- European indices finished today's session slightly higher as fresh PMI figures showed the Eurozone economic contraction eased in November and price pressures cooled.

-

ECB Centeno said 75 bp interest rate hikes cannot be the norm.

-

Mainland China has seen daily new Covid cases rising to more than 28,000, close to the levels from the Shanghai lockdown that began in April.

-

Moods improved on Wall Street after FOMC minutes showed that a substantial majority of Fed members believes that a slowing in the pace of the fed funds rate increase would likely soon be appropriate, as it would better allow the Committee to assess progress toward its goals of maximum employment and price stability. The Dow Jones erased early losses and is trading 0.305 higher, the S&P 500 rose 0.5% higher and the Nasdaq added 0.9%.

-

On the data front, US business activity contracted for a fifth straight month in November, with a measure for manufacturing dipping below the 50 mark for the first time since 2020. US weekly claims rose more than expected to a three-month high last week.

-

Oil prices fell nearly 4.0% on reports that the European Union is considering setting a price cap on Russian oil in the $65-70 per barrel range. Later in the session EIA data showed a much bigger-than-expected drop in US inventories last week.

-

NATGAS erased most of the early gains after the latest EIA data showed a smaller-than-expected draw in inventories. Still, prices remain at the highest level in two months.

-

Precious metals rebounded on Wednesday amid weaker dollar and dovish FED minutes. Gold bounced off major support at $1732.00 and is testing local resistance at $1750, while silver rose to $21.50 per ounce, rebounding from the two-week low of $20.8.

-

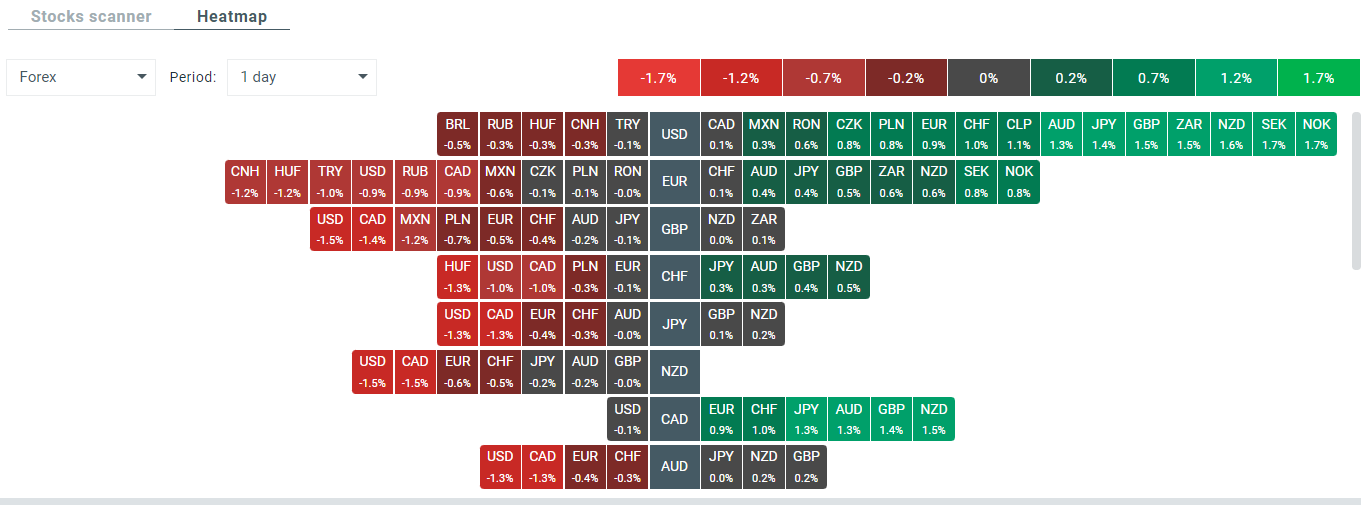

The dollar index fell below over 1.0% to 106.15, extending losses for a second session. The New Zealand dollar strengthened on Wednesday, after the RBNZ delivered a supersized 75 basis point rate hike and raised the forecast for its peak rate from 4.10 to 5.50%. Currently GBP and NZD are the best performing major currencies while USD and CAD lag the most.

-

Upbeat sentiment prevails on the cryptocurrency market, where Bitcoin jumped above $16,400 level, while Ethereum briefly tested local resistance at $1175 level.

USD weakened against the majority of currencies following the release of FOMC Minutes. Source: xStation5

NZDUSD again tests key resistance at 0.6240, which is marked with 61.8% Fibonacci retracement of the upward wave launched in March 2020. Should break higher occur, upward move may accelerate towards local downward trendline or even resistance at 0.6430. On the other hand, if sellers manage to regain control, retest of local lows at 0.6065 cannot be ruled out. Source: xStation5

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.