-

Today's session on Wall Street did not take place due to a federal holiday. US index futures closed with symbolic gains. The exception was US100 (Nasdaq 100) futures, which fell by 0.2%.

-

On the Old Continent, the session was mixed, but most trading floors ended the day in positive territory. The exception was the German DAX, which lost 0.4%. In contrast, the British FTSE 100 gained almost 0.3%, the French CAC 40 gained less than 0.1%, and the Spanish IBEX 35 rose by 1%.

-

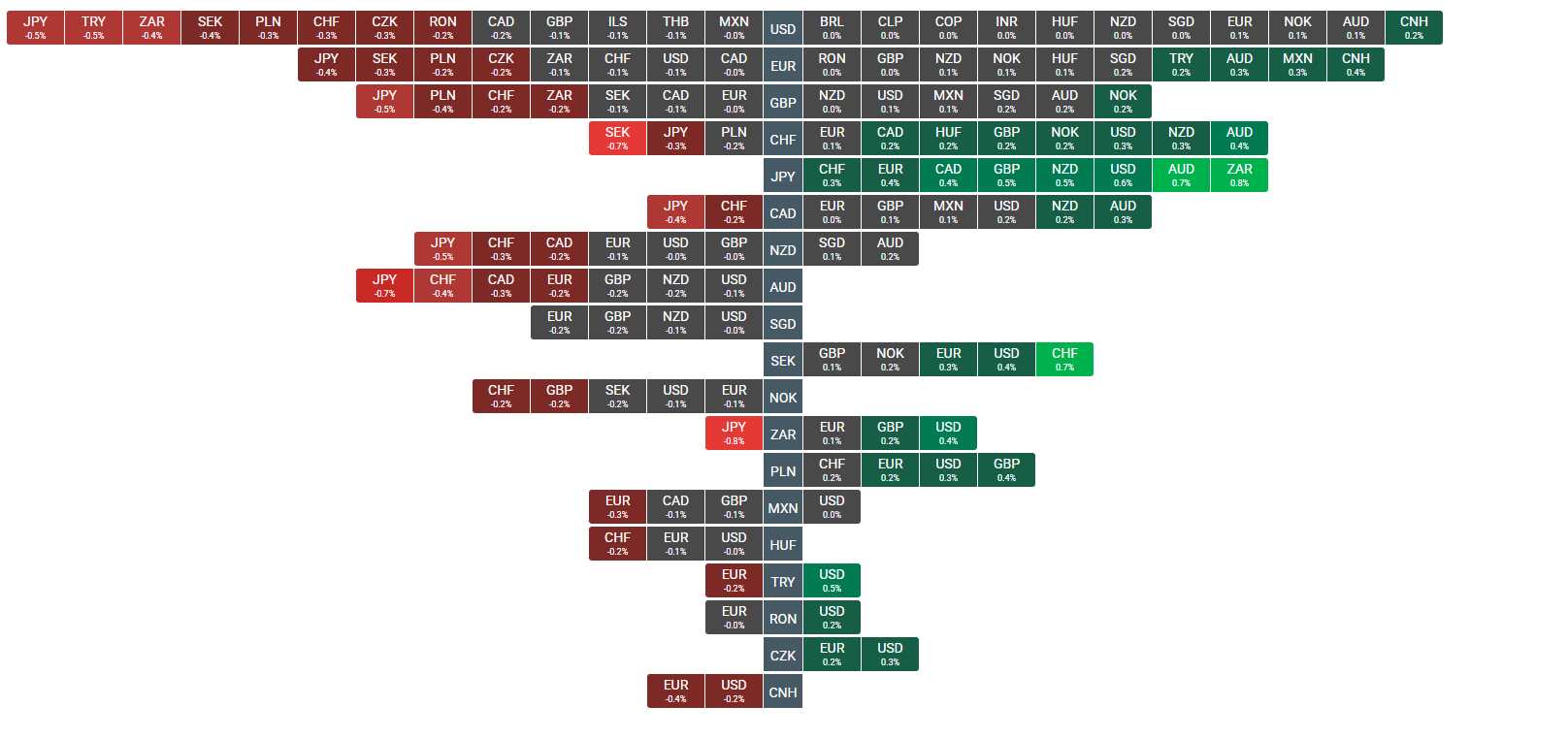

The forex market is seeing a significant strengthening of the dollar against other major global currencies. The biggest increase is seen in the USD/JPY pair, which is trading at around 153.5.

-

The precious metals market is under slight pressure due to the strengthening of the dollar. Gold is down about 0.8% and has fallen below $5,000 per ounce, while silver is down about 0.4% and is testing the $76 per ounce level.

-

The oil market is seeing a rebound. Brent crude is up about 1.6% and is trading just below $69 per barrel, while WTI crude is up nearly 1.8% and testing the $64 level.

-

Henry gas contracts (NATGAS) are under heavy pressure and are down about 4.5%.

-

The cryptocurrency market is experiencing mixed sentiment and selective pressure. Bitcoin is down about 1.2% and has fallen below $68,000, while Ethereum is up more than 0.6% and hovering around $1,980.

Source: xStation5

When AI becomes a risk

Bank Holiday in USA and Wall Street is closed 🏛️

Crypto news: Will Bitcoin drop again? 🔍 Cryptocurrencies try to stabilize after the sell-off

US500 rebounds slightly after the sell-off 🗽 US earnings season confirms profit expansion

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.