-

European blue chips indices dropped over 2%

-

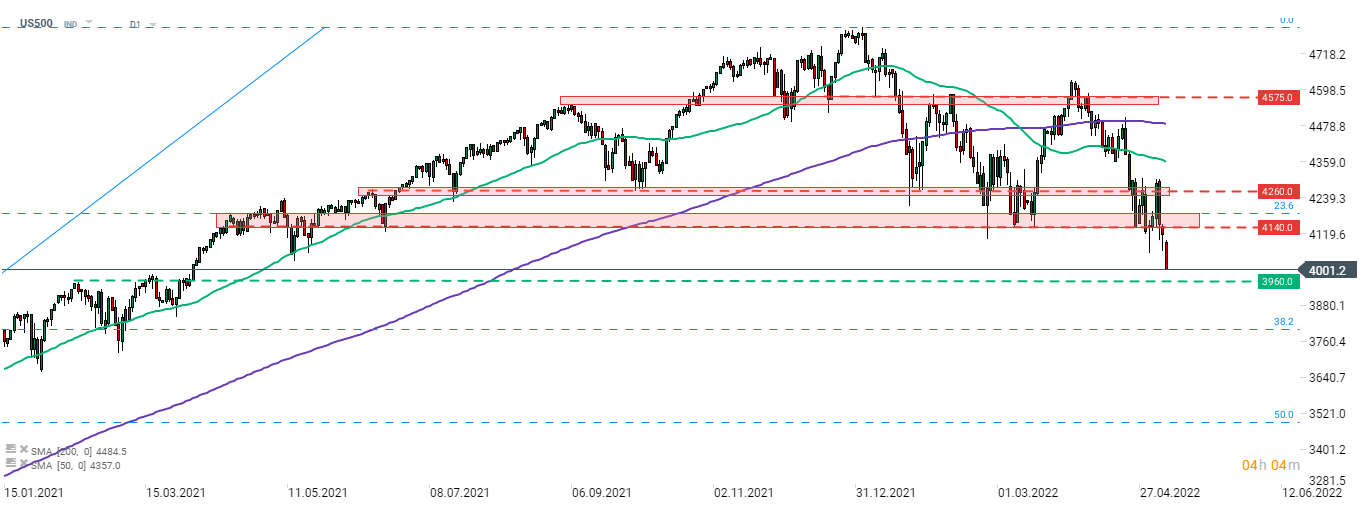

US futures drop - Nasdaq down 3.5%, S&P 500 tests 4,000 pts area

-

Oil pulls bank after Saudi Arabia lowered export prices to Asia and Europe, and on overall risk-off attitude in the market

-

Cryptocurrencies sink. Bitcoin dropped below $31,000 while Ethereum trades 8% lower

-

Precious metals pull back on the back of US dollar strength. Palladium gains as UK plans to impose tariffs on commodity from Russia and Belarus

-

EUR, JPY and USD are the best performing major currencies while AUD and NZD lag the most

-

Stricter lockdowns in parts of Shanghai

-

ECB members are getting more hawkish, Holzmann sees need for 2-3 rate hikes this year

-

Palantir plunges 20% after Q1 earnings. Guidance for Q2 disappoints

Risk assets like oil, crypto and equities are experiencing a sell-off today. While there were no clear news for the drop, the fact that it has been steadily progressing throughout the day strongly hints that it is simply continuation of the move started ahead of the weekend.

Market continues to sell off amid risk of a global economic slowdown resulting from pandemic situation in China or tighter monetary policy. Pandemic in China is far from over and restrictions are not only being imposed in new place of the country but also become more stricter. This will magnify supply chain disruptions going forward what will have an impact on the global economy. Apart from that, central banks are getting more and more hawkish. Even in a central bank like ECB number of hawks is growing. Holzmann is the latest to call for rate hikes - he sees a need for 2- or 3 in 2022. This could explain EUR resilience to today's risk-off moods. Oil is also experiencing a heavy selling. While overall risk-off attitude is playing a key factor, it should be noted that Saudi Arabia decided to lower export prices for Light Arab crude to Asia and Europe.

US500 tests 4,000 pts mark as risk assets sell-off on concerns over state of global economy. Source: xStation5

US500 tests 4,000 pts mark as risk assets sell-off on concerns over state of global economy. Source: xStation5

US100: Wall Street's stronghold of growth❓

US100 loses 0.5% 📉Meta shares decline extends on AI CAPEX worries & Deutsche Bank remarks

CHN.cash under pressure despite positive Trump remarks 🚩

Wall Street optimism tempers amid falling odds of December Fed rate cut

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.