Last week, despite dovish signals from the Federal Reserve, which initiated technical quantitative easing (QE) and cut interest rates, proved disappointing for both the Nasdaq 100 and Bitcoin. The largest U.S. technology equity index fell by more than 2% over the past five sessions, while Bitcoin declined from above USD 94.5k following the Fed decision to around USD 87k over the weekend. On Monday morning, the price of the largest cryptocurrency is hovering near USD 89.5k.

- Spot Bitcoin trading volumes have been declining. At the same time, activity in derivatives markets is weakening including futures and, in particular, options (open interest). Altcoins remain unable to recover from the October 10 crash, while trading volumes in smaller projects point to ongoing bearish market conditions. Bitcoin is still trading roughly 30% below its October peak near USD 126k and continues to struggle to regain upward momentum.

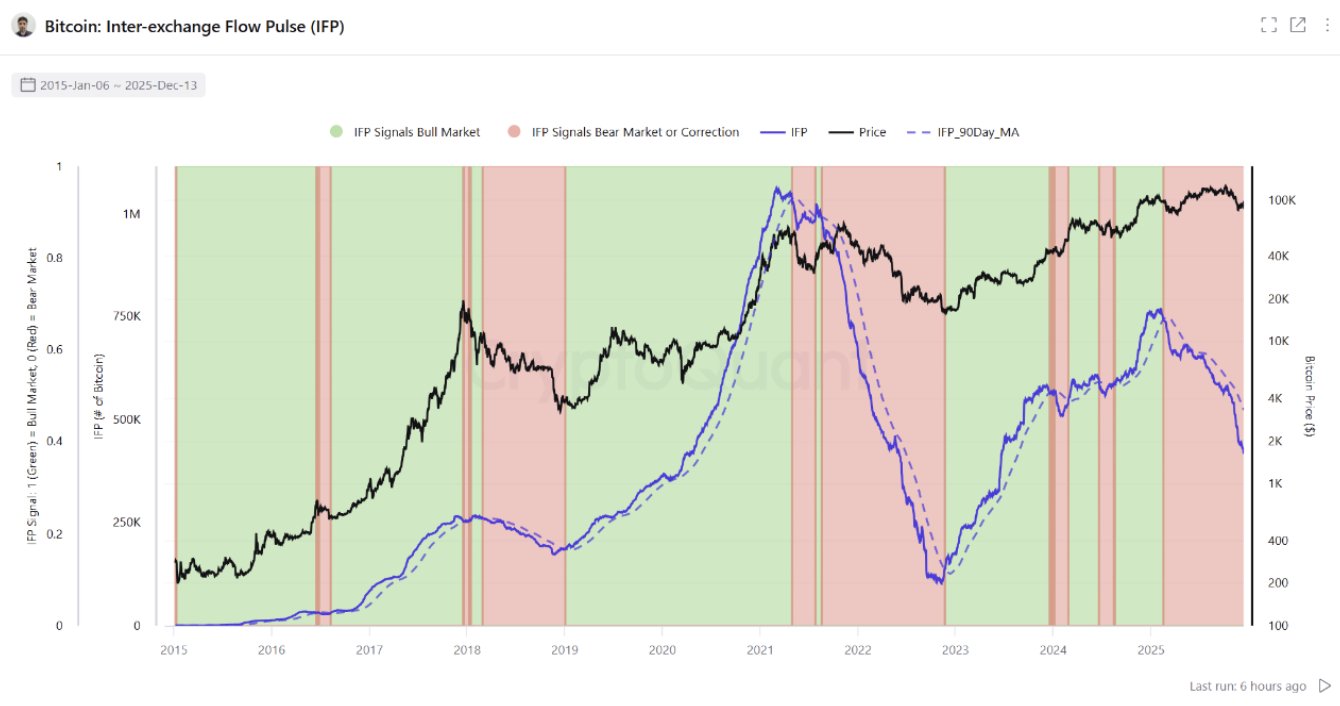

- On-chain data suggest elevated downside risk. A stronger price move is likely to follow several weeks of historically low volatility, reflecting a prolonged consolidation around the USD 90k level. The IFP (Inter-Exchange Flow Pulse) indicator, which measures on-chain Bitcoin activity between exchanges, has been consistently declining — a pattern that also preceded bear markets in 2018 and 2022. At the same time, Bitcoin inflows to Binance are at their lowest levels since 2018, suggesting a broad reluctance among investors to sell BTC at current price levels.

Bitcoin and Ethereum charts (H1)

Source: xStation5

Source: xStation5

Source: CryptoQuant

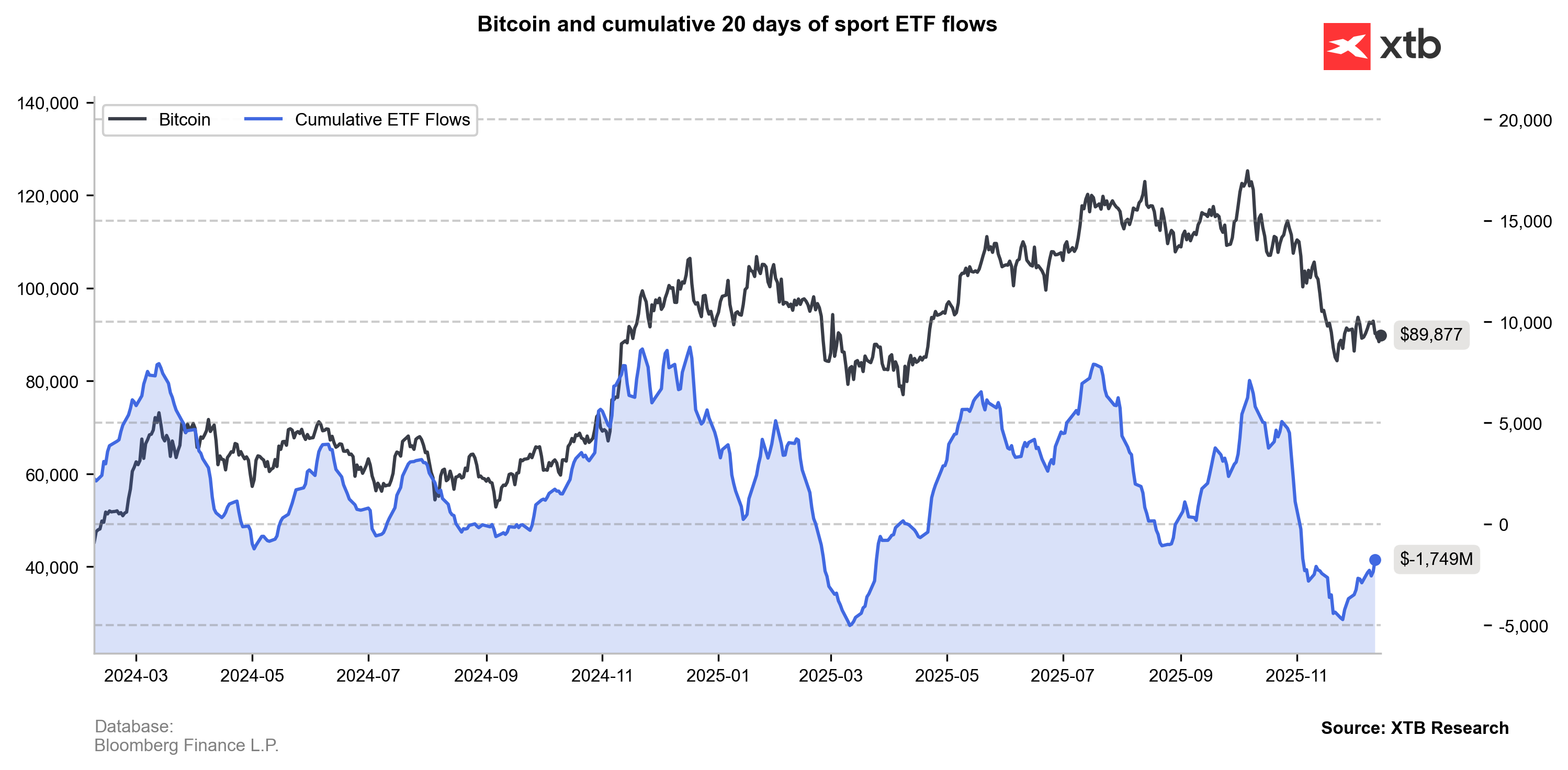

ETF Flows

Without a clear improvement in equity market sentiment and a meaningful rebound in trading activity across crypto markets, downside risks remain elevated despite solid fundamentals for the year ahead. These include an expected strong U.S. earnings season, the prospect of interest rate cuts in 2026, and a potentially broad, dovish shift in Federal Reserve policy. Recently, ETF funds have recorded only modest inflows during price increases, while experiencing sharp outflows during market declines.

Source: XTB Research, Bloomberg Finance L.P

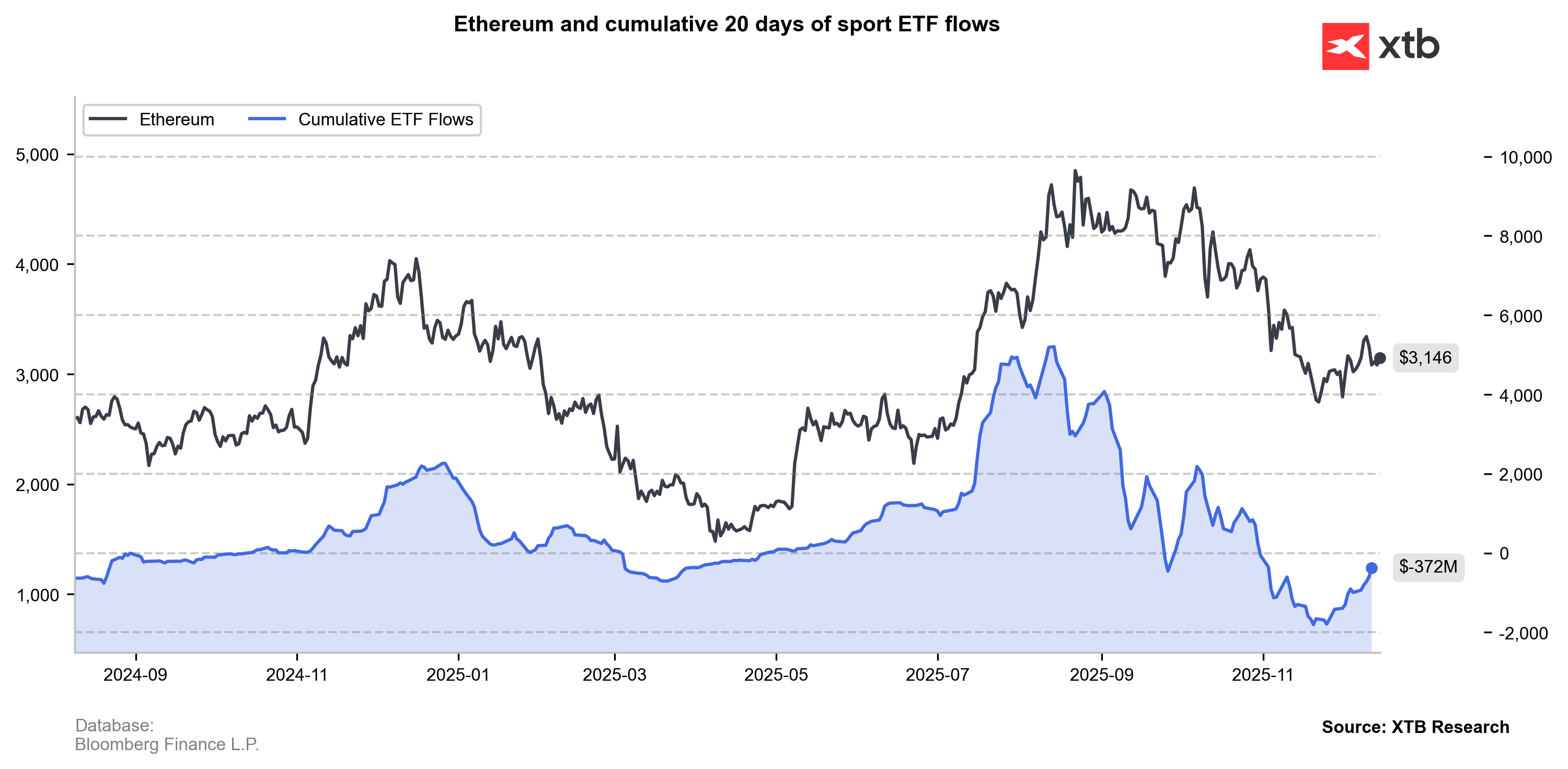

Source: XTB Research, Bloomberg Finance L.P

Despite attempts to revive activity, overall sentiment within ETF funds points to caution and significantly reduced interest in Bitcoin and Ethereum investments. This resembles a state of market “fatigue” and demand exhaustion following years of strong gains. On the positive side, ETF funds focused on Bitcoin, Ethereum, and even Solana (SOL) recorded positive net inflows last week.

Source: XTB Research, Bloomberg Finance L.P

Source: XTB Research, Bloomberg Finance L.P

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.