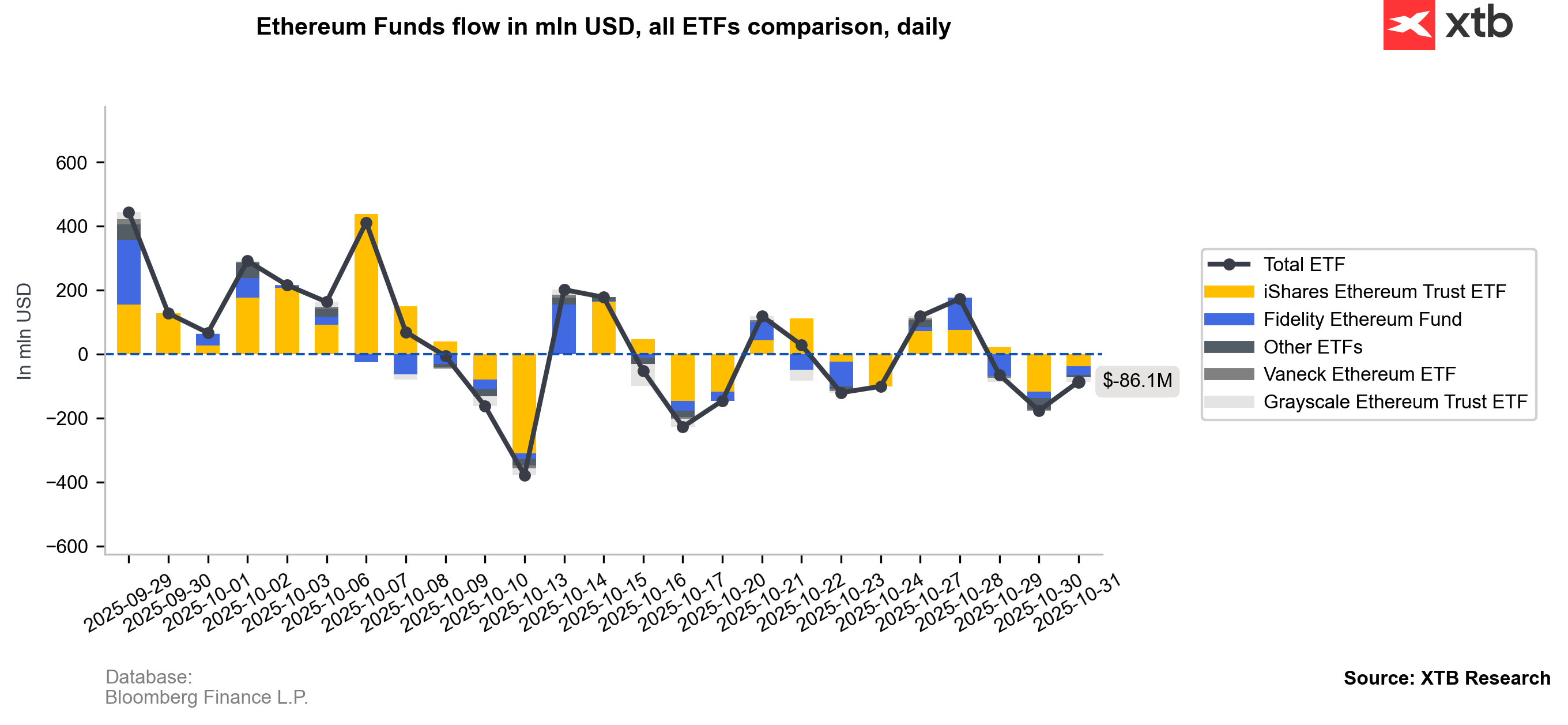

Cryptocurrencies remain largely dependent on stock market sentiment. According to Goldman Sachs data, the put-call skew in the Mag7 group (the seven largest tech companies) inverted for the first time since December 2024, meaning that the implied volatility of call options (betting on price increases) has exceeded that of puts (betting on declines). This phenomenon is rare and may signal that investors are potentially over-positioned for further equity market gains.However, weak technical conditions (also visible in Ethereum) and declining interest in U.S. spot ETF inflows are, to some extent, undermining the narrative of a strong autumn rally in the crypto market. As a result, the market may increasingly mirror the 2021 scenario, when the first half of November brought sharp declines in cryptocurrencies, triggering a bear market that lasted until around December 2022.

Bitcoin and Ethereum

Bitcoin (BTC)

Key support levels for BTC remain the psychological $100,000 area and $94,000 (the retracement of this year’s entire advance). Should both levels be broken, we may cautiously assume that Bitcoin’s uptrend has ended. The current price is about 6% below the average cost basis for short-term holders, which indicates stress and potential loss realization within this group. Based on realized price metrics across all investor cohorts, a potential bear-market bottom would likely form in the $50,000–$55,000 range. Conversely, if Bitcoin finds solid support and resumes its rally, a breakout above $110,000 could open the way toward new all-time highs above $126,000.

Source: xStation5

Ethereum (ETH)

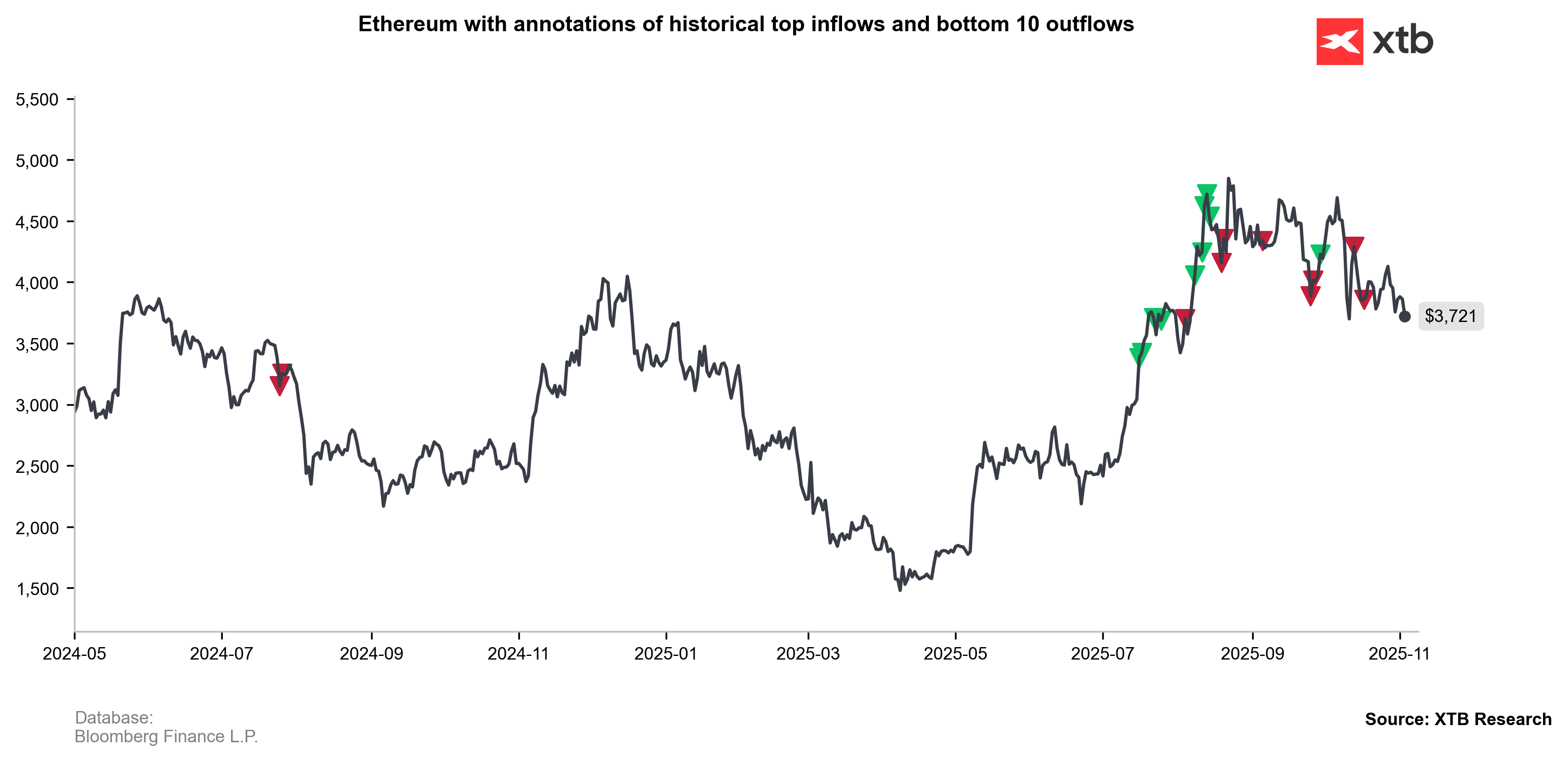

Ethereum is currently under pressure, but based on historical price impulses, we can cautiously assume that market geometry supports at least a consolidation phase after the recent decline. Historically, however, drops below the 200-day EMA have almost always led to deeper sell-offs for ETH than the current one. To maintain a bullish trend, a quick rebound above $3,700 would be necessary. Otherwise, renewed pressure could push the price back toward $2,500, erasing this summer’s upward move.

Sources: xStation5

Source: xStation5

Bloomberg Finance L.P. , XTB Research

Bloomberg Finance L.P. , XTB Research

Source: Bloomberg Finane L.P. , XTB Research

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.