- The Silvergate Capital problem has caused the market to begin to see similarities with the FTX situation although this time the size of Silvergate is much smaller and bankruptcy is not a foregone conclusion. Silvergate's market cap is now smaller than 200 mln USD;

- Bitcoin retreated overnight, near $22,300, losing $1,200 and $22 billion in market capitalization in just 20 minutes;

- Ethereum is also losing, with nearly $10 billion evaporating from its capitalization. In total, the cryptocurrency market lost nearly $50 billion overnight and is now valued at around $1.08 trillion;

- The value of all futures liquidations is oecnie more than $230 million and the price movement shows that the decline was triggered by a massive 'margin call';

Could it be FTX 2.0 event ?

Silvergate, after posting a nearly $1 billion net loss in 2022, indicated that it would not file its annual 10K report with the SEC in time and warned of possible financial problems. As a result, deposits to and from the bank were suspended by Coinbase, among others, and shares fell 57%. The investigation into the bank's relationship with FTX and Alameda Research is being conducted by the US Department of Justice. If bankruptcy occurs, we can expect increased comments from regulators although it is not yet clear to what extent the dire financial situation has not been affected by the FTX connections and the 'run' on November and December payouts - for example, in 1929 even well-capitalized banks in the US collapsed - due to the avalanche of payouts.

FDIC won't save from losses?

Last year, the key leverage ratio - which measures a bank's equity as a share of total assets - fell for Silvergate by nearly 6% from a healthy 11% to just over 5%. This is the cutoff point, after a drop below which the FDIC, the bank failure regulator, usually comes knocking at the door. The FDIC guarantees returns of up to $250,000 but assets accumulated at Silvergate are not subject to them because the regulations do not cover cryptocurrencies. CoinDesk pointed out that banks usually collapse on Friday night allowing the FDIC to work, transferring the deposits to a new custodian and looking for buyers for the remaining assets - but this time the future remains uncertain indicating a continuation of bank runs and possible bankruptcy, the effects of which are still not fully predictable.

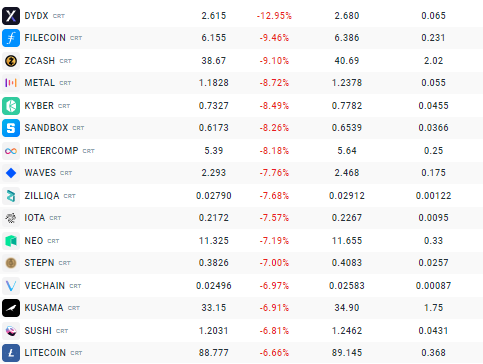

The vast majority of altcoins are seeing significant declines. Filecoin and DYDX are losing the most. Source: xStation5

Silvergate Capital's (SI.US) share price is currently at historic lows. Source: xStation5 Bitcoin chart, H4 interval. The declines have been temporarily halted, but the rebound is very weak and the zone in the vicinity of $20,000 to $21,500 (orange color), marked by three previous price reactions (the local peak from before the FTX bankruptcy, the attempt to climb above it from January and the local lows from mid-February) and the 38.2 Fibonacci retracement of the upward wave initiated at the beginning of November 2022, may be more important for the trend going forward. This may indicate a possible test of the next support level. Source: xStation5

Bitcoin chart, H4 interval. The declines have been temporarily halted, but the rebound is very weak and the zone in the vicinity of $20,000 to $21,500 (orange color), marked by three previous price reactions (the local peak from before the FTX bankruptcy, the attempt to climb above it from January and the local lows from mid-February) and the 38.2 Fibonacci retracement of the upward wave initiated at the beginning of November 2022, may be more important for the trend going forward. This may indicate a possible test of the next support level. Source: xStation5

Bitcoin loses the momentum again 📉Ethereum slides 5%

Three markets to watch next week (06.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.