Cryptocurrencies are starting the new week calmly but on a positive note, with Bitcoin trading above $111,000 and Ethereum hovering around $4,300. Last week’s declines on Wall Street have eased, index futures are gaining, and the U.S. dollar is weakening. The biggest “pain point” for the cryptocurrency market remains the ongoing BTC sell-off from whale wallets. Their average BTC holdings per address have fallen below 500 BTC — the lowest level since 2018.

- Bitcoin and Ethereum are trading about 10% below their all-time highs, while sentiment toward altcoins remains muted. After BTC rebounded from around $108,000 to over $111,000, the market is waiting for a clear momentum signal. Whales sold about 115,000 BTC worth $12.7 billion in August — the largest outflow since 2022.

- The 7-day change indicator for the largest BTC addresses set a new record since March 2021. Whale selling is slowly losing steam: weekly BTC supply changes fell from 95,000 BTC in the week ending September 3 to 38,000 BTC between September 3–6.

- Markets now await U.S. CPI inflation data on Thursday — a reading below forecasts could act as a strong bullish catalyst for crypto. Meanwhile, MicroStrategy (MSTR.US) remains excluded from the S&P 500 index — its shares are down more than 2.5% in premarket trading.

- New Nasdaq regulations target “treasury” companies that accumulated crypto through bond (debt) issuance. These rules don’t ban such practices but require shareholder approval and lengthen the process.

- Bitcoin mining difficulty has reached a new record above 136 trillion, marking the fifth consecutive increase since June. Miner revenues have dropped to their weakest level since June, adding pressure on BTC mining profitability.

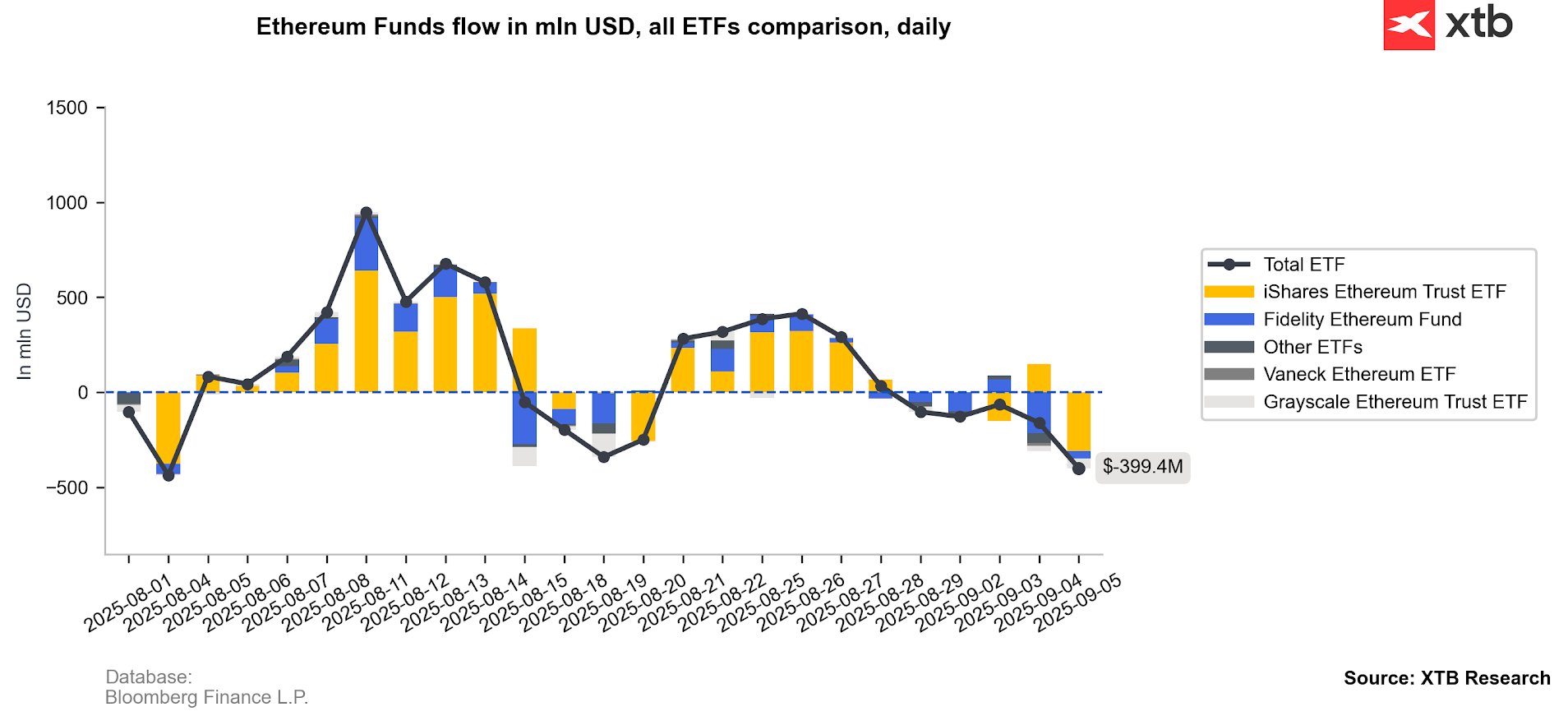

The LTH NUPL indicator for ETH, along with a two-month high in the Coin Days Destroyed metric, points to profit-taking by investors. Ethereum-based ETFs have seen five consecutive days of net outflows, signaling shifting investor sentiment toward risk and the broader crypto market. The key question: will this shift prove lasting?

Bitcoin and Ethereum (D1 interval)

Looking at BTC, we see the price moving within a short-term downward channel. Since February 2025, BTC has repeatedly broken out upward. A breakout above $115,000 could push Bitcoin toward new highs, while a drop below $107,000 could send the price back to the $95,000–$100,000 zone, where prior reactions were observed. Importantly, the price recently bounced from the key on-chain STH Realized Price of around $109,000, suggesting that short-term holders are once again posting “slight,” unrealized gains. A return below $108,000, however, could trigger a “capitulation” among this group.

Source: xStation5

A move above $4,400 could lead ETH to retest its ATH — this time near $5,000 per token.

Source: xStation5

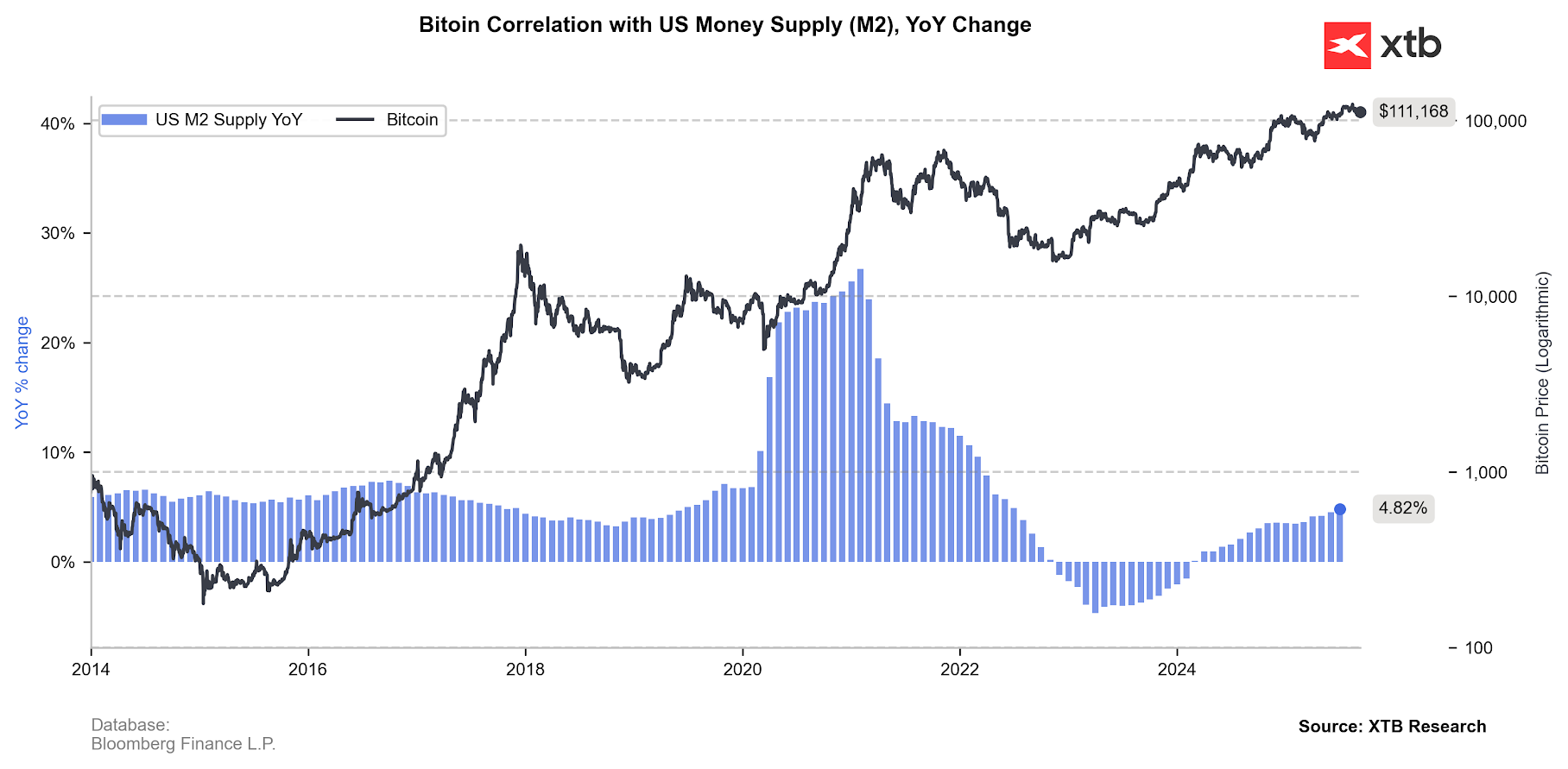

The M2 money supply across major central bank balance sheets is rising, which supports gold and, with some lag, should also support BTC.

Source: XTB Research, Bloomberg Finance L.P.

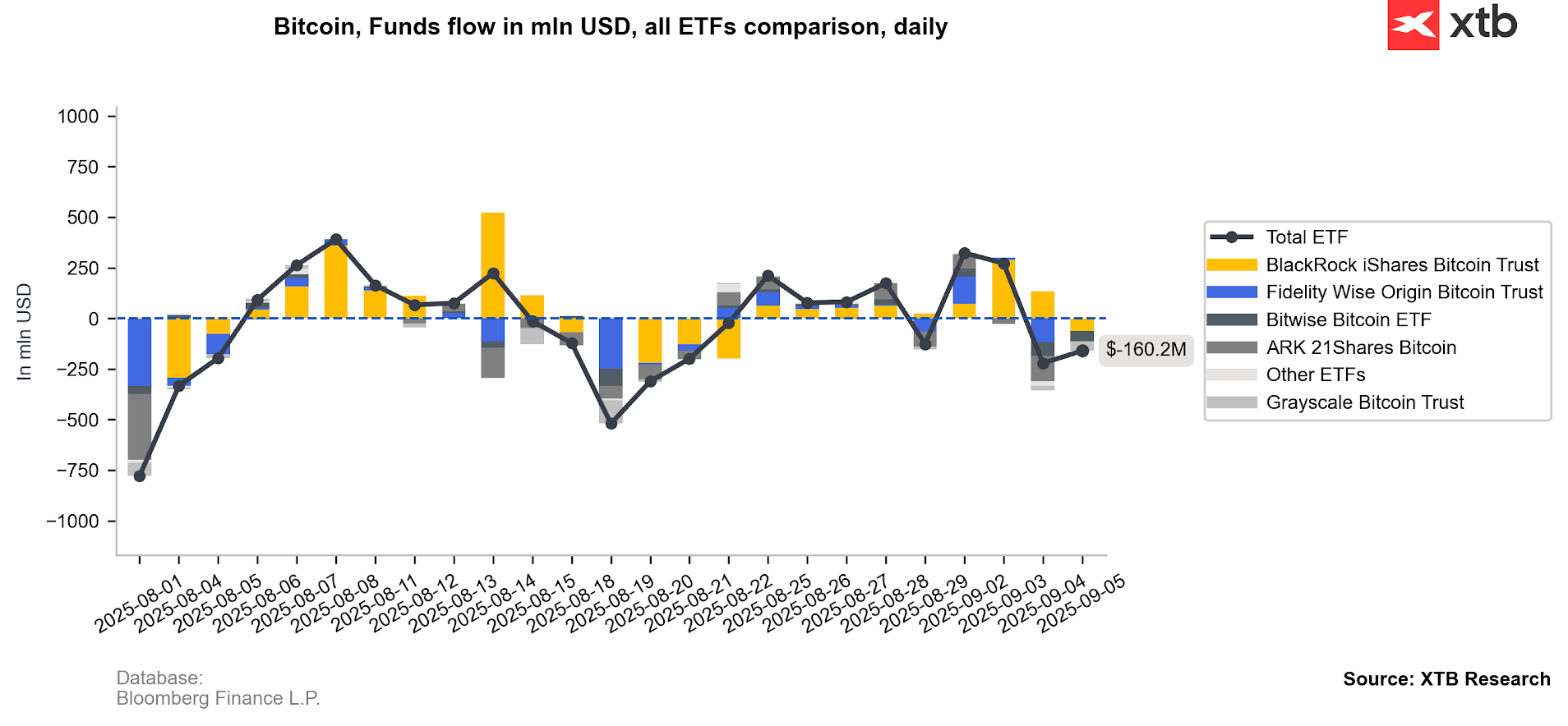

ETF inflows weakening

The situation in Bitcoin ETFs points to some selling, though volumes remain relatively small. Overall activity in this group has slowed and currently does not exert a decisive impact on prices. On the other hand, a strong rise in net inflows could help Bitcoin climb to new ATHs. For now, whale supply is not being sufficiently “absorbed.”

Source: XTB Research, Bloomberg Finance L.P.

Looking at Ethereum, we see five consecutive net outflow days. This should not be surprising, considering the scale of ETF accumulation in recent weeks. BlackRock’s ETF alone sold over $300 million worth of ETH. Still, this is not a reliable price predictor — around August 20 we saw a similar situation, followed by rising net inflows in subsequent sessions. All this suggests that the current cooling phase is natural and does not signal a strategic withdrawal of capital from crypto.

Source: XTB Research, Bloomberg Finance L.P.

Eryk Szmyd XTB Financial Markets Analyst

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Morning wrap (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.