-

US indices traded under pressure today as banking sector woes continue to linger

-

PacWest Bancorp slumped over 40% today after the company confirmed that it is reviewing strategic options. First Horizon traded over 30% lower after company terminated merger agreement with TD Bank

-

Other US regional banks also trade under pressure. Western Alliance dropped 40% after Financial Times reported that the bank is also looking at strategic options. However, Western Alliance rejected FT report as 'absolutely false'

-

European stock market indices traded lower today, pressured by banking concerns as well as ECB decision

-

The European Central Bank slowed down the pace of rate hikes and delivered a 25 basis point hike today, in-line with expectations. Deposit rate increased to 3.25% - the highest level since late-2008

-

President Lagarde said that it is clearing ECB is not pausing yet

-

Reuters reported that some members of ECB governing council expect 2-3 more rate hikes ahead

-

Norges Bank delivered a 25 bp rate hike, in-line with expectations, putting the main interest rate at 3.25%

-

Chinese manufacturing PMI dropped from 50.0 to 49.5 in April (exp. 50.3)

-

Euro area PPI inflation slowed from 13.3 to 5.9% YoY in March (exp. 6.2% YoY)

-

US Challenger job-cuts report came in at 67k in April - below 89.7k reported in March

-

US trade deficit for March came in at $64.2 billion (exp. -$63.4 billion) as exports increased and imports dropped slightly

-

US jobless claims came in slightly above expectations at 242k (exp. 240k)

-

EIA report showed a 54 billion cubic feet build in US natural gas inventories (exp. 52 bcf)

-

Apple is set to announced fiscal-Q2 results after market close today

-

WTI experienced a flash crash overnight which is blamed on a 'fat finger' of an institutional trader. US oil benchmark briefly plunged to below $64 per barrel before recovering losses quickly

-

Gold briefly traded at the record highs slightly below $2,080. However, precious metal pulled back later on and now trades in the $2,050 area

-

Cryptocurrencies traded mostly lower today with Bitcoin dropping below $29,000 mark

-

NZD, CAD and AUD are the best performing G10 currencies while EUR, CHF and USD lag the most

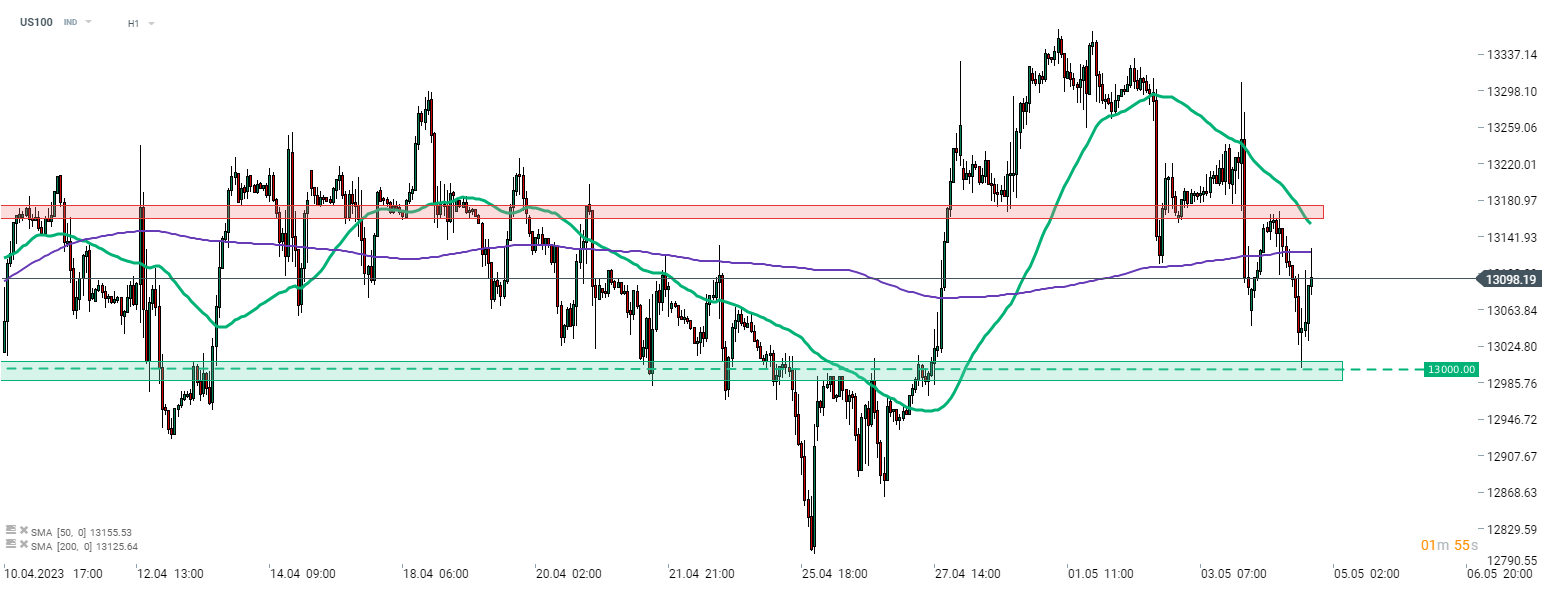

Nasdaq-100 (US100) outperforms other Wall Street indices today, like S&P 500, Dow Jones or Russell 2000. This is because the tech-heavy index does not have any banking shares in it. However, the final of 5 US megatech companies - Apple - is set to report earnings today after market close, which could be an important driver for US100. US100 bounced off the 13,000 pts area today and rallied back to 200-hour moving average (purple line). However, bulls have failed to break above it. Source: xStation5

Nasdaq-100 (US100) outperforms other Wall Street indices today, like S&P 500, Dow Jones or Russell 2000. This is because the tech-heavy index does not have any banking shares in it. However, the final of 5 US megatech companies - Apple - is set to report earnings today after market close, which could be an important driver for US100. US100 bounced off the 13,000 pts area today and rallied back to 200-hour moving average (purple line). However, bulls have failed to break above it. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.