- Signs of progress in the Russia-Ukraine talks

- China is reportedly ready to provide military aid to Russia

- Commodity currencies and Wall Street indices under pressure

European indices finished today's session higher, with DAX gaining over 2% amid hopes of diplomatic resolution to the Russia-Ukraine conflict as both countries reported progress in peace talks yesterday, despite Russian forces continuing their military operations. Ukraine officials said it had begun hard talks with Russia on a ceasefire, immediate withdrawal of troops and security guarantees. On the data front, Germany’s monthly WPI inflation fell to 1.7% in February, above analysts estimates of 0.9%.

However, moods deteriorated in the afternoon. US indices erased early gains and are currently trading in red after White House informed its NATO allies that China had expressed a willingness to provide military and economic assistance to Russia. China foreign minister Wangyi emphasized today China has a legitimate right to safeguard its interest and hopes not to be impacted by sanctions on Russia. The Dow trades around the flat line, while the S&P 500 and the Nasdaq dropped 0.8% and 1.9%, respectively.

Downbeat moods prevail in the commodities markets amid a stronger dollar, which puts additional pressure on commodities currencies. US 10-year Treasury yields jumped to 2.12% while precious metals took a hit. Gold price pulled back to $1955 level, while silver is approaching support at $25.00. Also, oil markets extended losses from the previous week and were down more than 6%. Major cryptocurrencies moved higher during today's session, however bulls cut some gains after the US open. Bitcoin price jumped briefly above 39,000, however buyers failed to uphold momentum and price pulled back to $38,500. Ethereum trades around $2520 level after an unsuccessful attempt to breach the $ 2,600 mark.

The Australian dollar and other commodity currencies are facing intense selling pressure on Monday. AUDUSD air is currently testing local support at 0.7200, which coincides with 50 SMA (green line) and previous price reactions. Source:xStation5

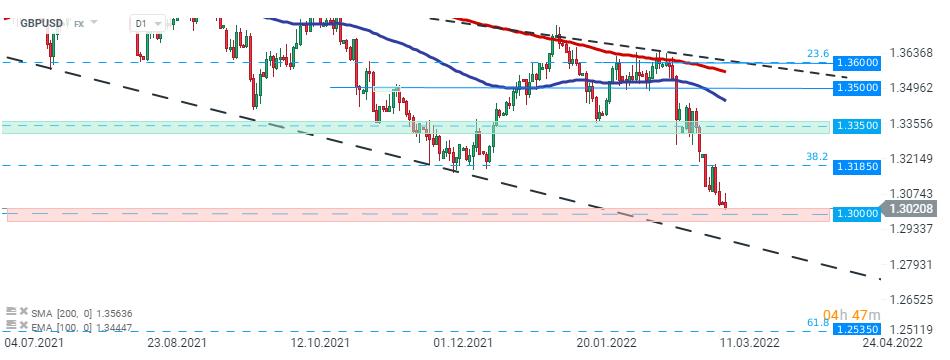

GBPUSD pair fell sharply in recent days and is currently approaching psychological support at 1.3000. Should break lower occur, downward move may accelerate towards lower limit of the wedge formation or even support at 1.2535, which coincides with 61.8% Fibonacci retracement of the upward wave launched in March 2020. On the other hand, if buyers manage to regain control, then the nearest resistance to watch is located around 1.3185. Source: xStation5

GBPUSD pair fell sharply in recent days and is currently approaching psychological support at 1.3000. Should break lower occur, downward move may accelerate towards lower limit of the wedge formation or even support at 1.2535, which coincides with 61.8% Fibonacci retracement of the upward wave launched in March 2020. On the other hand, if buyers manage to regain control, then the nearest resistance to watch is located around 1.3185. Source: xStation5

BREAKING: Canadian Wholesale & Manufacturing Sales higher than expected 📊USDCAD reacts

🚩Cocoa and coffee futures decline sharply amid US South America trade deals 📉

BREAKING: EU GDP data slightly above expectations! 📈💶

DE40: European markets extend decline

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.