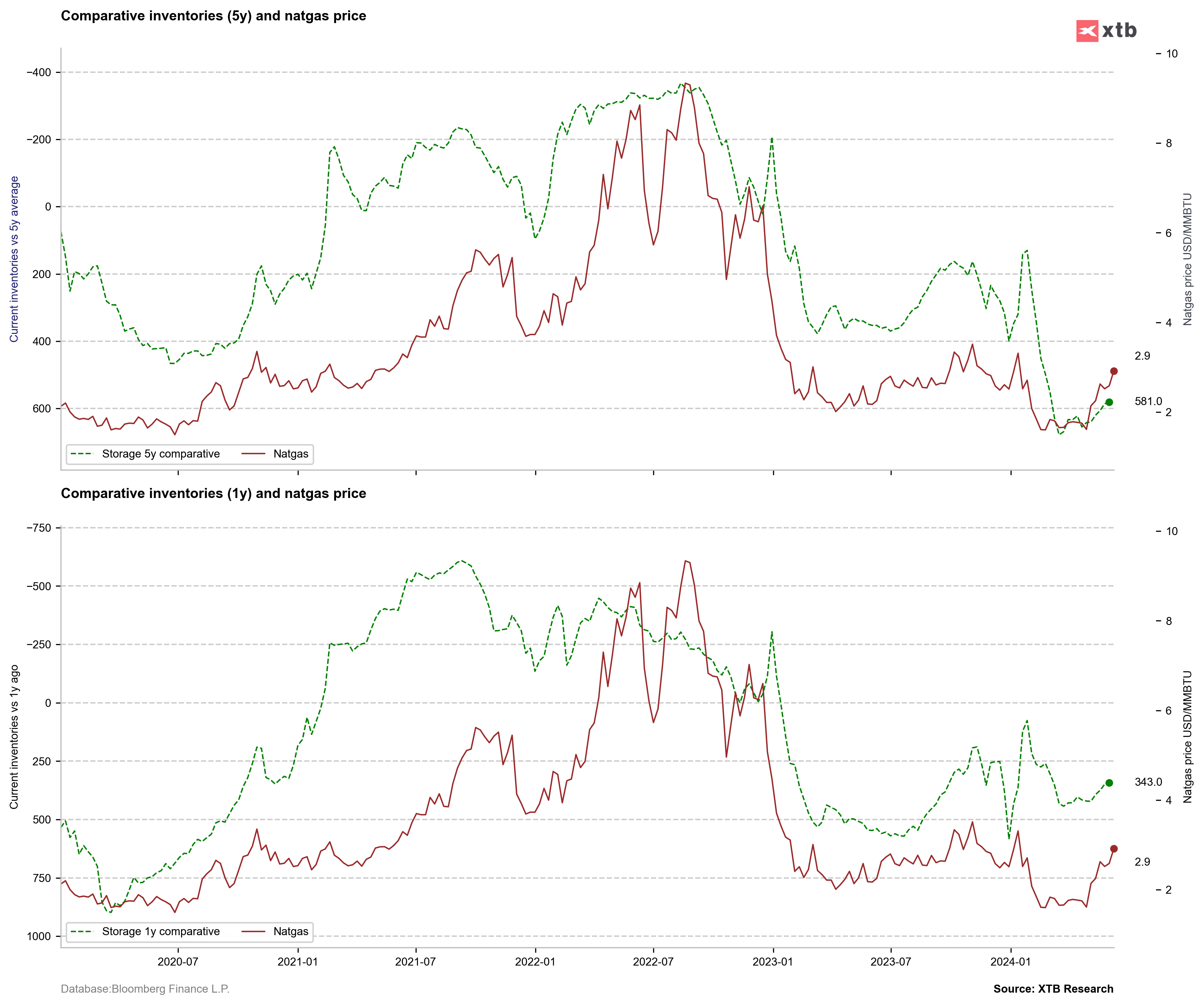

- Gas inventories are about 25% higher than the five-year average for the period and about 15% higher than a year earlier. However, the oversupply compared to these levels is decreasing, as illustrated by the decline in comparative inventories

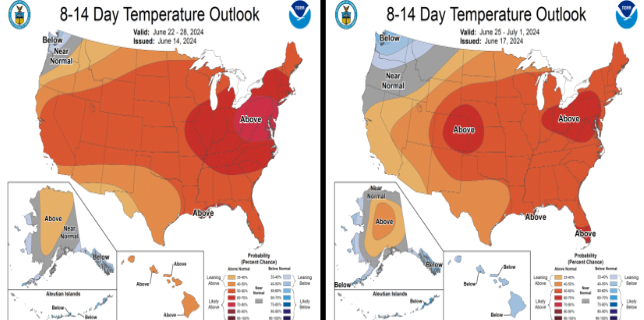

- It is worth noting that gas demand is significantly higher than a year ago, although only slightly higher than the five-year average. The next two weeks are expected to bring further heat waves in the US, but gas prices are undergoing a noticeable downward correction below $3/MMBTU

Comparative inventories are declining, although the oversupply compared to the five-year average and last year remains at a high level. Source: Bloomberg Finance LP, XTB

Temperatures in the US are expected to remain high, which should keep gas demand at above-average levels. Source: Bloomberg Finance LP, XTB

The rollover in gas prices was slightly positive for prices, but high temperatures in the US and increased demand may prevent the gap from closing in the near future. On the other hand, gas is testing the upper limit of the gap that appeared after the weekend. Area near $2.90/MMBTu may constitute significant resistance. Source: xStation5

Cocoa

- The authorities of Côte d'Ivoire have decided to halt the sale of cocoa delivery contracts for the upcoming season due to uncertainty regarding the harvest. The cocoa and coffee regulator of Côte d'Ivoire usually sells between 50% and 70% of the next season's deliveries to set the price paid to farmers

- It is worth noting that in recent years, the amount of cocoa delivered to Western countries has decreased, while the amount of cocoa processed locally has increased. At the same time, exports of products such as cocoa butter and cocoa powder have risen

- Cocoa inventories continue to decline and are at their lowest levels since mid-2021. However, stocks are still far from the extreme lows of 2004 or 2009, so it is expected that cocoa processing should not see significant declines in Q2 2024

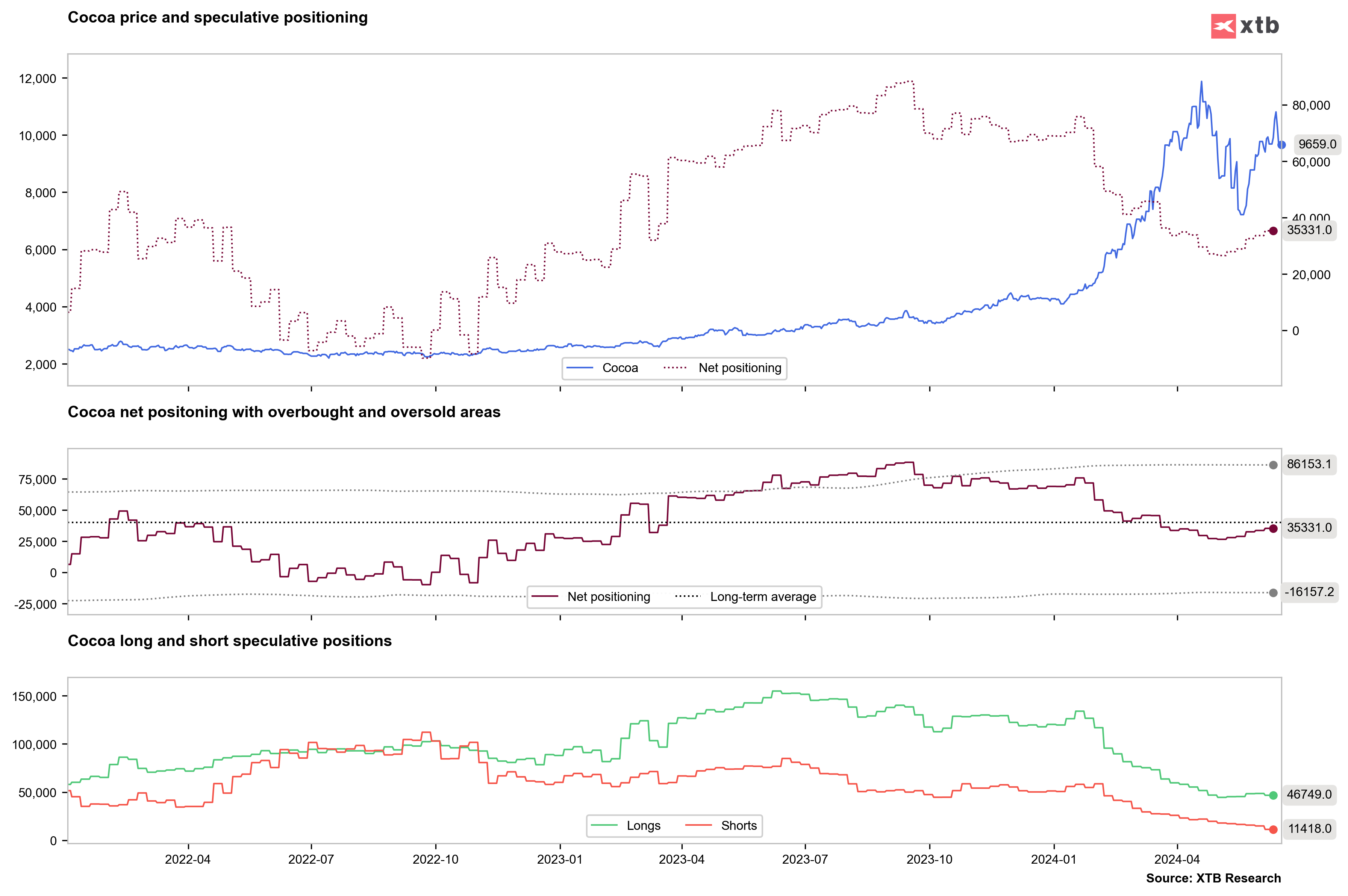

- We will learn more about processing data from Europe, Asia, Africa, and America around mid-July. Previous data coincided with local peaks

Net positioning on the cocoa market is rebounding again, which may indicate at least the maintenance of current prices. Source: Bloomberg Finance LP, XTB

Seasonality indicates that May and June are usually negative for cocoa. The same is true for September and October. However, it is worth remembering that this season is particularly important due to one of the largest deficits in the market's history. Source: Bloomberg Finance LP

Cocoa prices were in consolidation for almost a month before the Q1 demand data. Then, the data turned out to be better than expected, leading to a significant rebound, but it also marked the end of strong increases in the market. Are we facing a month of consolidation in the market awaiting key data? Source: xStation5

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.