Swiss bank Credit Suisse (CSGN.CH) is constantly under downward pressure. Today, the shares are losing more than 5.0% following the announcement that the publication of annual results has been postponed in the face of a call by the US SEC, which is demanding an explanation for certain inaccuracies in earlier financial statements.

Back in February, the Bank communicated that 2022 had been the most difficult year in the corporation's history to date. The annual loss is expected to reach levels not seen since 2008, primarily related to massive withdrawals by the richest clients and the massive scandals in which the Bank has been involved (including the collapse of the private firm Archegos Capital, which managed the funds of Sung Kook Hwang, linked to Tiger Management).

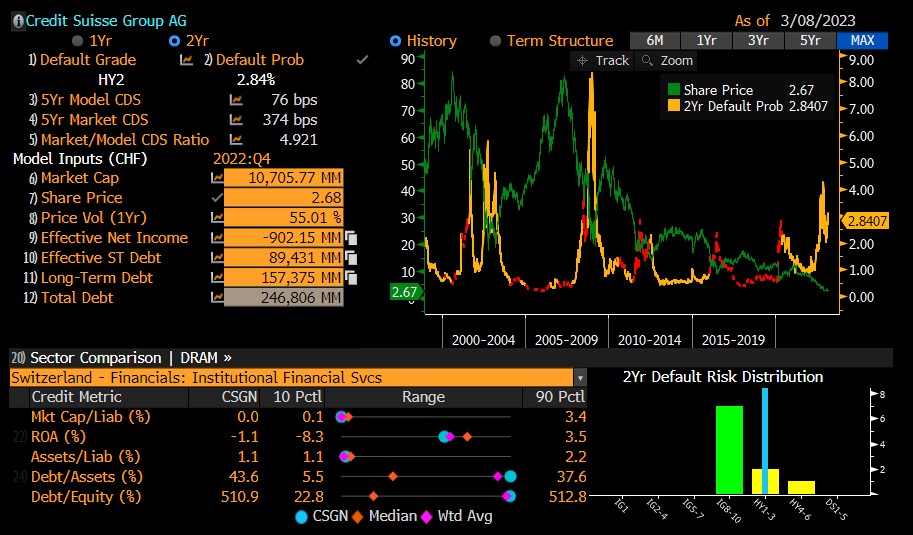

The risk profile around the Bank does not inspire optimism. Most rating agencies have assessed the company's situation as negative, and continued pressure and incoming news are dragging share prices down. All this increases the probability of the Bank's collapse, which is currently close to 2.84%. Source: Bloomberg

The risk profile around the Bank does not inspire optimism. Most rating agencies have assessed the company's situation as negative, and continued pressure and incoming news are dragging share prices down. All this increases the probability of the Bank's collapse, which is currently close to 2.84%. Source: Bloomberg

Credit Suisse is trying to rectify the bank's situation and continues to review its operations. The bank is cutting costs and jobs and spinning off parts of its business, including its core IB unit, by reactivating the Credit Suisse First Boston entity.

Source: xStation 5

Source: xStation 5

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.