Crptocurrencies erased some of the euphoric gains amid a mixed end to the US cash session. U.S. indices traded without spectacular price swings today, however Bitcoin and Ethereum continued their southward movement:

- The end of the week's trading could result in risk averse investors looking to exit risk-free positions before the stock markets open next week. Investors will learn today about consumer sentiment readings according to the University of Michigan, inflation expectations, and import/export data;

- Ethereum developers have postponed the date of 'the merge' to September 15, which means that the transition to Proof of Stake will take place 4 days sooner. The news is positive for investors because it shows the Ethereum team's 'confidence' in the correct change to the consensus method;

- Leon Li, the main holder of shares in one of the largest cryptocurrency exchanges, Huobi Global is considering selling them for a sum hovering around $3 billion. Bloomberg named Justin Sun, creator of the Tron cryptocurrency, and Sam Bankman Fried, head of the FTX exchange, as potential buyers. The information has so far not been confirmed by either of them. Such a huge acquisition would be one of the largest in the history of the cryptocurrency industry.

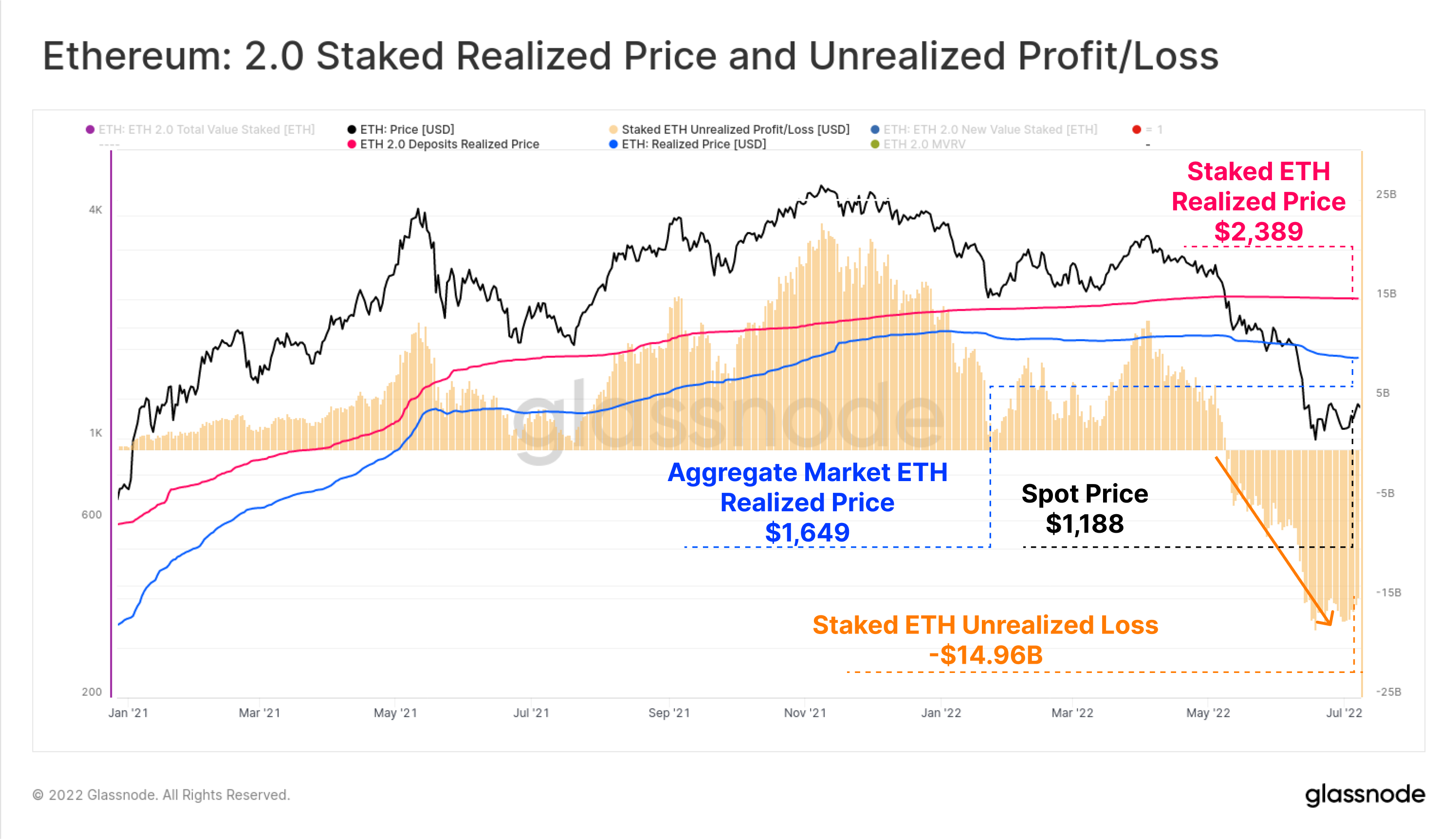

Since 2021, investors have been depositing Ethereum in the stETH version waiting for the ETH 'merge', which would allow them to become so-called 'validators', approving the blockchain transaction through the new Proof of Stake consensus method. The average 'Realized price' of deposited ETH was around $2,400, which is almost 45% higher than the market 'Realized Price' of Ethereum tokens. This means that the unrealized loss of stETH in the deposit contract awaiting merge is almost $15 billion. Potentially, investors opting for so-called staking will not want to dispose of ETH tokens at a loss which may support a limited supply scenario. Source: Glassnode

Since 2021, investors have been depositing Ethereum in the stETH version waiting for the ETH 'merge', which would allow them to become so-called 'validators', approving the blockchain transaction through the new Proof of Stake consensus method. The average 'Realized price' of deposited ETH was around $2,400, which is almost 45% higher than the market 'Realized Price' of Ethereum tokens. This means that the unrealized loss of stETH in the deposit contract awaiting merge is almost $15 billion. Potentially, investors opting for so-called staking will not want to dispose of ETH tokens at a loss which may support a limited supply scenario. Source: Glassnode

Ethereum chart, D1 interval. From a technical point of view, Ethereum recently bounced off the lower limit of the upward channel and broke through the main resistance at the level of $1820, which is marked by previous price reactions and the 23.6% Fibonacci retracement of the last downward wave. As long as the price is above the mentioned level, a continuation of the upward movement is possible. Source: xStation5

Ethereum chart, D1 interval. From a technical point of view, Ethereum recently bounced off the lower limit of the upward channel and broke through the main resistance at the level of $1820, which is marked by previous price reactions and the 23.6% Fibonacci retracement of the last downward wave. As long as the price is above the mentioned level, a continuation of the upward movement is possible. Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

Bitcoin jumps above $70k USD despite stronger dollar📈

Daily summary: Markets capitulate under the influence of the Persian Gulf

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.