The cryptocurrency market is retreating during Friday's session and introducing uncertainty among investors. In the past, it was often the weekends and week openings that were periods of heightened volatility in the cryptocurrency market. Is the sector in for another strong wave of declines?

-

Buyers recently managed to lift the price of Bitcoin back above $30,000, causing bulls to expect a broader rebound. However, the price reactions of the 'king of cryptocurrencies' in the zone above $30,000 indicated a still strong and active supply;

-

Bitcoin this Friday is again showing a correlation with weak sentiment on indices, most notably the NASDAQ technology index. The divergence that occurred last Friday when the index gained 3.5% and Bitcoin fell did not last long. It is worth pointing out, however, that Bitcoin fell both when the NASDAQ was surging and when contracts on the NASDAQ were losing, potentially indicating demand getting closer to capitulation.

-

There is no doubt that there is extreme fear in the cryptocurrency market, as evidenced by the updated 'Fear and greed index'. In the past, price levels reached by Bitcoin when sentiment was very negative have proven to be suitable places to buy. At the same time, however, in the case of preserved cyclicality in the cryptocurrency market, the 'extreme fear' index alone does not mean that the price has already reached a price bottom, the potential for declines in the event of a downturn still exists;

-

Positive opinions of JP Morgan analysts, who pointed to the undervaluation of Bitcoin, whose price should be currently at $38,000, did not cause investor euphoria or even the expected 'relief rally' which also indicates strong negative sentiment and very active supply;

-

Ethereum is in a potentially key zone for demand, in the $1,600 - $1,800 range. If it is defended once again, it could mean a strong upside momentum, however, if it is supply that manages to break out of support we could see high volatility downwards caused by, among other things, the liquidation of many long leveraged positions in these zones. Also, bulls in the options market may be forced to exit Ethereum due to the rising cost of premium to hold positions. The still bullish RSI indicator has not translated into an increase in ETH prices;

-

The markets' expected 'merge' of Ethereum to version 2.0, which is considered the most important cryptocurrency market event of 2022, has not supported the token's rising price so far and, contrary to expectations, has still not triggered the 'rally under event' characteristic of a bull market. It is the nature of the market that not everyone can be right about the course of such events. It is often completely different from the expectations and perceptions of most investors. At the same time, however, the powerful growth of the Ethereum network in an environment of melting supply can support long-term investors and create a real wave of demand if large volumes return to the market.

-

Sentiment is also weakening among other, smaller cryptocurrencies. This is well illustrated by Dogecoin's lack of a strong price reaction on Elon Musk's acceptance of payments with this cryptocurrency, which gained nearly 10% at the time and quickly gave back the growth. During the bull market, such news among 'altcoins' often ended with several hundred percent increases;

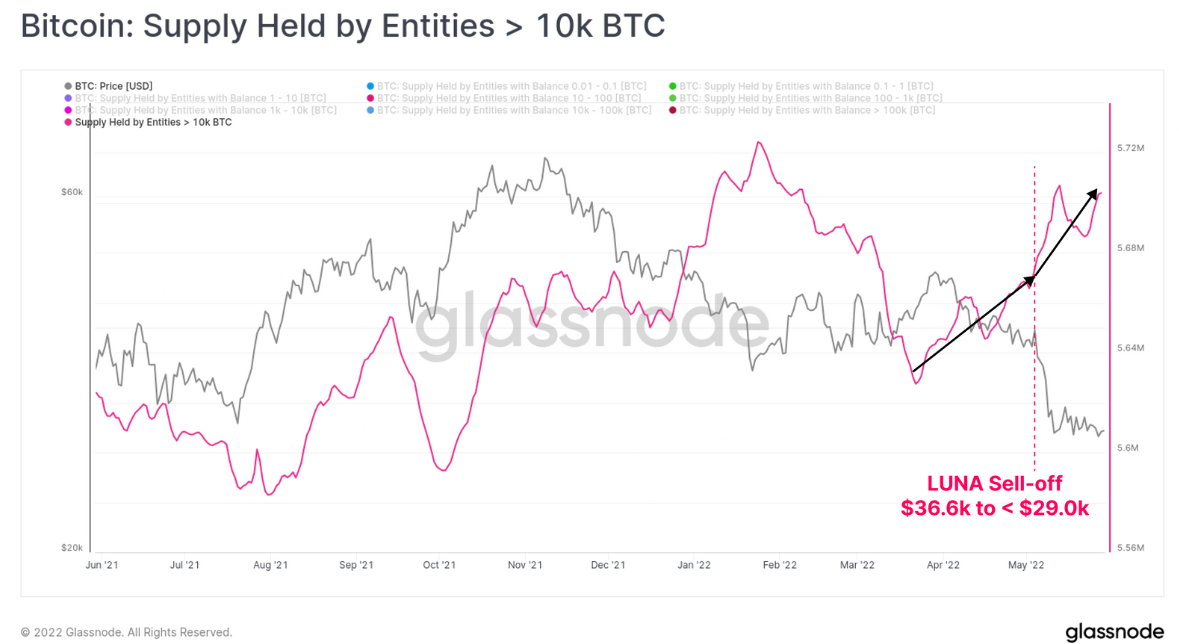

The number of entities holding more than 10,000 BTC has steadily increased. The trend also seemed immune to the fall of Terra (Luna). The project held the place of one of the leaders in the crypto industry. Source: Glassonde

The number of entities holding more than 10,000 BTC has steadily increased. The trend also seemed immune to the fall of Terra (Luna). The project held the place of one of the leaders in the crypto industry. Source: Glassonde

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.