Strengthening dollar and yields are putting pressure on Bitcoin, ahead of tomorrow's US data: CPI inflation, the Fed decision and the Powell conference. Contracts for the dollar index (USDIDX) are trading up more than 0.2% today, another session in a row, and yields on 10-year U.S. Treasury bonds are back above 4.45%, although they were trading at 4.26% last week. Some cryptocurrencies are losing considerably more today than Bitcoin, which is slipping less than 5%. Ethereum is trading down nearly 6% and has retreated below $3500; Intercomp and Sushi are losing nearly 10%, and declines on Uniswap exceed 12%.

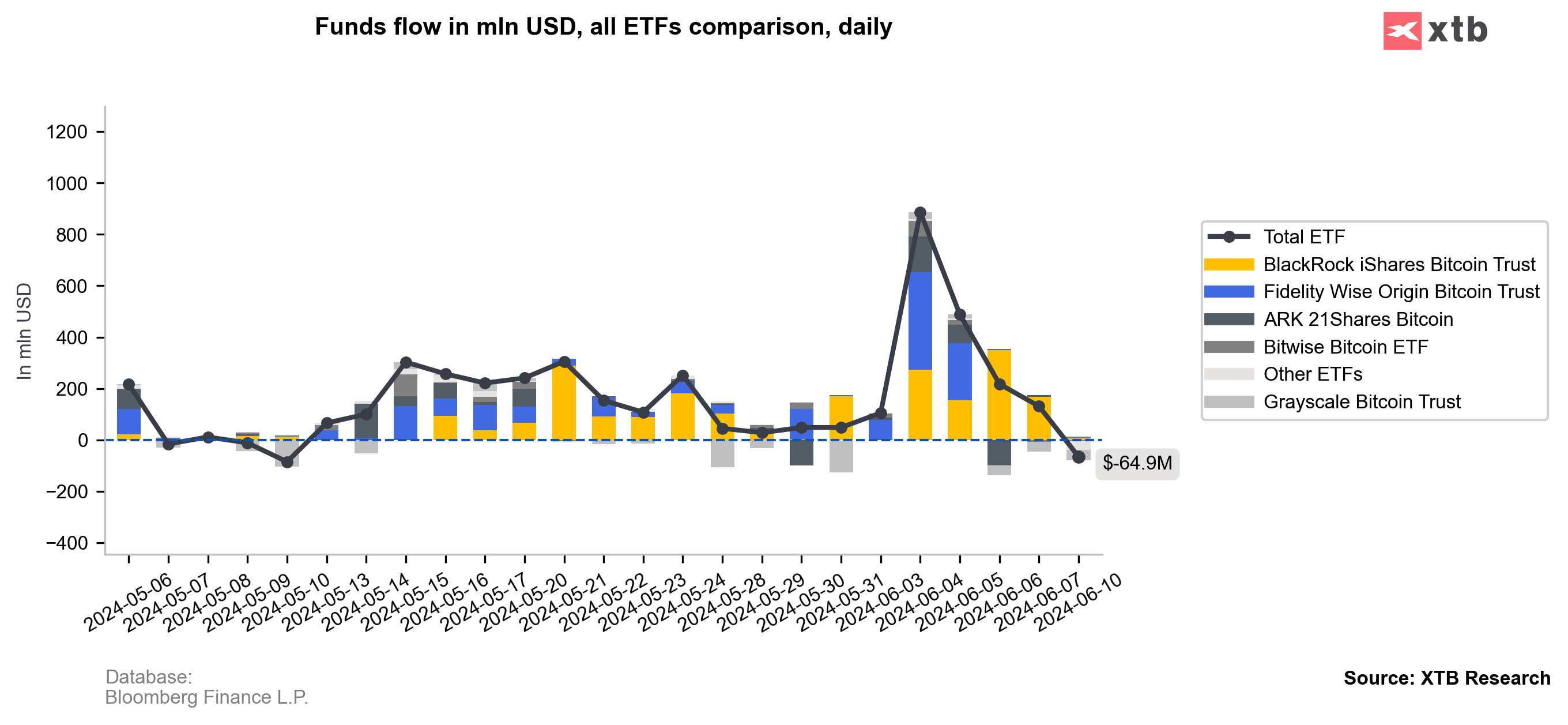

Yesterday, ETFs recorded small net outflows of $64.9 million after 19 days of buying. Source: Bloomberg Finance L.P.

BITCOIN (D1 interval)

Bitcoin is trading down nearly 5% today, and key short-term support can be found at $65,300, where we see the 50-session moving average and the 23.6 Fibonacci retracement of the January 2024 upward wave. Source: xStation5

Source: xStation5

UNISWAP (H1)

News of the acquisition of Crypto Game: The Game turned out to be only a short-term, speculative catalyst for increases on Uniswap. Today, those increases have been completely erased, and the token is testing the area below $9, last seen in the second half of May. The market reacted with a sell-off at the level of the exponential 200-session moving average (EMA200,red line). Source: xStation5

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.