- European stocks ended the week lower

- Wall Street swings between gains and losses

- NATGAS price surges ahead of winter storm

European indices finished the week in negative territory, with the German DAX down 1.3%, CAC 40 closed 0.8% lower and FTSE 100 fell 1.1% amid mounting geopolitical tensions in Ukraine and recent hawkish narrative from the Federal Reserve. On the data front, GDP readings from France, Spain and Sweden surprised on the upside. For the week, DAX dropped 1.8%, the second straight weekly loss.

Major Wall Street erased early losses and are trading higher. Dow Jones gains 0.40% after losing more than 300 points early in the session, the S&P 500 jumped 1% and the Nasdaq rose 1.5%. On the other hand, both Dow and the S&P are heading towards a fourth week of losses and the Nasdaq is set to fall for a 5th straight week as recent FED hawkish comments regarding monetary policy weighed on market sentiment. On the data front, PCE inflation YoY came in slightly above market estimates, while employment costs increased 4% from a year ago, the fastest in the 20-year data history, though the quarterly rise of 1% was less than expected. On the corporate front, Apple jumped 5% after the company reported record revenues and said it expects supply chain constraints, which are contributing to inflation, to ease in the coming months.

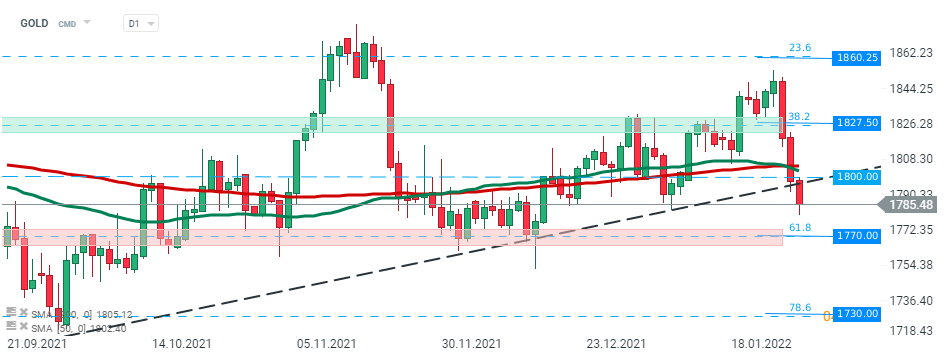

Mostly downbeat moods prevail today in commodity markets as the dollar continues to move higher while the US 10-year Treasury yield remains elevated at 1.78%. Over the past few weeks, the dollar has been consolidating and even depreciating against some emerging currencies. However, the ever stronger message from the US central bank regarding interest rate hikes and excellent GDP data finally made it back to the top. As a result gold fell at one point 1.0% and tested $1,780.00 level while silver dropped 2.6% to $22.10 level however managed to erase some of the losses. WTI cut early gains and is trading 0.50% lower around $87.20 level. On the other hand, natural gas prices jumped 14% on stronger demand for heating and power plant fuel as a powerful winter storm is set to hit the U.S. Northeast. Major cryptocurrencies traded sideways this week. During today’s session Bitcoin rose slightly and is testing $37 000 level while Ethereum rose 5% to $2460 mark.

GOLD fell sharply following the FED decision on Wednesday and downward move accelerated during today's session. Price broke below long-term upward trendline and if current sentiment prevails, next support at $1770 may be at risk. Source: xStation5

Morning Wrap: Russian Oil with a 30-Day Purchase Permit

Market wrap: European stocks attempt to stabilize despite the surge in oil prices 🔍

Chart of the Day: EURUSD – Why is the Euro Losing to the Dollar?

Cattle futures fall amid JBS plant strike, rising corn and Middle East 📌

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.